Region:Asia

Author(s):Dev

Product Code:KRAA1574

Pages:84

Published On:August 2025

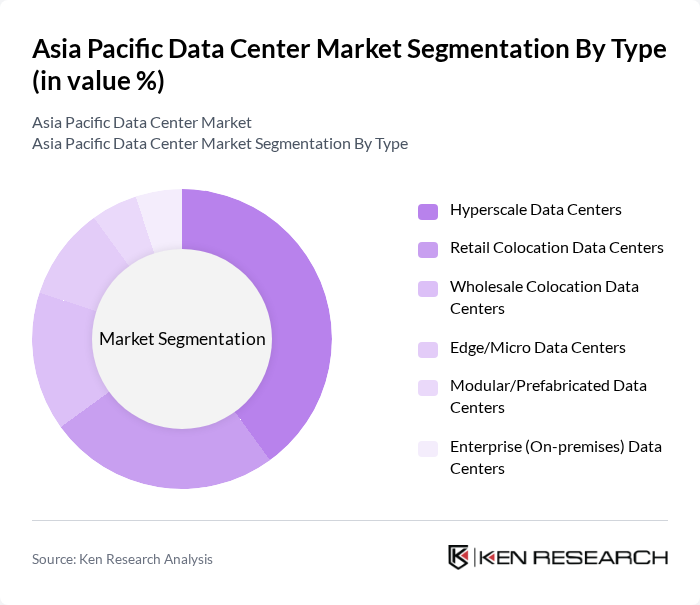

By Type:The Asia Pacific Data Center Market is segmented into various types, including Hyperscale Data Centers, Retail Colocation Data Centers, Wholesale Colocation Data Centers, Edge/Micro Data Centers, Modular/Prefabricated Data Centers, and Enterprise (On-premises) Data Centers. Among these, Hyperscale Data Centers are leading the market due to their ability to scale rapidly and efficiently meet the growing demand for cloud services and big data analytics.

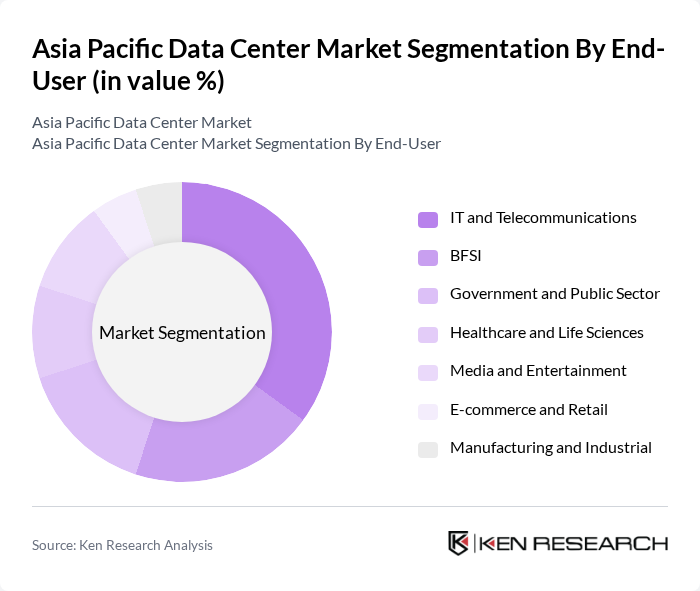

By End-User:The market is also segmented by end-users, including IT and Telecommunications, BFSI, Government and Public Sector, Healthcare and Life Sciences, Media and Entertainment, E-commerce and Retail, and Manufacturing and Industrial. The IT and Telecommunications sector is the dominant end-user, driven by the increasing demand for cloud computing and data storage solutions.

The Asia Pacific Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty (including MC Digital Realty, Mapletree JV), NTT Global Data Centers (NTT Ltd.), China Telecom Corporation Limited, China Mobile Limited, China Unicom (Hong Kong) Limited, Alibaba Cloud (Alibaba Group), Tencent Cloud, Baidu AI Cloud, Amazon Web Services (AWS), Microsoft Azure, Google Cloud, ST Telemedia Global Data Centres (STT GDC), Singtel (Nxera), Keppel Data Centres, Princeton Digital Group (PDG), AirTrunk, NEXTDC Limited, CDC Data Centres, Global Switch Holdings Limited, Telehouse (KDDI Corporation), KDDI Corporation, Rakuten Symphony/Edge (Rakuten Group), GDS Holdings Limited, Chayora Holdings Limited, BDx Data Centers (Big Data Exchange), EdgeConneX, Colt Data Centre Services (Colt DCS), Iron Mountain Data Centers, CyrusOne LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific data center market appears promising, driven by technological advancements and increasing digitalization. As organizations continue to embrace hybrid cloud solutions, the demand for data centers will likely rise. Additionally, the focus on energy efficiency and sustainability will shape investment strategies, with companies seeking to reduce their carbon footprint. The integration of advanced security measures will also be crucial in addressing growing cybersecurity threats, ensuring the resilience of data center operations in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Retail Colocation Data Centers Wholesale Colocation Data Centers Edge/Micro Data Centers Modular/Prefabricated Data Centers Enterprise (On?premises) Data Centers |

| By End-User | IT and Telecommunications BFSI Government and Public Sector Healthcare and Life Sciences Media and Entertainment E?commerce and Retail Manufacturing and Industrial |

| By Region | China Japan Australia India Singapore South Korea Southeast Asia (Malaysia, Indonesia, Thailand, Vietnam, Philippines) Hong Kong & Taiwan New Zealand |

| By Application/Workload | Cloud and SaaS Storage/Backup and Archiving Business Continuity and Disaster Recovery Big Data and Analytics AI/ML and High?Performance Computing (HPC) Content Delivery/Streaming |

| By Investment Category | Facility Construction (Building & Fit?outs) Power Infrastructure (UPS, Generators, Switchgear) Cooling Infrastructure (Chillers, CRAH/CRAC, Liquid Cooling) IT Infrastructure (Servers, Storage, Network) Connectivity (Dark Fiber, IX, Subsea Cables) Services (Design, Engineering, O&M) |

| By Power and Efficiency | IT Load Capacity (kW/MW Tiers) Power Usage Effectiveness (PUE Bands) Renewable and Low?Carbon Energy Adoption (Grid, PPAs, HVO Fuel) |

| By Security & Compliance | Physical Security Cybersecurity and Zero?Trust Solutions Compliance Certifications (ISO/IEC 27001, SOC 2, PCI DSS) Data Residency and Sovereignty Controls |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 150 | Data Center Managers, IT Infrastructure Directors |

| Hyperscale Data Centers | 100 | Cloud Architects, Operations Managers |

| Enterprise Data Center Operations | 80 | IT Managers, Facility Operations Leads |

| Data Center Energy Efficiency | 70 | Sustainability Officers, Energy Managers |

| Emerging Technologies in Data Centers | 90 | Chief Technology Officers (CTOs), R&D Managers in IT |

The Asia Pacific Data Center Market is valued at approximately USD 100 billion, reflecting significant investment in colocation and hyperscale facilities, driven by cloud adoption, 5G rollout, and the proliferation of IoT technologies.