Region:Asia

Author(s):Dev

Product Code:KRAC0487

Pages:95

Published On:August 2025

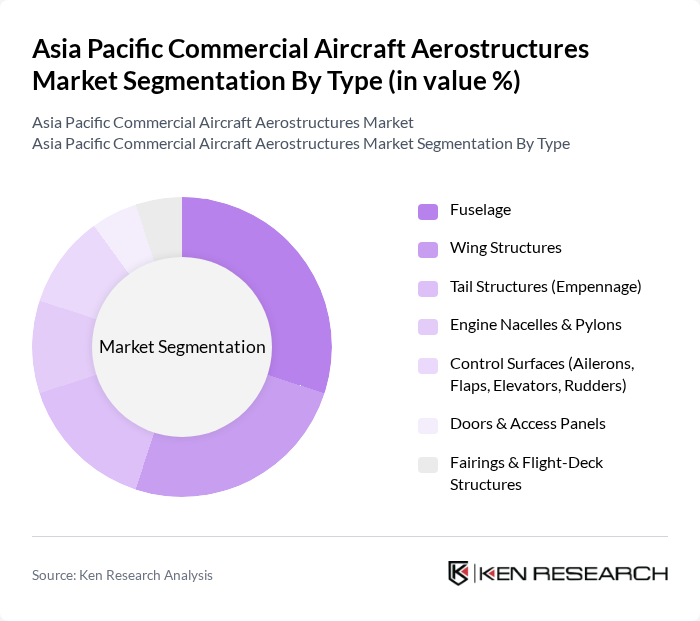

By Type:The market is segmented into various types of aerostructures, including fuselage, wing structures, tail structures, engine nacelles and pylons, control surfaces, doors and access panels, and fairings and flight-deck structures. Each of these components plays a critical role in the overall performance and safety of aircraft, with specific materials and manufacturing processes tailored to meet stringent industry standards.

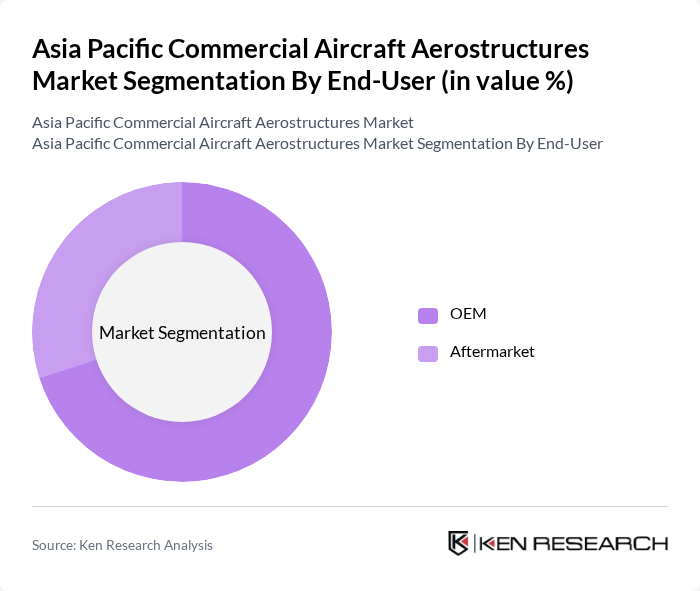

By End-User:The market is divided into two primary end-user segments: Original Equipment Manufacturers (OEM) and Aftermarket. OEMs are responsible for the initial production of aircraft, while the aftermarket segment focuses on maintenance, repair, and overhaul services. The growth in air travel and the increasing fleet size are driving demand in both segments, with OEMs benefiting from new aircraft orders and the aftermarket gaining from the need for ongoing maintenance.

The Asia Pacific Commercial Aircraft Aerostructures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus SE, The Boeing Company, Spirit AeroSystems, GKN Aerospace, Mitsubishi Heavy Industries (MHI) – Aerospace, Kawasaki Heavy Industries – Aerospace Systems, Subaru Corporation – Aerospace Company, Korea Aerospace Industries (KAI), COMAC (Commercial Aircraft Corporation of China, Ltd.), AVIC (Aviation Industry Corporation of China), ST Engineering Aerospace, Hindustan Aeronautics Limited (HAL), Leonardo S.p.A., Safran Nacelles, Aernnova Aerospace contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific Commercial Aircraft Aerostructures Market is poised for substantial growth, driven by increasing air travel demand and technological advancements. As airlines expand their fleets, manufacturers will need to adapt to evolving consumer preferences, particularly regarding sustainability and efficiency. The focus on lightweight materials and eco-friendly aircraft will shape future developments, while strategic partnerships will enhance innovation and market reach. Overall, the region is set to become a global hub for aerospace manufacturing, attracting investments and talent.

| Segment | Sub-Segments |

|---|---|

| By Type | Fuselage Wing Structures Tail Structures (Empennage) Engine Nacelles & Pylons Control Surfaces (Ailerons, Flaps, Elevators, Rudders) Doors & Access Panels Fairings & Flight-Deck Structures |

| By End-User | OEM Aftermarket |

| By Material | Metals (Aluminum, Titanium) Composites (CFRP, GFRP) Alloys & Hybrid Structures |

| By Aircraft Class | Narrow-Body Wide-Body Regional Jets Turboprops |

| By Manufacturing Process | Automated Fiber Placement (AFP) & Tape Laying (ATL) Additive Manufacturing Metal Forming & Machining Assembly & Integration |

| By Country | China India Japan South Korea Indonesia Australia Rest of Asia-Pacific |

| By Application | Primary Structures Secondary Structures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Aircraft Manufacturers | 90 | Chief Engineers, Production Managers |

| Aerostructures Suppliers | 75 | Supply Chain Managers, Quality Assurance Leads |

| Regulatory Bodies | 45 | Aviation Safety Inspectors, Policy Makers |

| Research Institutions | 55 | Aerospace Researchers, Academic Professors |

| Industry Consultants | 65 | Market Analysts, Aerospace Consultants |

The Asia Pacific Commercial Aircraft Aerostructures Market is valued at approximately USD 12 billion, driven by increasing air travel demand, advancements in aircraft technology, and rising production rates of commercial aircraft.