Region:Asia

Author(s):Geetanshi

Product Code:KRAC0078

Pages:86

Published On:August 2025

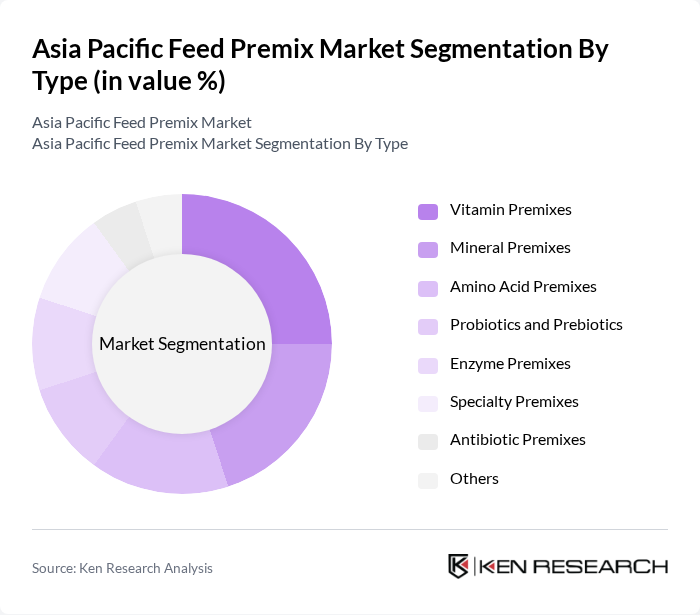

By Type:The feed premix market is segmented into Vitamin Premixes, Mineral Premixes, Amino Acid Premixes, Probiotics and Prebiotics, Enzyme Premixes, Specialty Premixes, Antibiotic Premixes, and Others. Each segment plays a vital role in enhancing the nutritional value of animal feed, addressing the specific dietary needs of various livestock. Vitamin Premixes are essential for metabolic health, Mineral Premixes support bone and muscle development, Amino Acid Premixes aid protein synthesis, Probiotics and Prebiotics improve gut health, Enzyme Premixes enhance nutrient absorption, Specialty Premixes target specific health outcomes, and Antibiotic Premixes are used for disease prevention in regulated contexts .

The Vitamin Premixes subsegment holds the largest share, driven by their essential role in animal health and growth. Demand for vitamin-enriched feed continues to surge as producers focus on improving feed efficiency and animal welfare. This trend is especially pronounced in poultry and swine production, where vitamins are critical for growth rates and overall health. Increasing awareness of balanced nutrition and regulatory support for fortified feeds further reinforce the dominance of vitamin premixes .

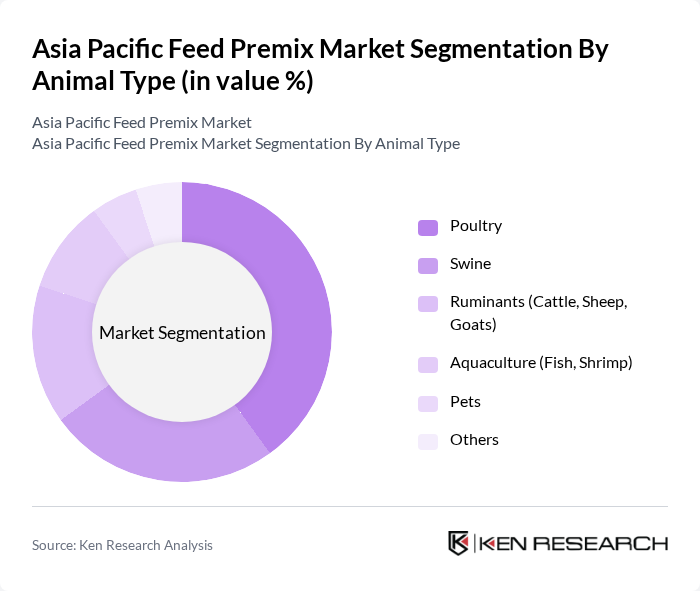

By Animal Type:The feed premix market is also segmented by animal type, including Poultry, Swine, Ruminants (Cattle, Sheep, Goats), Aquaculture (Fish, Shrimp), Pets, and Others. Each animal type has distinct nutritional requirements, influencing the formulation and demand for specific premix types. Poultry requires high-energy and protein-rich premixes, swine benefit from amino acid and vitamin blends, ruminants need mineral and fiber-based premixes, aquaculture relies on specialized micronutrient formulations, and pets require balanced premixes for overall health .

The Poultry segment is the largest in the feed premix market, driven by high demand for poultry meat and eggs across Asia Pacific. Growth is supported by rising consumption, intensive farming practices, and the need for efficient feed formulations to enhance growth and health. The segment benefits from ongoing innovation in feed composition and increased adoption of fortified premixes to meet production and welfare standards .

The Asia Pacific Feed Premix Market features a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company, Alltech, Inc., BASF SE, DSM Nutritional Products (Koninklijke DSM N.V.), Nutreco N.V., Evonik Industries AG, Land O'Lakes, Inc. (Purina Animal Nutrition), Kemin Industries, Inc., InVivo Group (Neovia), Phibro Animal Health Corporation, De Heus Animal Nutrition, Trouw Nutrition (a Nutreco company), Beneo GmbH, Adisseo, Charoen Pokphand Group (CP Group), Guangdong Haid Group Co., Ltd., New Hope Group, Japfa Ltd., and Zhengbang Group drive innovation, geographic expansion, and service delivery in the market .

The Asia Pacific feed premix market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. As digital technologies integrate into feed production, efficiency and traceability will improve, enhancing product quality. Additionally, the increasing focus on organic and customized feed solutions will cater to evolving consumer preferences. In future, the market is expected to adapt to these trends, fostering innovation and collaboration among stakeholders to meet the rising demand for high-quality animal nutrition.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamin Premixes Mineral Premixes Amino Acid Premixes Probiotics and Prebiotics Enzyme Premixes Specialty Premixes Antibiotic Premixes Others |

| By Animal Type | Poultry Swine Ruminants (Cattle, Sheep, Goats) Aquaculture (Fish, Shrimp) Pets Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Packaging Type | Bags Bulk Containers Sachets Others |

| By Country/Region | China India Japan Australia & New Zealand Southeast Asia Others |

| By Price Range | Economy Mid-Range Premium |

| By Application | Feed for Livestock Feed for Aquaculture Feed for Pets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Premix Usage | 120 | Poultry Farm Owners, Feed Nutritionists |

| Swine Feed Premix Trends | 90 | Swine Producers, Veterinary Nutritionists |

| Ruminant Feed Premix Insights | 70 | Dairy Farmers, Livestock Feed Specialists |

| Feed Premix Distribution Channels | 60 | Distributors, Supply Chain Managers |

| Regulatory Impact on Feed Premix | 50 | Regulatory Affairs Managers, Industry Analysts |

The Asia Pacific Feed Premix Market is valued at approximately USD 24 billion, reflecting a significant growth trend driven by the increasing demand for high-quality animal feed essential for livestock productivity and health.