Region:Asia

Author(s):Geetanshi

Product Code:KRAD4131

Pages:100

Published On:December 2025

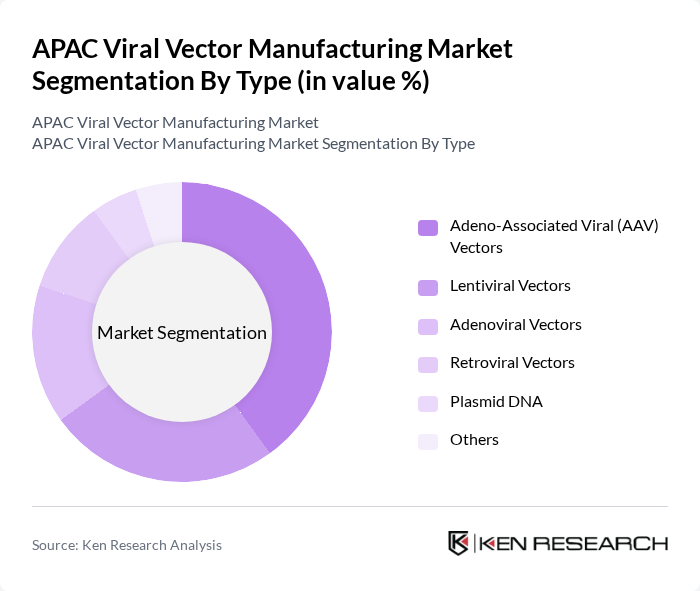

By Type:The viral vector manufacturing market is segmented into various types, including Adeno-Associated Viral (AAV) Vectors, Lentiviral Vectors, Adenoviral Vectors, Retroviral Vectors, Plasmid DNA, and Others. Among these, Adeno-Associated Viral (AAV) Vectors are currently leading the market due to their high efficiency in gene delivery and low immunogenicity, making them ideal for gene therapy applications. The increasing focus on personalized medicine and the growing number of clinical trials utilizing AAV vectors are driving their dominance in the market.

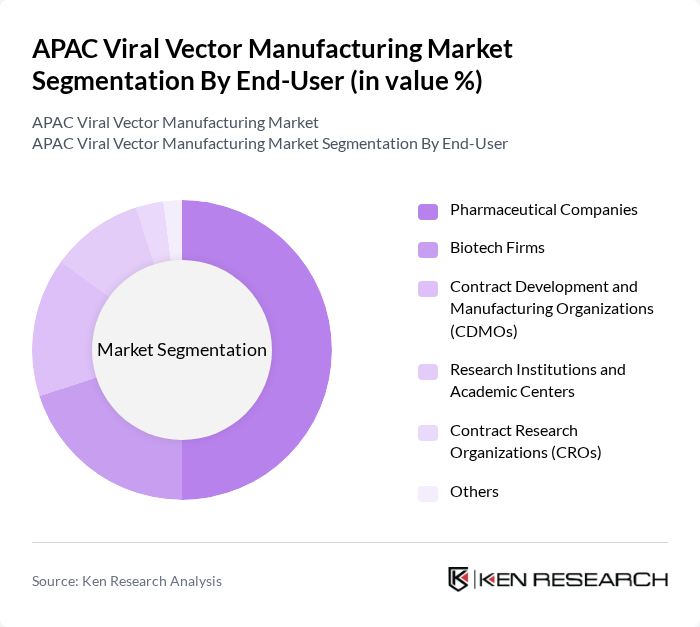

By End-User:The market is also segmented by end-users, which include Pharmaceutical Companies, Biotech Firms, Contract Development and Manufacturing Organizations (CDMOs), Research Institutions and Academic Centers, Contract Research Organizations (CROs), and Others. Pharmaceutical Companies are the leading end-users, driven by their extensive research and development activities in gene therapies and vaccines. The increasing collaboration between pharmaceutical companies and biotech firms for innovative therapies is further enhancing the demand for viral vector manufacturing.

The APAC Viral Vector Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as WuXi AppTec, WuXi Biologics, GenScript Biotech, Lonza Group, Catalent, Inc., Takara Bio Inc., Aurigene Pharmaceutical Services, Biological E. Limited, Zydus Lifesciences, Bharat Biotech International Limited, Oxford Biomedica, Thermo Fisher Scientific, Merck KGaA, Novartis, Amgen contribute to innovation, geographic expansion, and service delivery in this space.

The APAC viral vector manufacturing market is poised for significant growth, driven by technological advancements and increasing demand for personalized medicine. As the region continues to invest in biotechnology, the integration of automation and AI in manufacturing processes will enhance efficiency and reduce costs. Furthermore, the focus on sustainable practices will shape the future landscape, ensuring that production methods align with environmental standards while meeting the rising therapeutic needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Adeno-Associated Viral (AAV) Vectors Lentiviral Vectors Adenoviral Vectors Retroviral Vectors Plasmid DNA Others |

| By End-User | Pharmaceutical Companies Biotech Firms Contract Development and Manufacturing Organizations (CDMOs) Research Institutions and Academic Centers Contract Research Organizations (CROs) Others |

| By Application | Gene Therapy Vaccine Development Cell Therapy Oncolytic Virus Therapy Others |

| By Delivery Method | In Vivo Delivery Ex Vivo Delivery Others |

| By Scale of Production | Small Scale (Research/Clinical) Medium Scale (Late-Stage Clinical) Large Scale (Commercial) Others |

| By Geography | China India Japan South Korea Singapore Australia Thailand Rest of APAC |

| By Regulatory Compliance | FDA Compliance EMA Compliance PMDA (Japan) Compliance NMPA (China) Compliance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gene Therapy Developers | 100 | R&D Directors, Product Managers |

| Contract Manufacturing Organizations (CMOs) | 80 | Operations Managers, Quality Assurance Heads |

| Regulatory Affairs Specialists | 60 | Regulatory Managers, Compliance Officers |

| Academic Research Institutions | 70 | Principal Investigators, Lab Managers |

| Healthcare Providers Utilizing Gene Therapies | 90 | Clinical Directors, Pharmacists |

The APAC Viral Vector Manufacturing Market is valued at approximately USD 1.01.9 billion, driven by the increasing demand for gene and cell therapies, particularly in response to the COVID-19 pandemic and the rising prevalence of genetic disorders.