APAC Rigid Packaging Market Overview

- The APAC Rigid Packaging Market is valued at USD 119 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for sustainable packaging solutions, rapid urbanization, and the expansion of the food and beverage sector. The rise in disposable income, the growth of e-commerce, and changing consumer preferences towards convenience and quality packaging have further fueled market growth. The region’s dominance is reinforced by investments in advanced manufacturing technologies and a strong focus on recyclable and eco-friendly materials .

- Key players in this market include China, India, and Japan, which dominate due to their large manufacturing bases, rapid industrialization, and significant consumer markets. China leads with its extensive production capabilities and technological advancements, while India benefits from a growing middle class and increasing demand for packaged goods. Japan's advanced technology and innovation in packaging solutions also contribute to its market strength. The region’s leadership is further supported by the expansion of the personal care, cosmetics, and pharmaceutical sectors .

- In 2023, the Indian government implemented the Plastic Waste Management Amendment Rules, 2022 issued by the Ministry of Environment, Forest and Climate Change. This regulation mandates the reduction of single-use plastics and promotes the use of recyclable materials in packaging. The rules require producers, importers, and brand owners to ensure the collection and environmentally sound management of plastic packaging waste, and set extended producer responsibility targets for recycling and reuse. This regulatory framework aims to enhance environmental sustainability and encourage manufacturers to adopt eco-friendly practices in the rigid packaging sector .

