APAC Solvents Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5418

December 2024

83

About the Report

APAC Solvents Market Overview

- The APAC solvents market is valued at USD 19 billion, driven by increasing demand from endues industries such as paints and coatings, pharmaceuticals, and personal care products. The market benefits from the region's rapid industrialization, urbanization, and growing construction sector. Additionally, advancements in solvent manufacturing technologies and the rising adoption of biobased solvents to meet stringent environmental regulations have bolstered market growth. The diverse applications of solvents across multiple industries solidify APAC's leading position globally.

- Dominant demand centers for solvents in APAC include China, India, and Japan. China's vast manufacturing base and construction activities drive its leadership, while India's expanding pharmaceutical and personal care industries boost its market presence. Japans advanced chemical production capabilities and emphasis on highquality and sustainable solvents further strengthen its role in the market. These countries benefit from a mix of industrial growth, technological advancements, and strategic regulatory frameworks that support solvent adoption.

- Governments across the Asia-Pacific (APAC) region have implemented stringent environmental protection laws to regulate solvent usage and mitigate environmental impact. For instance, China's Air Pollution Prevention and Control Action Plan enforces strict limits on volatile organic compound (VOC) emissions, compelling industries to adopt low-VOC or VOC-free solvents. Similarly, Japan's Air Pollution Control Act mandates stringent VOC emission standards, influencing solvent formulation and application.

