Region:Asia

Author(s):Rebecca

Product Code:KRAA1443

Pages:100

Published On:August 2025

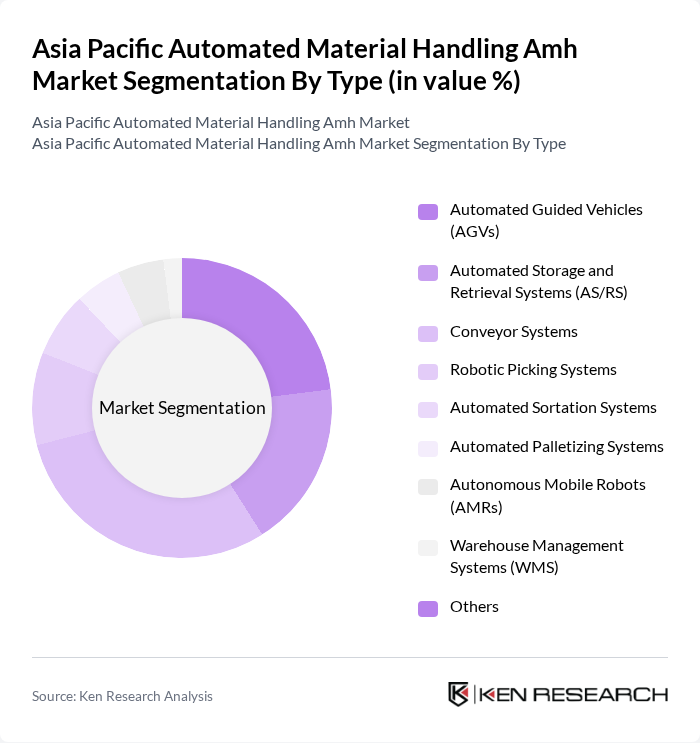

By Type:The market is segmented into Automated Guided Vehicles (AGVs), Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotic Picking Systems, Automated Sortation Systems, Automated Palletizing Systems, Autonomous Mobile Robots (AMRs), Warehouse Management Systems (WMS), and Others. Among these, Conveyor Systems and Robots (including AGVs and AMRs) are gaining significant traction due to their versatility, scalability, and efficiency in transporting goods within warehouses and manufacturing facilities. Conveyor systems, in particular, lead the segment due to their widespread adoption across industries such as automotive, food and beverage, and e-commerce, driven by the need for continuous, efficient movement of goods .

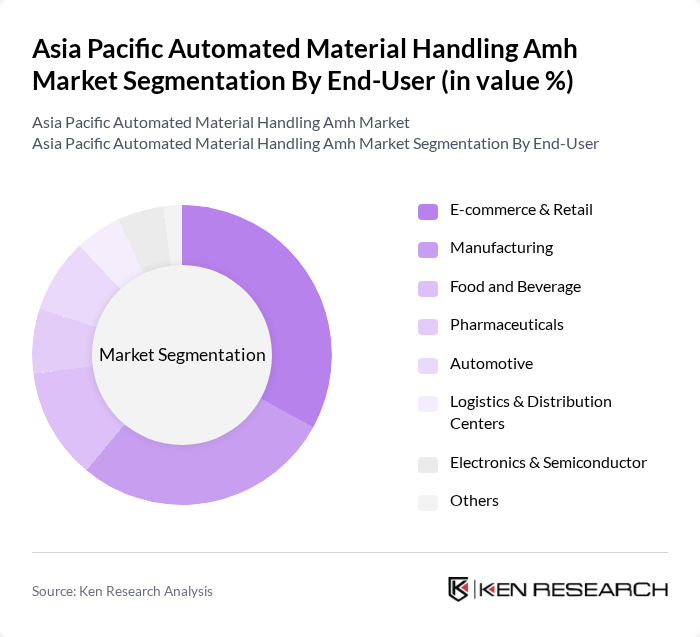

By End-User:The end-user segmentation includes E-commerce & Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Logistics & Distribution Centers, Electronics & Semiconductor, and Others. The E-commerce & Retail sector is the leading end-user of automated material handling systems, driven by the need for rapid order fulfillment, efficient inventory management, and the explosive growth of online shopping. Manufacturing and automotive sectors also contribute significantly due to the adoption of automation for assembly lines and just-in-time inventory practices .

The Asia Pacific Automated Material Handling Amh Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daifuku Co., Ltd., Murata Machinery, Ltd., Toyota Industries Corporation, KION Group AG, Dematic, Honeywell Intelligrated, SSI Schaefer, Vanderlande Industries, Swisslog Holding AG, Knapp AG, TGW Logistics Group, Bastian Solutions, Geekplus Technology Co., Ltd., BEUMER Group, Mitsubishi Logisnext Asia Pacific Pte. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automated material handling market in Asia Pacific appears promising, driven by ongoing technological advancements and increasing demand for efficiency. As companies continue to invest in smart warehousing and robotics, the market is expected to evolve significantly. Furthermore, the integration of AI and IoT technologies will enhance operational capabilities, allowing businesses to optimize their supply chains. This transformation is likely to attract new players and investments, fostering a competitive landscape that prioritizes innovation and sustainability in material handling solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Robotic Picking Systems Automated Sortation Systems Automated Palletizing Systems Autonomous Mobile Robots (AMRs) Warehouse Management Systems (WMS) Others |

| By End-User | E-commerce & Retail Manufacturing Food and Beverage Pharmaceuticals Automotive Logistics & Distribution Centers Electronics & Semiconductor Others |

| By Application | Warehousing Distribution Centers Assembly Lines Packaging Order Fulfillment Cold Chain Logistics Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Sales Others |

| By Function | Storage Transportation Sorting Packaging Others |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines) South Asia (India, Bangladesh, Sri Lanka, Pakistan) Oceania (Australia, New Zealand) Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector AMH Implementation | 120 | Warehouse Managers, Operations Directors |

| Automotive Manufacturing AMH Solutions | 90 | Production Managers, Supply Chain Managers |

| Pharmaceutical Distribution Automation | 60 | Logistics Coordinators, Compliance Officers |

| Food & Beverage Industry AMH Adoption | 50 | Quality Assurance Managers, Distribution Supervisors |

| E-commerce Fulfillment Centers | 70 | eCommerce Operations Managers, IT Managers |

The Asia Pacific Automated Material Handling market is valued at approximately USD 30 billion, driven by the increasing demand for automation in logistics and warehousing, along with advancements in technology such as robotics and IoT-enabled systems.