APAC Polyester Fiber Market Overview

- The APAC Polyester Fiber Market is valued at USD 47 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for polyester fibers in diverse applications such as textiles, automotive, and home furnishings. The market is further propelled by rising consumer preference for lightweight, durable, and easy-care materials, as well as the accelerating adoption of sustainable and recycled fibers. The expansion of digital textile printing and the integration of circular production models are also shaping market dynamics, with chemical recycling facilities growing rapidly in the region .

- Key players in this market include China, India, and Japan, which dominate due to robust manufacturing capabilities and large-scale production facilities. China is the global leader in polyester fiber production, supported by its integrated supply chain and technological advancements. India and Japan also contribute significantly, driven by strong textile industries, innovation in fiber technology, and increasing investments in sustainable manufacturing .

- The National Technical Textiles Mission, 2020 issued by the Ministry of Textiles, Government of India, provides a comprehensive framework to enhance the competitiveness of the textile sector. This policy includes incentives for sustainable practices, encourages the adoption of recycled polyester fibers, and mandates compliance with quality standards for eco-friendly production, aligning with global sustainability goals and fostering investment in advanced recycling technologies .

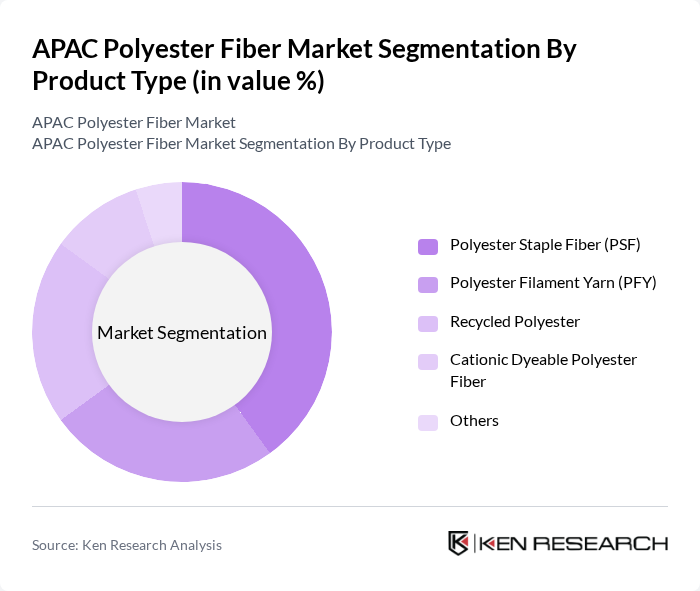

APAC Polyester Fiber Market Segmentation

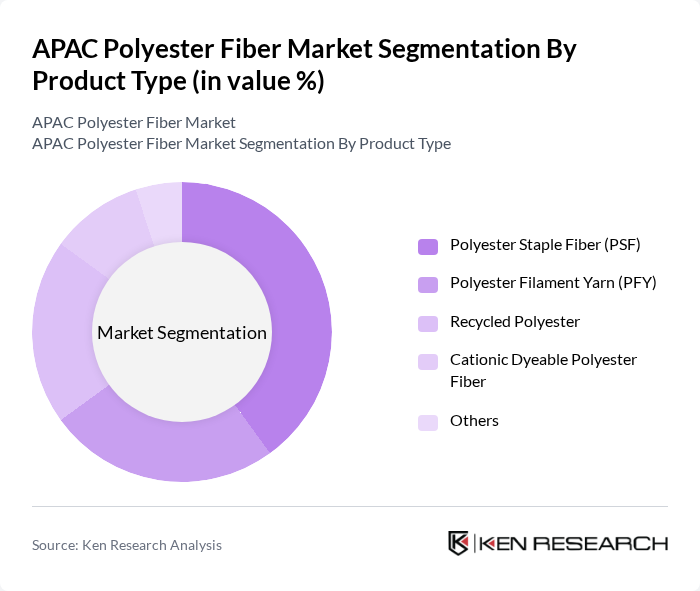

By Product Type:The product type segmentation includes Polyester Staple Fiber (PSF), Polyester Filament Yarn (PFY), Recycled Polyester, Cationic Dyeable Polyester Fiber, and Others. Polyester Staple Fiber (PSF) leads the market due to its extensive use in the textile industry, driven by demand for comfortable, durable, and versatile fabrics. The increasing focus on sustainability and the circular economy is accelerating the adoption of Recycled Polyester, which is gaining substantial traction among manufacturers and brands seeking to reduce environmental impact .

