Region:Asia

Author(s):Geetanshi

Product Code:KRAC0054

Pages:94

Published On:August 2025

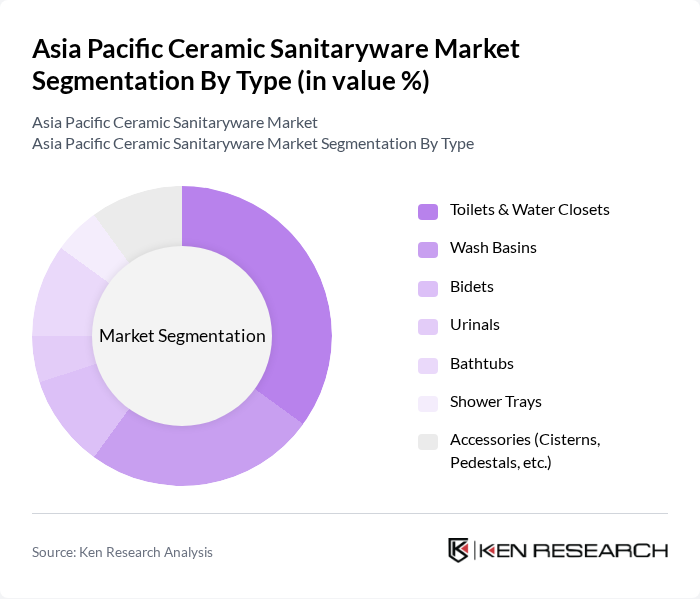

By Type:The market is segmented into various types of ceramic sanitaryware products, including toilets & water closets, wash basins, bidets, urinals, bathtubs, shower trays, and accessories such as cisterns and pedestals. Among these, toilets & water closets are the most dominant segment due to their essential role in sanitation and hygiene. The increasing focus on modern bathroom designs and the introduction of water-efficient and technologically advanced models are further driving the demand for this segment.

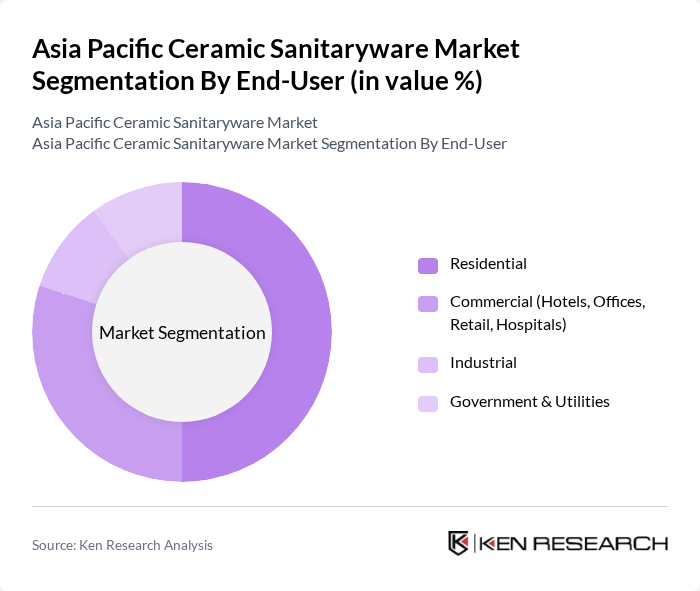

By End-User:The market is segmented by end-user into residential, commercial (including hotels, offices, retail, and hospitals), industrial, and government & utilities. The residential segment holds the largest share, driven by increasing home renovations, new construction projects, and the adoption of modern bathroom solutions with stylish and functional sanitaryware.

The Asia Pacific Ceramic Sanitaryware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kohler Co., Roca Sanitario S.A., LIXIL Group Corporation, TOTO Ltd., Geberit AG, Villeroy & Boch AG, Duravit AG, American Standard Brands (part of LIXIL), Ideal Standard International NV, Cera Sanitaryware Limited, Hindware Limited, Jaquar Group, Parryware (Roca Bathroom Products Pvt. Ltd.), Somany Ceramics Limited, RAK Ceramics PJSC, Asian Granito India Ltd., Toto Vietnam Co., Ltd., Inax (LIXIL Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific ceramic sanitaryware market appears promising, driven by technological advancements and a growing emphasis on sustainability. As smart home technologies gain traction, manufacturers are likely to integrate IoT features into sanitaryware products, enhancing user experience. Additionally, the increasing focus on eco-friendly materials will likely lead to innovative product offerings, catering to environmentally conscious consumers. The market is expected to evolve, reflecting changing consumer preferences and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Toilets & Water Closets Wash Basins Bidets Urinals Bathtubs Shower Trays Accessories (Cisterns, Pedestals, etc.) |

| By End-User | Residential Commercial (Hotels, Offices, Retail, Hospitals) Industrial Government & Utilities |

| By Region | China India (North, South, East, West) Japan Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, etc.) Rest of Asia Pacific |

| By Application | New Construction Renovation & Replacement Commercial Projects |

| By Distribution Channel | Direct Sales (B2B) Retail Outlets (Showrooms, Dealers) Online Sales |

| By Price Range | Economy Mid-Range Premium |

| By Material Type | Ceramic Porcelain Vitreous China Stoneware & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Sanitaryware Market | 100 | Homeowners, Interior Designers |

| Commercial Sanitaryware Applications | 90 | Facility Managers, Architects |

| Public Infrastructure Projects | 80 | Government Officials, Project Managers |

| Export Market Dynamics | 60 | Export Managers, Trade Analysts |

| Trends in Eco-friendly Sanitaryware | 70 | Sustainability Consultants, Product Developers |

The Asia Pacific Ceramic Sanitaryware Market is valued at approximately USD 25.7 billion, driven by factors such as urbanization, rising disposable incomes, and an increased focus on hygiene and sanitation in both residential and commercial spaces.