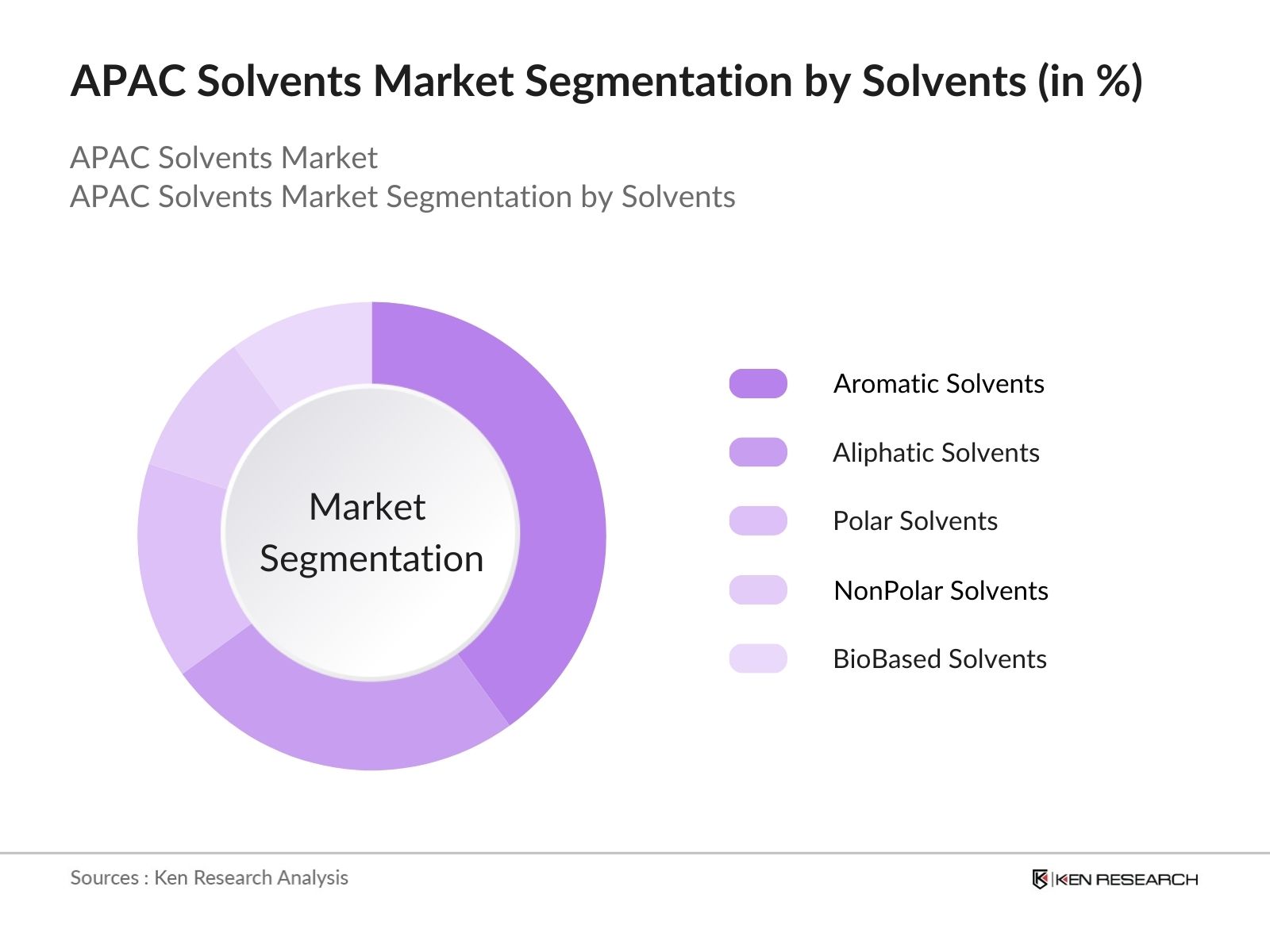

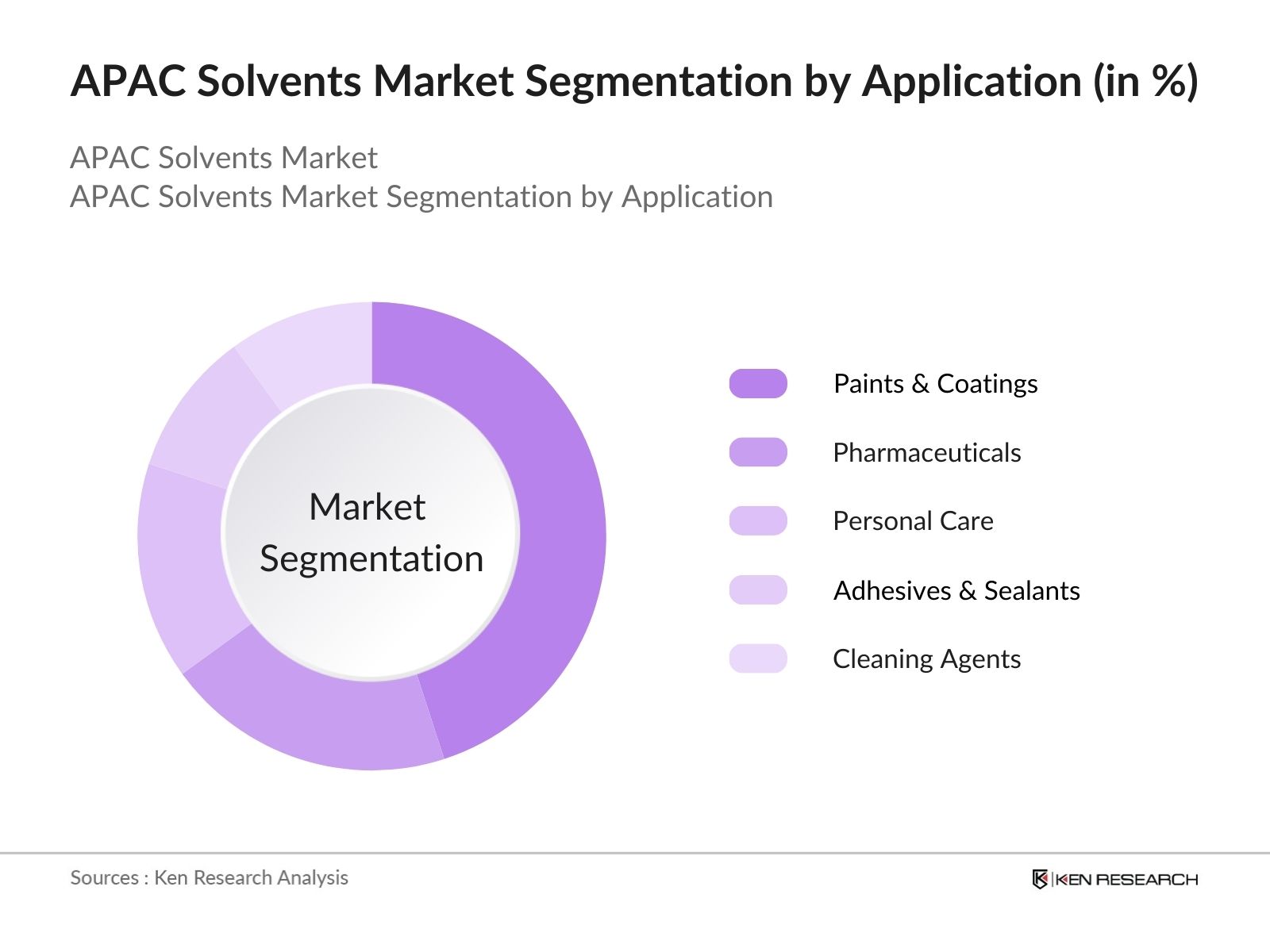

APAC Solvents Market Segmentation

- By Solvent Type: The market is segmented by solvent type into aromatic solvents, aliphatic solvents, polar solvents, nonpolar solvents, and biobased solvents. Aromatic solvents dominate this segment due to their extensive use in the paints and coatings industry, which continues to thrive amidst rising infrastructure and construction projects in the region. Their excellent solvency power and compatibility with various industrial applications make them indispensable for manufacturers. Despite the growing adoption of biobased solvents, aromatic solvents retain a leading share due to their established infrastructure and cost-effectiveness.

- By Application: The market is segmented by application into paints and coatings, pharmaceuticals, personal care, adhesives and sealants, and cleaning agents. Paints and coatings lead this segment, accounting for the highest market share due to rising construction activities and infrastructure investments across APAC nations. The demand for decorative and industrial coatings has surged, particularly in emerging markets like China and India. Solvents used in this sector are favored for their ability to enhance paint performance, durability, and application efficiency, further cementing their dominance.

APAC Solvents Market Competitive Landscape

The APAC solvents market is highly competitive, with key players leveraging strong distribution networks, advanced production capabilities, and continuous innovation to maintain their market positions. Major companies include BASF SE, Eastman Chemical Company, Shell Chemicals, LyondellBasell Industries, and Sinopec. These leaders focus on developing ecofriendly and highperformance solvent solutions to address stringent regulatory requirements and meet evolving customer demands.

APAC Solvents Market Analysis

Growth Drivers

- Infrastructure Development and Construction Boom: The ongoing construction of residential, commercial, and industrial facilities across APAC countries is a major driver for solvent demand. With China and India leading infrastructure investments, the need for highquality paints and coatings has significantly increased, directly influencing solvent consumption. For example, China has allocated billions of dollars for its Belt and Road Initiative, while Indias Smart Cities Mission has created new opportunities for solvent manufacturers.

- Pharmaceutical and Personal Care Industry Growth: The rising demand for pharmaceuticals and personal care products in APAC countries has significantly driven the solvents market. Solvents are critical in manufacturing processes like drug formulation and personal care product development. With India emerging as a global pharmaceutical hub and South Korea advancing its cosmetics industry, the market is experiencing consistent growth.

- Regulatory Support (Policy Initiatives): Governments across the APAC region have implemented policies to support industrial growth and environmental sustainability. For instance, China's 14th Five-Year Plan emphasizes green development, encouraging the adoption of eco-friendly solvents. India's National Chemical Policy aims to boost the chemical sector's growth, including solvent production, by providing incentives and streamlining regulations.