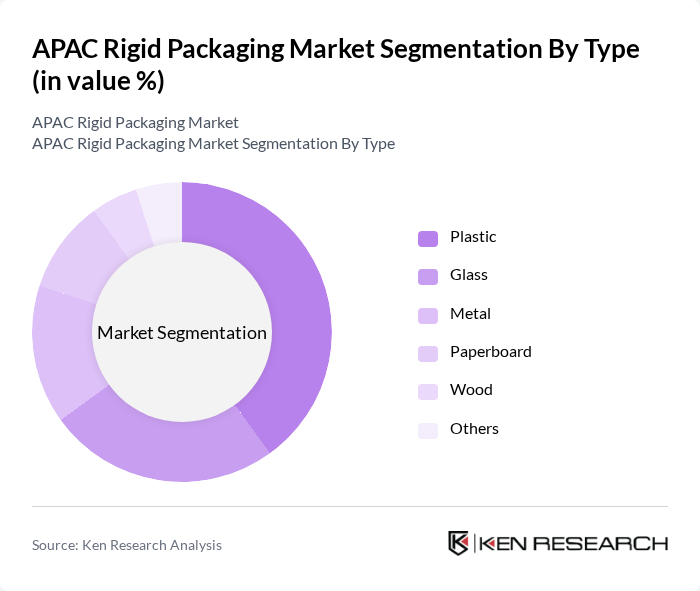

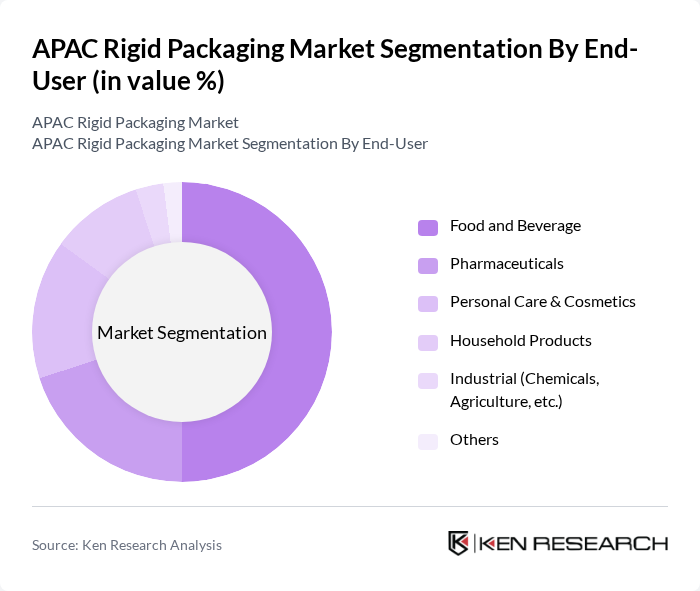

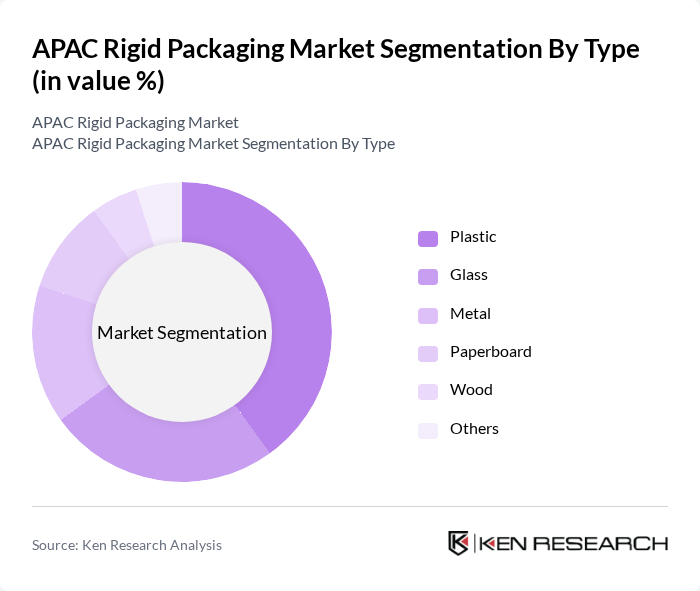

APAC Rigid Packaging Market Segmentation

By Type:The rigid packaging market can be segmented into various types, including plastic, glass, metal, paperboard, wood, and others. Each type serves different applications and industries, catering to diverse consumer needs. Plastic remains the dominant material due to its versatility, durability, and cost-effectiveness, while glass and metal are preferred for premium and sensitive products. Paperboard and wood are gaining traction as sustainable alternatives, particularly in food, beverage, and personal care applications .

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals, personal care & cosmetics, household products, industrial (chemicals, agriculture, etc.), and others. Each segment has unique requirements and preferences that influence packaging choices. The food and beverage sector is the largest consumer, driven by rising demand for packaged and convenience foods, followed by pharmaceuticals and personal care, which require stringent safety and quality standards. Industrial applications are also growing, particularly in chemicals and agriculture, where bulk and durable packaging is essential .

APAC Rigid Packaging Market Competitive Landscape

The APAC Rigid Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Sealed Air Corporation, Berry Global, Inc., Crown Holdings, Inc., Mondi Group, Smurfit Kappa Group, WestRock Company, DS Smith Plc, Huhtamaki Oyj, Sonoco Products Company, International Paper Company, Tetra Pak International S.A., ALPLA Group, Silgan Holdings Inc., Pactiv Evergreen Inc., Toyo Seikan Group Holdings, Ltd., Greatview Aseptic Packaging Company, Shanghai Zijiang Enterprise Group Co., Ltd., Uflex Ltd., Rengo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Rigid Packaging Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Packaging Solutions:The APAC region is witnessing a significant shift towards sustainable packaging, driven by consumer preferences and regulatory pressures. In future, the sustainable packaging market is projected to reach approximately $400 billion, with rigid packaging accounting for a substantial share. This trend is supported by the growing awareness of environmental issues, as 75% of consumers in the region express a preference for eco-friendly packaging options, according to a recent industry report.

- Growth in the E-commerce Sector:The e-commerce sector in APAC is expected to grow to $3 trillion in future, significantly boosting the demand for rigid packaging solutions. With online retail sales projected to increase by 25% annually, companies are investing in robust packaging to ensure product safety during transit. This surge in e-commerce is particularly evident in countries like China and India, where online shopping is becoming a primary purchasing method for consumers, further driving the rigid packaging market.

- Rising Consumer Awareness Regarding Product Safety:Consumer awareness regarding product safety is at an all-time high, with 70% of consumers in APAC prioritizing safety features in packaging. This trend is leading to increased demand for tamper-evident and child-resistant packaging solutions. In future, the market for safety-focused rigid packaging is expected to grow by $20 billion, as manufacturers respond to consumer demands for enhanced protection and quality assurance in food and pharmaceutical products.

Market Challenges

- High Raw Material Costs:The rising costs of raw materials, particularly plastics and metals, pose a significant challenge for the rigid packaging industry in APAC. In future, the price of polyethylene is projected to increase by 15%, impacting production costs. This escalation in raw material prices can lead to higher end-user prices, potentially reducing demand for rigid packaging solutions. Manufacturers are thus compelled to explore alternative materials and cost-effective production methods to mitigate these challenges.

- Stringent Environmental Regulations:Governments across APAC are implementing stringent regulations aimed at reducing plastic waste, which can hinder the growth of the rigid packaging market. For instance, countries like India and Japan have introduced laws that limit the use of single-use plastics. In future, compliance with these regulations may require significant investment in sustainable packaging technologies, posing a financial burden on manufacturers and potentially slowing market growth in the short term.

APAC Rigid Packaging Market Future Outlook

The APAC rigid packaging market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation in packaging processes, efficiency and cost-effectiveness will improve. Additionally, the shift towards eco-friendly materials will likely accelerate, with innovations in biodegradable and recyclable packaging gaining traction. The collaboration between packaging manufacturers and e-commerce platforms will further enhance distribution efficiency, ensuring that the market remains dynamic and responsive to consumer needs in future.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in Southeast Asia are experiencing rapid urbanization, leading to increased demand for rigid packaging solutions. With a projected population growth of 200 million in future, these markets present significant opportunities for manufacturers to expand their product offerings and capture new customer segments, particularly in food and beverage sectors.

- Innovations in Biodegradable Packaging:The development of biodegradable packaging materials is gaining momentum, with investments expected to reach $10 billion in future. This innovation aligns with consumer demand for sustainable options and regulatory pressures. Companies that invest in research and development of biodegradable rigid packaging can position themselves as leaders in sustainability, attracting environmentally conscious consumers and enhancing brand loyalty.