Region:Asia

Author(s):Geetanshi

Product Code:KRAB0112

Pages:94

Published On:August 2025

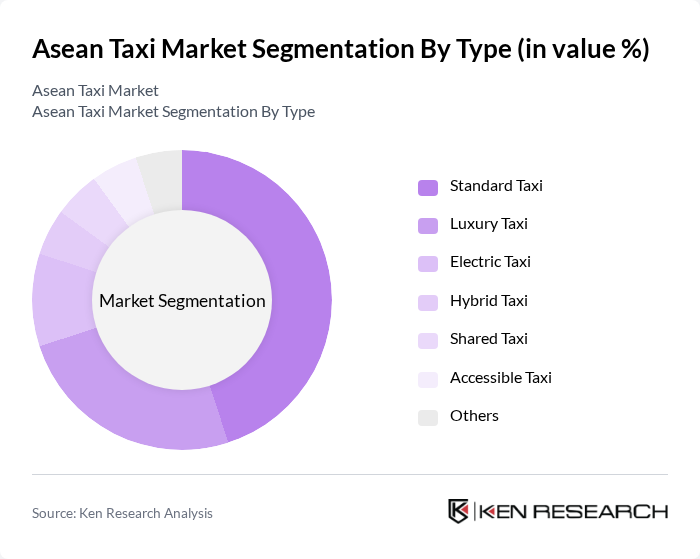

By Type:The taxi market can be segmented into various types, including Standard Taxi, Luxury Taxi, Electric Taxi, Hybrid Taxi, Shared Taxi, Accessible Taxi, and Others. Among these, Standard Taxis dominate the market due to their affordability and widespread availability. They cater to a broad customer base, including daily commuters and tourists, making them the preferred choice for many users. Luxury Taxis are also gaining traction, particularly in urban areas where consumers are willing to pay a premium for enhanced comfort and service. The market is further witnessing increased adoption of Electric and Hybrid Taxis, driven by sustainability initiatives and government incentives for greener transportation options .

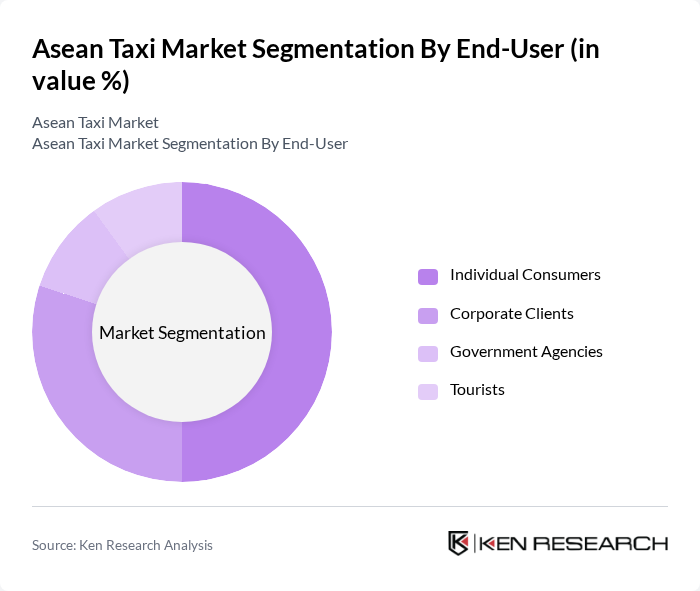

By End-User:The market can also be segmented based on end-users, including Individual Consumers, Corporate Clients, Government Agencies, and Tourists. Individual Consumers represent the largest segment, driven by the increasing need for convenient and flexible transportation options. Corporate Clients are also significant, as businesses often require reliable transportation for employees and clients. The tourism sector contributes to the demand for taxis, particularly in popular travel destinations across the region. The adoption of app-based booking platforms has further expanded accessibility for all end-user segments .

The Asean Taxi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab Holdings Inc., Gojek, ComfortDelGro Corporation Limited, Blue Bird Group, TADA Mobility, Ryde Group Ltd., Maxim (Indonesia, Vietnam, Philippines), Vinasun Corporation, SMRT Taxis, Sunlight Taxi Group (Vietnam), Uber Technologies Inc. (ASEAN operations limited), Easy Taxi (Southeast Asia), Indriver (Southeast Asia), MyCar (Malaysia), TaxiMonger (Malaysia) contribute to innovation, geographic expansion, and service delivery in this space .

The ASEAN taxi market is poised for transformative growth driven by urbanization, rising incomes, and technological advancements. As cities expand and populations increase, the demand for efficient transportation solutions will intensify. Additionally, the integration of electric vehicles and smart technologies will enhance service efficiency and sustainability. Stakeholders must navigate regulatory challenges while leveraging partnerships with local governments to foster innovation and improve service delivery, ensuring they remain competitive in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Taxi Luxury Taxi Electric Taxi Hybrid Taxi Shared Taxi Accessible Taxi Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tourists |

| By Region | Indonesia Thailand Singapore Malaysia Vietnam Philippines Other ASEAN Countries |

| By Application | Daily Commuting Airport Transfers Event Transportation Emergency Services |

| By Pricing Model | Metered Fare Flat Rate Subscription Services |

| By Service Type | On-Demand Services Pre-Booked Services Ride-Hailing Services |

| By Customer Segment | Business Travelers Local Residents Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Traditional Taxi Operators | 60 | Fleet Managers, Business Owners |

| Ride-Hailing Drivers | 80 | Independent Drivers, Partner Drivers |

| Urban Commuters | 100 | Regular Taxi Users, Occasional Riders |

| Regulatory Authorities | 40 | Transport Policy Makers, City Planners |

| Taxi Industry Experts | 40 | Consultants, Analysts, Academics |

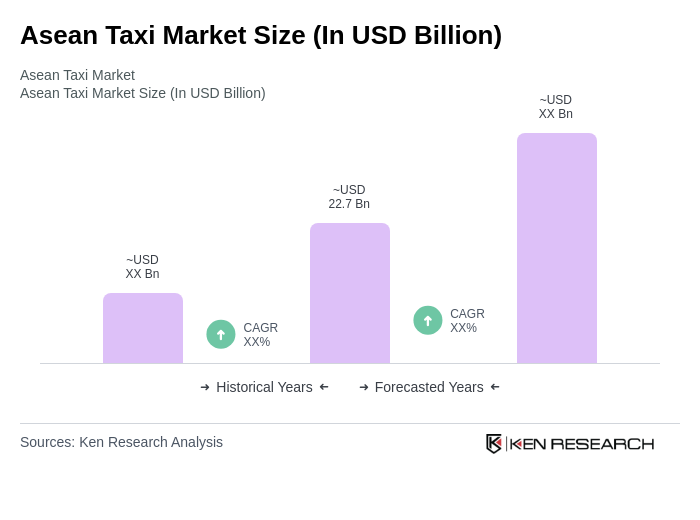

The Asean Taxi Market is valued at approximately USD 22.7 billion, driven by urbanization, rising disposable incomes, and the demand for convenient transportation options. The market is expected to grow further with the expansion of ride-hailing services and technological integration.