Region:Asia

Author(s):Rebecca

Product Code:KRAA9332

Pages:92

Published On:November 2025

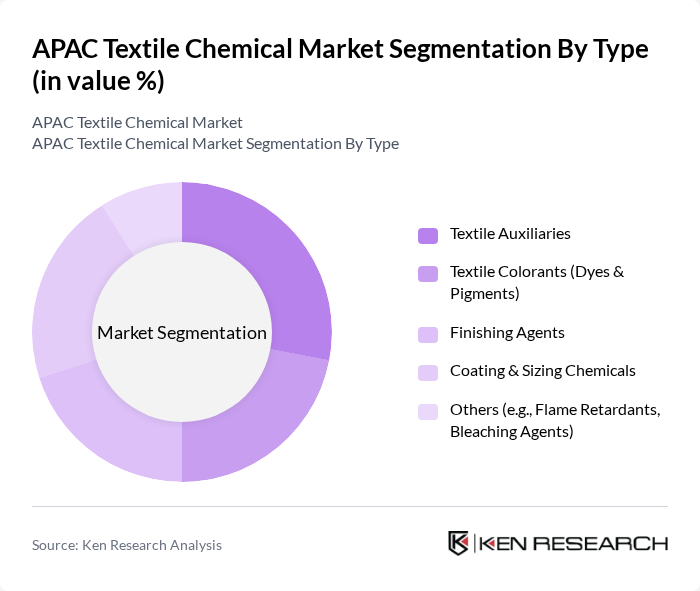

By Type:The textile chemical market is segmented into various types, including Textile Auxiliaries, Textile Colorants (Dyes & Pigments), Finishing Agents, Coating & Sizing Chemicals, and Others (e.g., Flame Retardants, Bleaching Agents). Among these, Textile Auxiliaries and Colorants together account for the majority share due to their essential roles in improving textile quality and enabling diverse coloration and finishing effects. The demand for high-performance and sustainable chemicals is driving growth in these segments, with finishing agents seeing rapid adoption for functional and eco-friendly textile finishes .

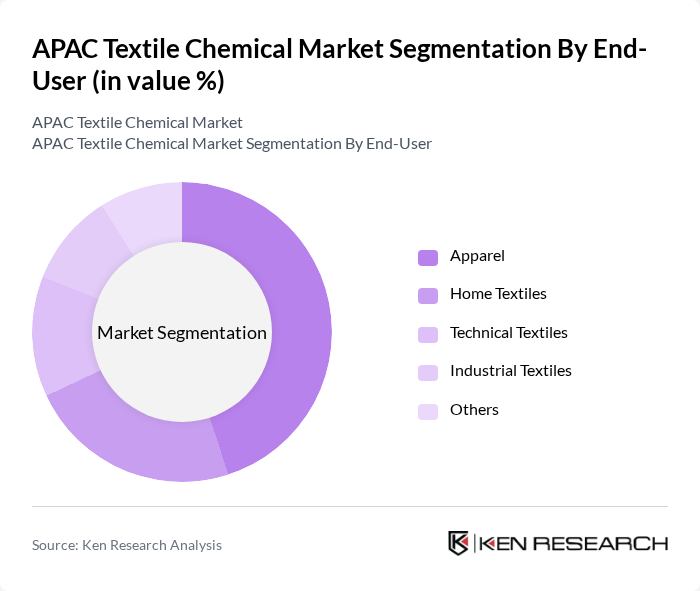

By End-User:The market is also segmented by end-user applications, including Apparel, Home Textiles, Technical Textiles, Industrial Textiles, and Others. The Apparel segment holds the largest share, driven by the continuous demand for fashionable and functional clothing, as well as the growing trend of sustainable fashion and the adoption of eco-friendly textile chemicals. Technical textiles are also gaining traction due to their applications in automotive, healthcare, and industrial sectors .

The APAC Textile Chemical Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Huntsman Corporation, Dow Chemical Company, Archroma, Clariant AG, Solvay S.A., Lanxess AG, Evonik Industries AG, Croda International Plc, Wacker Chemie AG, Kiri Industries Ltd., Eastman Chemical Company, NICCA Chemical Co., Ltd., DyStar Group, and Tanatex Chemicals B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC textile chemical market is poised for transformative growth, driven by increasing consumer demand for sustainable products and technological innovations. As manufacturers adopt eco-friendly practices, the market is expected to see a rise in biodegradable textile chemicals and advanced processing technologies. Additionally, the expansion of online retail channels will facilitate greater access to innovative textile solutions, further enhancing market dynamics. The focus on circular economy practices will also shape future developments, ensuring sustainability remains at the forefront of industry growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Textile Auxiliaries Textile Colorants (Dyes & Pigments) Finishing Agents Coating & Sizing Chemicals Others (e.g., Flame Retardants, Bleaching Agents) |

| By End-User | Apparel Home Textiles Technical Textiles Industrial Textiles Others |

| By Region | China India Bangladesh Vietnam Indonesia Rest of APAC |

| By Application | Pre-Treatment Textile Dyeing Textile Finishing Printing Others |

| By Product Formulation | Water-based Formulations Solvent-based Formulations Powder Formulations Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Sustainability Level | Conventional Chemicals Eco-friendly Chemicals Biodegradable Chemicals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Manufacturing Processes | 100 | Production Managers, Process Engineers |

| Textile Chemical Suppliers | 60 | Sales Managers, Product Managers |

| Sustainability Initiatives in Textiles | 50 | Sustainability Managers, Compliance Officers |

| Market Trends in Textile Chemicals | 70 | Market Analysts, Business Development Managers |

| Consumer Preferences in Textile Products | 40 | Brand Managers, Consumer Insights Analysts |

The APAC Textile Chemical Market is valued at approximately USD 17.5 billion, driven by increasing demand for textile products, advancements in chemical formulations, and a shift towards sustainable practices in the textile industry.