Region:Asia

Author(s):Geetanshi

Product Code:KRAA1992

Pages:96

Published On:August 2025

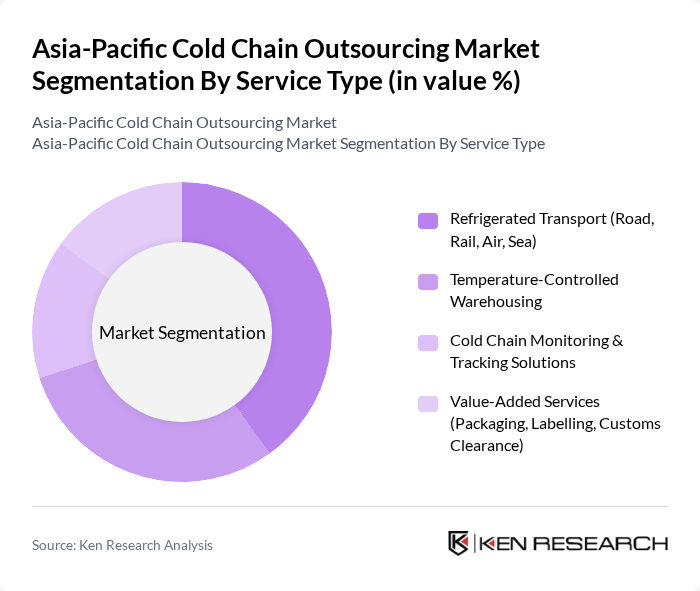

By Service Type:The service type segmentation includes offerings tailored to cold chain logistics needs.Refrigerated Transportis a major segment, ensuring safe movement of temperature-sensitive goods across road, rail, air, and sea.Temperature-Controlled Warehousingprovides optimal storage for perishables.Cold Chain Monitoring & Tracking Solutionsare increasingly adopted for real-time visibility and compliance, leveraging IoT and RFID technologies.Value-Added Servicessuch as packaging, labeling, and customs clearance streamline operations and support regulatory requirements .

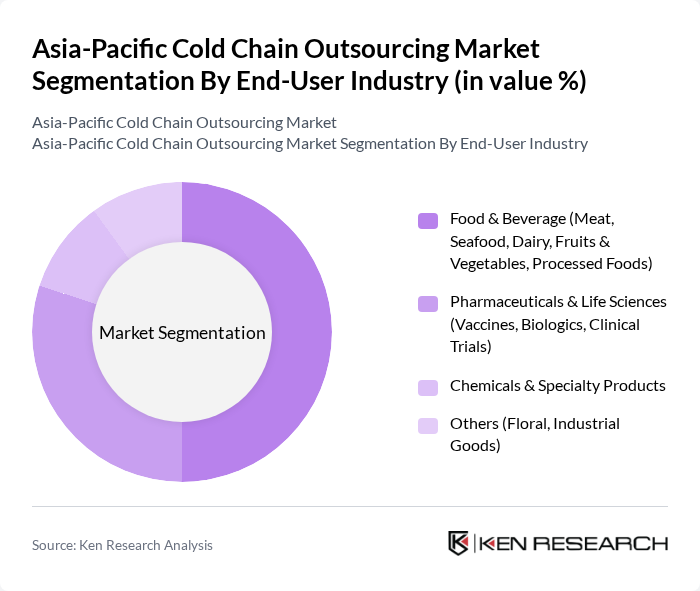

By End-User Industry:The end-user industry segmentation reflects the broad applications of cold chain outsourcing. TheFood & Beveragesector is the largest consumer, driven by demand for safe transport and storage of meat, seafood, dairy, fruits, vegetables, and processed foods.Pharmaceuticals & Life Sciencesrequire strict temperature controls for vaccines, biologics, and clinical trials.Chemicals & Specialty Productsutilize cold chain logistics for sensitive materials, while other industries, including floral and industrial goods, contribute to market expansion .

The Asia-Pacific Cold Chain Outsourcing Market features a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, Lineage Logistics, Americold Logistics, DB Schenker, Agility Logistics, Nichirei Logistics Group, Yamato Holdings Co., Ltd., SF Express (????), Maersk, CEVA Logistics, Kintetsu World Express, Sinotrans Limited, JWD Group (JWD InfoLogistics Public Company Limited), and CJ Logistics drive innovation, geographic expansion, and service excellence in this space .

The future of the cold chain outsourcing market in the Asia-Pacific region appears promising, driven by technological advancements and increasing investments in infrastructure. Companies are expected to adopt innovative solutions such as IoT for real-time monitoring and AI for predictive analytics, enhancing operational efficiency. Additionally, the focus on sustainability will likely lead to the adoption of eco-friendly refrigerants and practices, aligning with global environmental goals and consumer preferences for greener logistics solutions.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Refrigerated Transport (Road, Rail, Air, Sea) Temperature-Controlled Warehousing Cold Chain Monitoring & Tracking Solutions Value-Added Services (Packaging, Labelling, Customs Clearance) |

| By End-User Industry | Food & Beverage (Meat, Seafood, Dairy, Fruits & Vegetables, Processed Foods) Pharmaceuticals & Life Sciences (Vaccines, Biologics, Clinical Trials) Chemicals & Specialty Products Others (Floral, Industrial Goods) |

| By Temperature Range | Chilled (0°C to 8°C) Frozen (-18°C to -25°C) Deep-Frozen/Ultra-Low (-70°C and below) Ambient Controlled (8°C to 15°C) |

| By Country | China Japan India Australia & New Zealand South Korea Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, etc.) Rest of Asia-Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain Management | 120 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Cold Chain Solutions | 90 | Operations Managers, Quality Assurance Managers |

| Retail Cold Storage Practices | 60 | Procurement Officers, Inventory Managers |

| Technology Adoption in Cold Chain | 50 | IT Managers, Technology Managers |

| Logistics Outsourcing Trends | 70 | Supply Chain Executives, Business Development Managers |

The Asia-Pacific Cold Chain Outsourcing Market is valued at approximately USD 186 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with rising consumer expectations for quality and safety.