Region:Asia

Author(s):Dev

Product Code:KRAB0492

Pages:81

Published On:August 2025

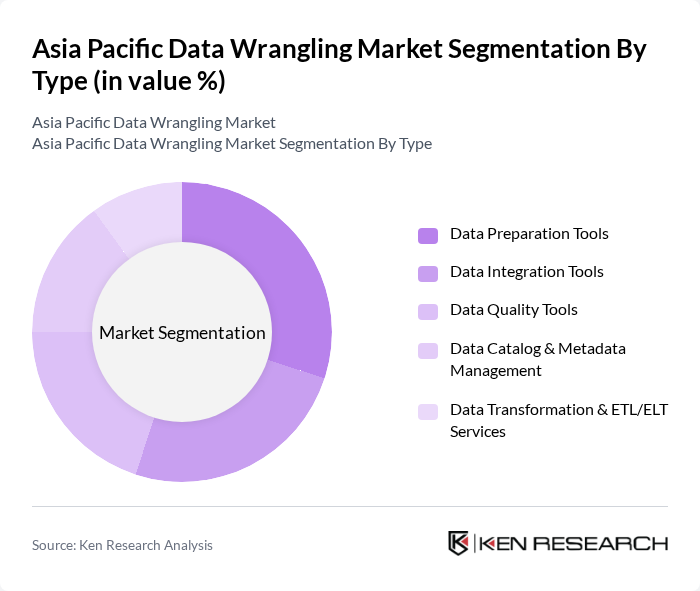

By Type:The market is segmented into various types, including Data Preparation Tools, Data Integration Tools, Data Quality Tools, Data Catalog & Metadata Management, and Data Transformation & ETL/ELT Services. Each of these subsegments plays a crucial role in the overall data wrangling process, catering to different organizational needs.

The Data Preparation Tools segment is currently leading the market due to the increasing demand for efficient data cleaning and transformation processes. Organizations are focusing on preparing their data for analysis, which is essential for deriving actionable insights. The rise in data complexity and volume has made these tools indispensable for businesses aiming to enhance their data analytics capabilities.

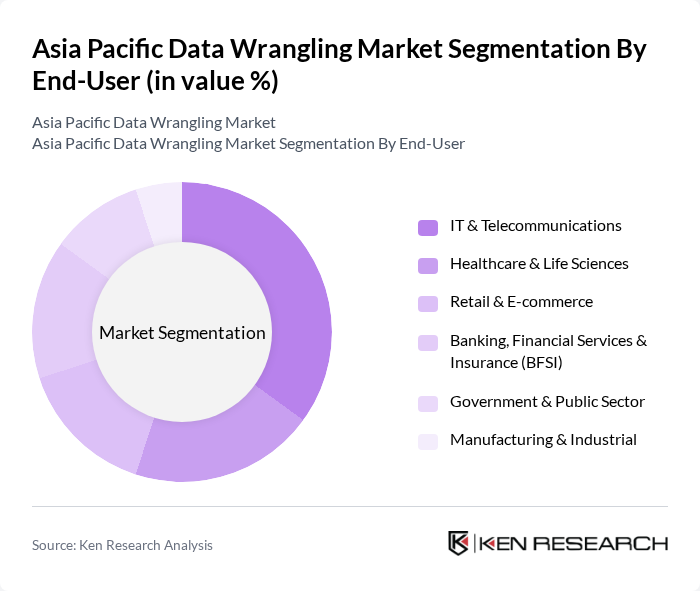

By End-User:The market is segmented by end-users, including IT & Telecommunications, Healthcare & Life Sciences, Retail & E-commerce, Banking, Financial Services & Insurance (BFSI), Government & Public Sector, and Manufacturing & Industrial. Each sector has unique requirements and challenges that data wrangling solutions address.

The IT & Telecommunications sector dominates the market, driven by the need for efficient data management and analytics to support various applications, including network optimization and customer experience enhancement. The rapid digital transformation in this sector has led to increased investments in data wrangling solutions, making it a key driver of market growth.

The Asia Pacific Data Wrangling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alteryx, Inc., Talend (a Qlik company), Informatica Inc., SAS Institute Inc., Microsoft Corporation (Power Query/Power BI), IBM Corporation (IBM DataStage, Watsonx.data), TIBCO Software Inc. (Spotfire, Data Virtualization), Domo, Inc., RapidMiner (Altair RapidMiner), Trifacta (Google Cloud Dataprep legacy; Wrangled into Google DataPrep/Cloud Data Wrangler), DataRobot, Inc., QlikTech International AB, Google Cloud, Amazon Web Services (AWS), Snowflake Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific data wrangling market is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly prioritize data-driven decision-making, the integration of AI and machine learning into data wrangling processes will enhance efficiency and accuracy. Furthermore, the growing emphasis on data governance and compliance will shape the development of innovative solutions, ensuring that businesses can navigate regulatory challenges while maximizing the value of their data assets.

| Segment | Sub-Segments |

|---|---|

| By Type | Data Preparation Tools Data Integration Tools Data Quality Tools Data Catalog & Metadata Management Data Transformation & ETL/ELT Services |

| By End-User | IT & Telecommunications Healthcare & Life Sciences Retail & E-commerce Banking, Financial Services & Insurance (BFSI) Government & Public Sector Manufacturing & Industrial |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Singapore, Malaysia, Thailand, Vietnam, Philippines) Rest of Asia-Pacific |

| By Application | Customer Analytics Operational Analytics Fraud Detection & AML Risk & Compliance Management IoT/Streaming Data Preparation |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments |

| By Policy Support | Data Protection & Privacy (e.g., PIPL, PDPB, PDPA) Innovation Grants & Smart City Programs Tax Incentives for Digital Adoption Workforce Training & Reskilling Programs |

| By Distribution Channel | Direct Sales Cloud Marketplaces (AWS, Azure, Google Cloud) Value-Added Resellers (VARs) & System Integrators Online Subscriptions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Management | 120 | Data Analysts, IT Managers |

| Healthcare Data Integration | 100 | Healthcare IT Directors, Data Governance Officers |

| Retail Customer Data Analytics | 90 | Marketing Managers, Data Scientists |

| Telecommunications Data Processing | 80 | Network Analysts, Operations Managers |

| Manufacturing Data Optimization | 70 | Supply Chain Managers, Production Analysts |

The Asia Pacific Data Wrangling Market is valued at approximately USD 670 million, reflecting significant growth driven by the increasing need for efficient data management and analysis amid rapid digital transformation and cloud adoption across the region.