Region:Asia

Author(s):Shubham

Product Code:KRAC4265

Pages:95

Published On:October 2025

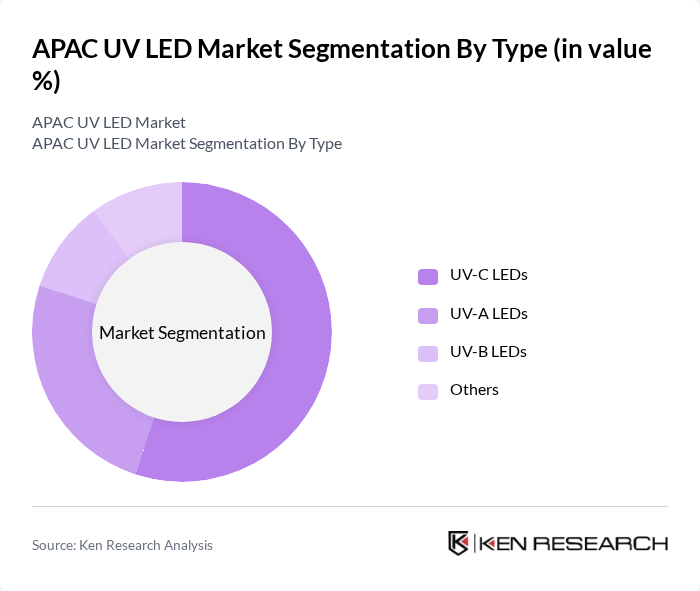

By Type:The market is segmented into UV-C LEDs, UV-A LEDs, UV-B LEDs, and Others. Among these, UV-C LEDs are leading due to their effectiveness in disinfection applications, particularly in healthcare, water treatment, and industrial sectors. The growing emphasis on hygiene, safety, and regulatory compliance has significantly increased the demand for UV-C LEDs, making them the dominant sub-segment in the market .

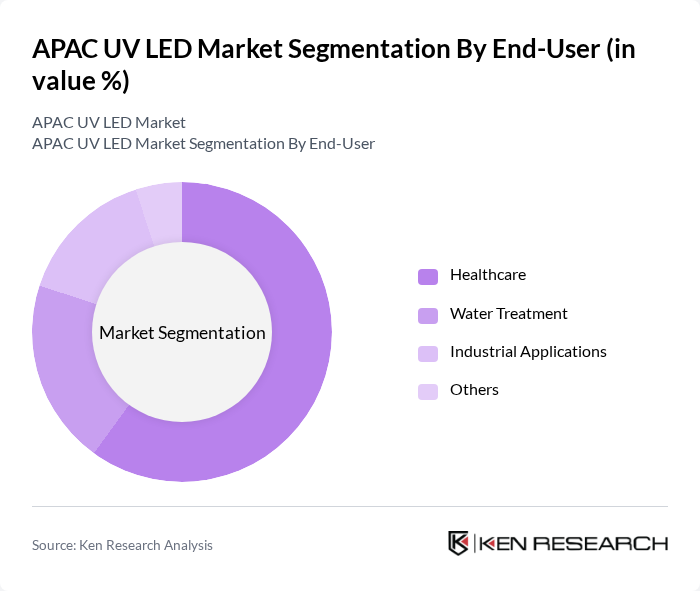

By End-User:The end-user segments include Healthcare, Water Treatment, Industrial Applications, and Others. The healthcare sector is the leading end-user, driven by the increasing need for sterilization and disinfection solutions in hospitals and clinics. The COVID-19 pandemic has further accelerated the adoption of UV LED technology in healthcare settings, and ongoing concerns about infection control continue to solidify its position as the dominant sub-segment. Water treatment and industrial applications are also experiencing robust growth due to regulatory and sustainability trends .

The APAC UV LED market is characterized by a dynamic mix of regional and international players. Leading participants such as Nichia Corporation, Seoul Semiconductor Co., Ltd., LG Innotek Co., Ltd., Foshan Nationstar Optoelectronics Co., Ltd., HC Semitek Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Ushio Inc., Sharp Corporation, Tokyo Electron Limited, San’an Optoelectronics Co., Ltd., Epileds Technologies Inc., Luminus Devices, Inc., Crystal IS, Inc., and UV-LED Technology GmbH contribute to innovation, geographic expansion, and service delivery in this space .

The APAC UV LED market is poised for significant growth, driven by increasing environmental awareness and technological advancements. As industries continue to prioritize sustainability, the demand for UV LEDs in applications such as disinfection and smart lighting is expected to rise. Furthermore, the integration of UV LEDs in consumer electronics will likely expand, creating new avenues for market penetration. The focus on energy efficiency and eco-friendly solutions will shape the future landscape, fostering innovation and collaboration across sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | UV-C LEDs UV-A LEDs UV-B LEDs Others |

| By End-User | Healthcare Water Treatment Industrial Applications Others |

| By Region | China Japan South Korea India Australia Rest of APAC |

| By Technology | Surface Mount Technology (SMT) Chip-on-Board (COB) Others |

| By Application | Disinfection Curing Horticulture Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare UV Disinfection Applications | 120 | Facility Managers, Infection Control Officers |

| Industrial UV Curing Processes | 110 | Production Managers, Quality Assurance Leads |

| Agricultural UV LED Usage | 90 | Agronomists, Farm Operations Managers |

| Consumer Electronics UV LED Integration | 100 | Product Development Engineers, R&D Managers |

| Environmental Impact Assessments | 80 | Sustainability Consultants, Environmental Engineers |

The APAC UV LED market is valued at approximately USD 420 million, driven by the increasing demand for energy-efficient lighting solutions and advancements in UV LED technology, particularly in applications like healthcare and water treatment.