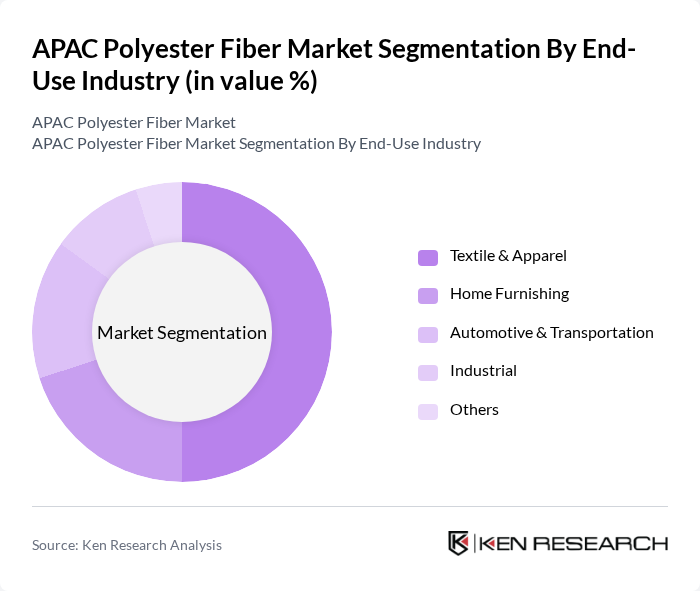

By End-Use Industry:The end-use industry segmentation covers Textile & Apparel, Home Furnishing, Automotive & Transportation, Industrial, and Others. Textile & Apparel is the dominant segment, fueled by rising demand for polyester fabrics in clothing, fashion, and sportswear. Growth in disposable income, urbanization, and changing consumer preferences toward synthetic fibers have significantly boosted this segment. The Automotive & Transportation sector is also experiencing increased polyester usage, particularly for lightweight interior components and technical textiles .

APAC Polyester Fiber Market Competitive Landscape

The APAC Polyester Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Indorama Ventures Public Company Limited, Reliance Industries Limited, Teijin Limited, Far Eastern New Century Corporation, Alpek Polyester, DAK Americas LLC, Lenzing AG, Eastman Chemical Company, Toray Industries, Inc., Huvis Corporation, Zhejiang Hengyi Group Co., Ltd., Jiangsu Sanfangxiang Group Co., Ltd., Sinopec Yizheng Chemical Fiber Co., Ltd., Shandong Ruyi Technology Group Co., Ltd., Nan Ya Plastics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

APAC Polyester Fiber Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Fabrics:The APAC region is witnessing a significant shift towards sustainable fabrics, with the market for eco-friendly textiles projected to reach $150 billion in future. This growth is driven by consumer preferences for sustainable products, with 70% of consumers indicating a willingness to pay more for eco-friendly options. The rise in environmental awareness is prompting manufacturers to innovate and adopt sustainable practices, thereby boosting the demand for polyester fibers made from recycled materials.

- Expansion of the Textile Industry:The textile industry in APAC is expected to grow at a rate of 5% annually, reaching a market value of $1 trillion in future. This expansion is fueled by increasing urbanization and rising disposable incomes, particularly in countries like India and Vietnam. The growing middle class is driving demand for diverse textile products, including polyester fibers, which are favored for their durability and versatility in various applications, from apparel to home textiles.

- Technological Advancements in Fiber Production:Innovations in fiber production technology are enhancing the efficiency and sustainability of polyester manufacturing. For instance, advancements in polymerization processes have reduced energy consumption by 20%, while new recycling technologies are expected to increase the availability of recycled polyester by 30% in future. These technological improvements not only lower production costs but also align with the growing demand for sustainable textile solutions, further driving market growth.

Market Challenges

- Fluctuating Raw Material Prices:The polyester fiber market faces challenges due to volatile raw material prices, particularly crude oil, which directly impacts production costs. In future, crude oil prices fluctuated between $70 and $90 per barrel, leading to unpredictable pricing for polyester fibers. This volatility can hinder manufacturers' ability to maintain stable pricing for their products, affecting profit margins and market competitiveness in the APAC region.

- Stringent Environmental Regulations:Increasingly stringent environmental regulations in APAC countries pose significant challenges for polyester fiber manufacturers. For example, the implementation of the EU's Green Deal and similar initiatives in Asia require compliance with strict emissions standards and waste management practices. Companies may face substantial fines or operational restrictions if they fail to meet these regulations, which can lead to increased operational costs and reduced market access.

APAC Polyester Fiber Market Future Outlook

The APAC polyester fiber market is poised for transformative growth, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are increasingly adopting circular economy practices, which are expected to reshape production processes. Additionally, the rise of e-commerce platforms is facilitating broader market access, allowing companies to reach a wider audience. These trends indicate a dynamic future for the polyester fiber market, with significant opportunities for growth and collaboration in sustainable practices.

Market Opportunities

- Innovations in Recycling Technologies:The development of advanced recycling technologies presents a significant opportunity for the polyester fiber market. In future, innovations are expected to increase the recycling rate of polyester fibers by 40%, enabling manufacturers to meet rising consumer demand for sustainable products while reducing waste. This shift not only enhances brand reputation but also aligns with global sustainability goals.

- Collaborations with Fashion Brands for Sustainable Lines:Partnerships between polyester fiber manufacturers and fashion brands focused on sustainability are emerging as a lucrative opportunity. Collaborations can lead to the creation of eco-friendly product lines, tapping into the growing market of environmentally conscious consumers. In future, it is anticipated that such collaborations could account for 25% of new product launches in the textile sector, driving innovation and market growth.