Challenges

- Stringent Environmental Regulations: Environmental regulations in the APAC region have become increasingly stringent, focusing on reducing volatile organic compound (VOC) emissions associated with solvent use. Japan's Air Pollution Control Act mandates strict VOC emission limits, compelling industries to adopt low-VOC or VOC-free solvents. Compliance with these standards often requires significant investment in new technologies and reformulation of products, posing challenges for manufacturers. The World Bank emphasizes that while these regulations aim to protect the environment, they also necessitate substantial adjustments within the industry.

- Price Volatility of Raw Materials: Fluctuations in crude oil prices affect the cost of petrochemicalbased solvents, creating pricing uncertainties for manufacturers and endusers. This volatility poses a significant challenge to maintaining competitive pricing and profitability. Such volatility affects production costs and profit margins for solvent manufacturers. The International Monetary Fund (IMF) reports that these price fluctuations can lead to uncertainty in the market, making it challenging for companies to plan and budget effectively.

APAC Solvents Market Future Outlook

The APAC solvents market is poised for substantial growth, driven by continuous industrial expansion, advancements in solvent production technologies, and the adoption of sustainable practices. With increasing investments in infrastructure, manufacturing, and personal care, the market is expected to thrive. Moreover, the shift toward biobased and lowVOC solvents will gain momentum as environmental concerns shape purchasing decisions and regulatory compliance.

Future Market Opportunities

- Emerging Markets in APAC: Emerging economies in the APAC region, such as Vietnam and Indonesia, present significant opportunities for the solvents market. Vietnam's manufacturing sector grew by 7.0 % in 2023, while Indonesia's industrial production increased by 5.1%, indicating expanding markets for solvents. The World Bank highlights that these countries are investing in infrastructure and industrial development, leading to increased demand for solvents in construction, automotive, and electronics industries.

- Growth in Specialty Solvents: The demand for specialty solvents, such as those used in pharmaceuticals and electronics, is on the rise in the APAC region. In 2023, the pharmaceutical industry in India grew rapidly in recent years, with solvents playing a crucial role in drug formulation and manufacturing. Similarly, South Korea's electronics sector, utilizes high-purity solvents in semiconductor production. The World Bank notes that the growth of these niche markets offers lucrative opportunities for solvent manufacturers to develop specialized products catering to specific industry needs.

Scope of the Report

|

By Solvent Type |

Aromatic Solvents Aliphatic Solvents Polar Solvents NonPolar Solvents Specialty Solvents |

|

By Application |

Paints & Coatings Pharmaceuticals Personal Care Adhesives & Sealants Cleaning Agents |

|

By End-user |

Automotive Construction Electronics Textile Others |

|

By Region |

China India Japan South Korea Southeast Asia |

|

By Distribution Channel |

Direct Sales Distributors Online Retail Others OEM Partnerships |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Industry, Environmental Protection Agencies)

Chemical Manufacturing Companies

Industrial Solvent Users

Corporate Strategy and Business Development Managers

Supply Chain and Procurement Managers

Environmental and Sustainability Consultants

Companies

Players Mentioned in the Report

BASF SE

Eastman Chemical Company

Shell Chemicals

LyondellBasell Industries

Sinopec

Dow Inc.

