Region:Asia

Author(s):Geetanshi

Product Code:KRAB0054

Pages:95

Published On:August 2025

By Type:The beer market in the Asia Pacific region is segmented into Lager, Ale, Stout & Porter, Specialty Beer, Non-Alcoholic Beer, and Others. Lager remains the most popular type, favored for its crisp taste and broad appeal. Ale and Specialty Beer are experiencing notable growth due to the increasing popularity of craft brewing, while Non-Alcoholic Beer is gaining traction among health-conscious consumers. The market is also witnessing a rise in demand for low- and no-alcohol beer options, reflecting shifting health preferences.

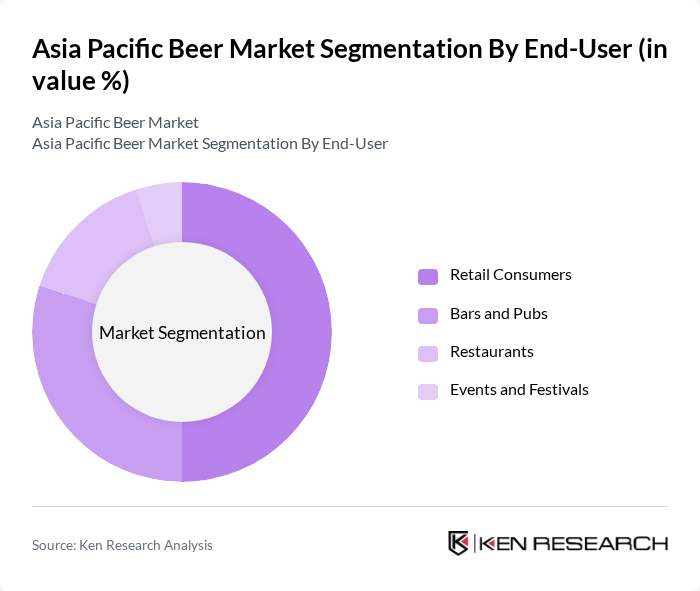

By End-User:The end-user segmentation of the beer market includes Retail Consumers, Bars and Pubs, Restaurants, and Events and Festivals. Retail Consumers form the largest segment, driven by the convenience of purchasing beer through supermarkets, convenience stores, and increasingly, e-commerce platforms. Bars and Pubs remain significant due to their role in social consumption, while Events and Festivals contribute to seasonal spikes in demand. The expansion of distribution channels, especially online retail, is further shaping consumer access and market dynamics.

The Asia Pacific Beer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asahi Group Holdings, Ltd., Kirin Holdings Company, Limited, Anheuser-Busch InBev SA/NV, Heineken N.V., China Resources Snow Breweries Limited, Tsingtao Brewery Co., Ltd., Sapporo Holdings Limited, San Miguel Corporation, Carlsberg Group, Thai Beverage Public Company Limited, Lotte Chilsung Beverage Co., Ltd., Hite Jinro Co., Ltd., Lion Pty Limited, Coopers Brewery Limited, BrewDog PLC contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific beer market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As the demand for craft and premium beers continues to rise, brands are likely to invest in sustainable practices and local sourcing. Additionally, the expansion of e-commerce platforms will enhance market accessibility, particularly in rural areas. These trends indicate a shift towards a more diverse and consumer-centric market landscape, fostering opportunities for both established and emerging players.

| Segment | Sub-Segments |

|---|---|

| By Type | Lager Ale Stout & Porter Specialty Beer Non-Alcoholic Beer Others |

| By End-User | Retail Consumers Bars and Pubs Restaurants Events and Festivals |

| By Region | China Japan India Australia Vietnam Thailand South Korea Rest of Asia Pacific |

| By Packaging Type | Glass Bottles Metal Cans PET Bottles Draught/Kegs |

| By Distribution Channel | On-trade (Bars, Restaurants, Pubs) Off-trade (Supermarkets/Hypermarkets, Convenience Stores) Online Retail Direct Sales |

| By Price Range | Economy Premium Super Premium |

| By Alcohol Content | Low Alcohol Regular Alcohol High Alcohol |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Beer Types | 120 | Regular Beer Consumers, Occasional Drinkers |

| Retail Distribution Channels | 60 | Retail Managers, Beverage Buyers |

| Impact of Health Trends on Beer Consumption | 50 | Health-Conscious Consumers, Nutritionists |

| Emerging Craft Beer Market Insights | 40 | Craft Brewery Owners, Industry Analysts |

| Trends in Beer Marketing Strategies | 70 | Marketing Managers, Brand Strategists |

The Asia Pacific Beer Market is valued at approximately USD 228 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and changing consumer preferences towards craft and premium beers.