Region:Asia

Author(s):Geetanshi

Product Code:KRAD7275

Pages:90

Published On:December 2025

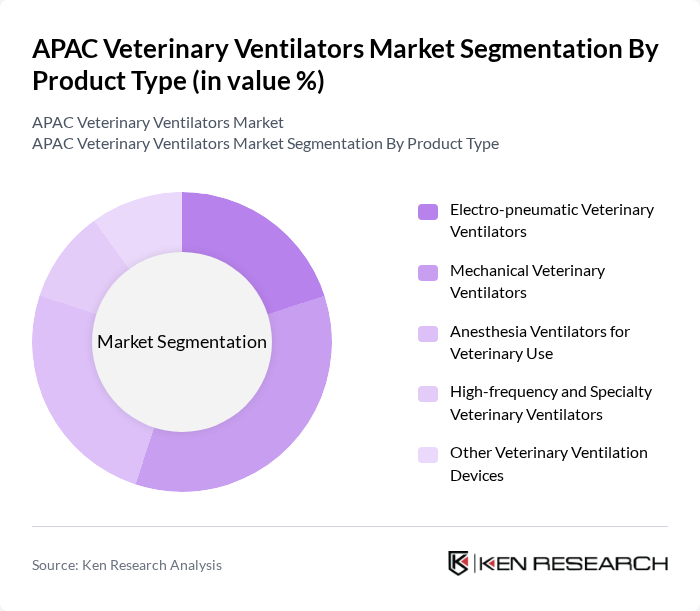

By Product Type:The product type segmentation includes various categories of veterinary ventilators that cater to different clinical needs and animal types. The market is characterized by a diverse range of products, each designed to meet specific requirements in veterinary medicine.

The Mechanical Veterinary Ventilators segment is currently dominating the market due to their versatility and reliability in various clinical settings. These ventilators are widely used in veterinary hospitals and clinics for both routine and emergency procedures. The increasing complexity of veterinary surgeries and the need for precise ventilation support have led to a higher adoption rate of mechanical ventilators. Additionally, advancements in technology have improved the efficiency and effectiveness of these devices, making them a preferred choice among veterinary professionals.

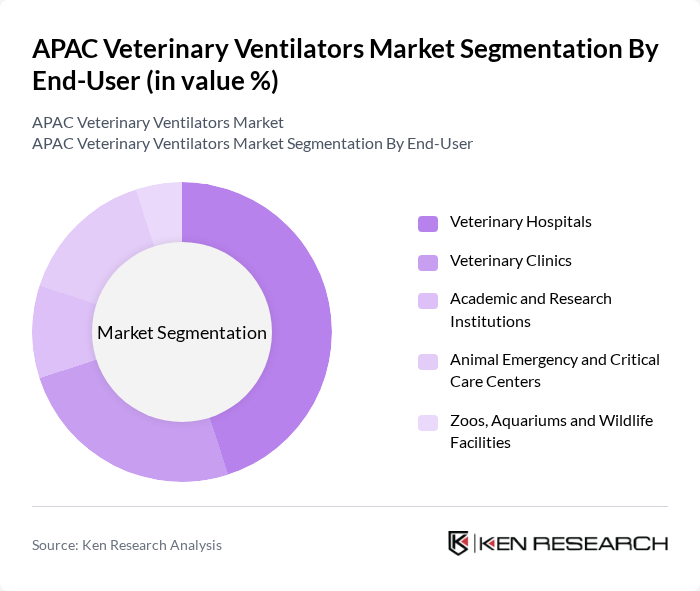

By End-User:The end-user segmentation highlights the various facilities and institutions that utilize veterinary ventilators. This includes a range of establishments from hospitals to specialized care centers, each with unique requirements for ventilation support.

The Veterinary Hospitals segment leads the market due to the high volume of surgeries and critical care cases handled in these facilities. Hospitals are equipped with advanced medical technologies and have a higher demand for reliable ventilation systems to ensure the safety and well-being of animals during procedures. The increasing number of veterinary hospitals and the growing trend of specialized veterinary care are further propelling the demand for ventilators in this segment.

The APAC Veterinary Ventilators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mindray Animal Medical (Shenzhen Mindray Bio-Medical Electronics Co., Ltd.), Shenzhen RWD Life Science Co., Ltd., Jiangsu Rooe Medical Technology Co., Ltd., Vetronic Services Ltd., DRE Veterinary (Avante Animal Health), Hallowell EMC (Hallowell Engineering & Manufacturing Corporation), Eickemeyer Veterinary Equipment GmbH & Co. KG, VetEquip Inc., Bionet Co., Ltd., Supera Anesthesia Innovations, JD Medical Dist. Co., Inc., Smiths Medical (ICU Medical, Inc.), Drägerwerk AG & Co. KGaA, GE HealthCare Technologies Inc., Medtronic plc contribute to innovation, geographic expansion, and service delivery in this space.

The APAC veterinary ventilators market is poised for significant growth, driven by increasing pet ownership and advancements in veterinary technology. As the demand for specialized veterinary care rises, practices are likely to invest in innovative equipment. Additionally, the integration of telemedicine and AI in veterinary services will enhance patient care and operational efficiency. These trends indicate a promising future for the market, with opportunities for growth and development in veterinary practices across the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Electro-pneumatic Veterinary Ventilators Mechanical Veterinary Ventilators Anesthesia Ventilators for Veterinary Use High-frequency and Specialty Veterinary Ventilators Other Veterinary Ventilation Devices |

| By End-User | Veterinary Hospitals Veterinary Clinics Academic and Research Institutions Animal Emergency and Critical Care Centers Zoos, Aquariums and Wildlife Facilities |

| By Animal Type | Small Companion Animals (Dogs, Cats) Other Companion Animals (Equine and Pets) Livestock (Cattle, Swine, Poultry and Others) Exotic and Wildlife Species |

| By Clinical Application | Anesthesia Support in Veterinary Surgery Emergency and Resuscitation Ventilation Intensive and Critical Care Ventilation Long-term and Home-care Ventilation |

| By Distribution Channel | Direct Sales to Veterinary Facilities Veterinary Equipment Distributors and Dealers Online and E-commerce Platforms Group Purchasing Organizations and Tender-based Procurement |

| By Country (APAC) | China Japan India Australia and New Zealand South Korea Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Others) Rest of Asia-Pacific |

| By Policy and Reimbursement Support | Government Funding and Subsidies for Veterinary Infrastructure Tax Incentives for Veterinary Equipment Procurement Grants for Veterinary Research and Teaching Hospitals Public–Private Partnership Programs and Other Policy Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Animal Hospitals | 100 | Veterinary Technicians, Hospital Administrators |

| Research Institutions | 50 | Veterinary Researchers, Academic Professors |

| Livestock Management Facilities | 80 | Farm Managers, Veterinary Consultants |

| Pet Care Services | 70 | Pet Care Managers, Animal Welfare Officers |

The APAC Veterinary Ventilators Market is valued at approximately USD 170 million, driven by factors such as the rising prevalence of respiratory diseases in animals, advancements in veterinary technology, and increasing pet ownership across the region.