ExxonMobil

Mitsubishi Chemical Holdings

SABIC

Chevron Phillips Chemical

Formosa Plastics Corporation

Huntsman Corporation

Celanese Corporation

Evonik Industries

BP Plc

Table of Contents

APAC Solvents Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

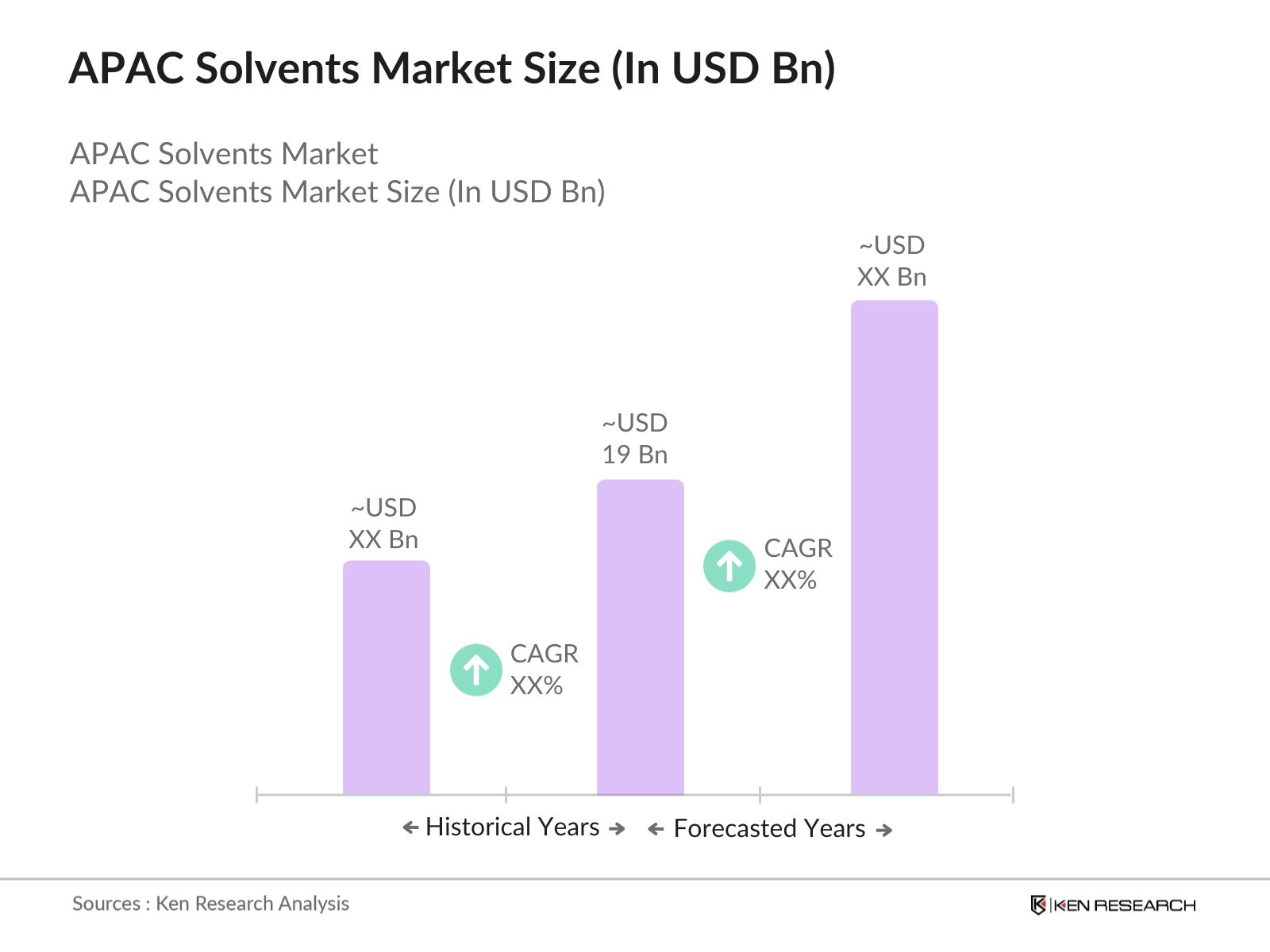

APAC Solvents Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

APAC Solvents Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Expansion (Industrial Output Growth)

3.1.2. Technological Innovations (R&D Expenditure)

3.1.3. Increasing Demand from End-Use Industries (Sectoral Demand Growth)

3.1.4. Regulatory Support (Policy Initiatives)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (Price Index Fluctuations)

3.2.2. Environmental Concerns (Emission Standards Compliance)

3.2.3. Stringent Regulatory Frameworks (Compliance Costs)

3.3. Opportunities

3.3.1. Emerging Markets in APAC (Market Penetration Rates)

3.3.2. Growth in Specialty Solvents (Niche Market Expansion)

3.3.3. Sustainable Solvent Development (Green Chemistry Initiatives)

3.4. Trends

3.4.1. Shift Towards Bio-based Solvents (Sustainability Trends)

3.4.2. Adoption of Advanced Manufacturing Techniques (Automation and AI)

3.4.3. Increasing Mergers and Acquisitions (Consolidation Trends)

3.5. Government Regulation

3.5.1. Environmental Protection Laws

3.5.2. Safety Standards Compliance

3.5.3. Import and Export Regulations

3.5.4. Incentives for Sustainable Practices

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

APAC Solvents Market Segmentation

4.1. By Solvent Type (In Value %)

4.1.1. Aromatic Solvents

4.1.2. Aliphatic Solvents

4.1.3. Polar Solvents

4.1.4. Non-Polar Solvents

4.1.5. Specialty Solvents

4.2. By Application (In Value %)

4.2.1. Paints & Coatings

4.2.2. Pharmaceuticals

4.2.3. Personal Care

4.2.4. Adhesives & Sealants

4.2.5. Cleaning Agents

4.3. By End-Use Industry (In Value %)

4.3.1. Automotive

4.3.2. Construction

4.3.3. Electronics

4.3.4. Textile

4.3.5. Others

4.4. By Region (In Value %)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. South Korea

4.4.5. Southeast Asia

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Sales

4.5.2. Distributors

4.5.3. Online Retail

4.5.4. Others

4.5.5. OEM Partnerships

APAC Solvents Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dow Inc.

5.1.2. BASF SE

5.1.3. Shell Chemicals

5.1.4. ExxonMobil

5.1.5. Eastman Chemical Company

5.1.6. LyondellBasell Industries

5.1.7. Chevron Phillips Chemical

5.1.8. Sinopec

5.1.9. SABIC

5.1.10. Evonik Industries

5.1.11. Mitsubishi Chemical Holdings

5.1.12. INEOS Group

5.1.13. Formosa Plastics Corporation

5.1.14. Celanese Corporation

5.1.15. Huntsman Corporation

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographic Presence, R&D Investment, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

APAC Solvents Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

APAC Solvents Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

APAC Solvents Market Future Segmentation

8.1. By Solvent Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Distribution Channel (In Value %)

APAC Solvents Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC Solvents Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industrylevel information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the APAC Solvents Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computerassisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple solvent manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottomup approach, thereby ensuring a comprehensive, accurate, and validated analysis of the APAC Solvents Market.

Frequently Asked Questions

01. How big is the APAC Solvents Market?

The APAC Solvents market is valued at USD 19 billion, driven by increasing demand from key industries such as paints & coatings, pharmaceuticals, and personal care products. The region's rapid industrialization and technological advancements significantly contribute to the market's substantial size.

02. What are the challenges in the APAC Solvents Market?

Challenges in the APAC Solvents market include volatility in raw material prices, stringent environmental regulations, and high initial investment costs. Additionally, the market faces technical challenges related to solvent efficiency and sustainability requirements.

03. Who are the major players in the APAC Solvents Market?

Key players in the APAC Solvents market include Dow Inc., BASF SE, Shell Chemicals, Eastman Chemical Company, and LyondellBasell Industries. These companies dominate the market due to their extensive product portfolios, strong geographic presence, and continuous innovation.

04. What are the growth drivers of the APAC Solvents Market?

The APAC Solvents market is propelled by factors such as increasing industrial expansion, technological advancements in solvent production, and rising demand from enduse industries like paints & coatings and pharmaceuticals. Additionally, the shift towards sustainable and ecofriendly solvents is boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.