Asia Pacific Food Enzymes Market Overview

- The Asia Pacific Food Enzymes Market is valued at USD 3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for processed foods, the rise in health-conscious consumers, and advancements in enzyme technology that enhance food quality and shelf life. The market is also supported by the growing trend of clean label products, which has led to a surge in the use of natural enzymes in food production .

- Countries such as China, Japan, and India dominate the Asia Pacific Food Enzymes Market due to their large food processing industries and significant consumer bases. China leads with its vast manufacturing capabilities and export potential, while Japan is known for its innovation in food technology. India’s growing population and increasing urbanization further contribute to the demand for food enzymes, making these regions key players in the market .

- In recent years, the Indian government has introduced updated food safety and standards regulations that include guidelines for the use of enzymes in food processing. These initiatives aim to enhance food safety and quality, encouraging manufacturers to adopt enzyme-based solutions and ensuring compliance with international standards, thereby fostering innovation in the sector .

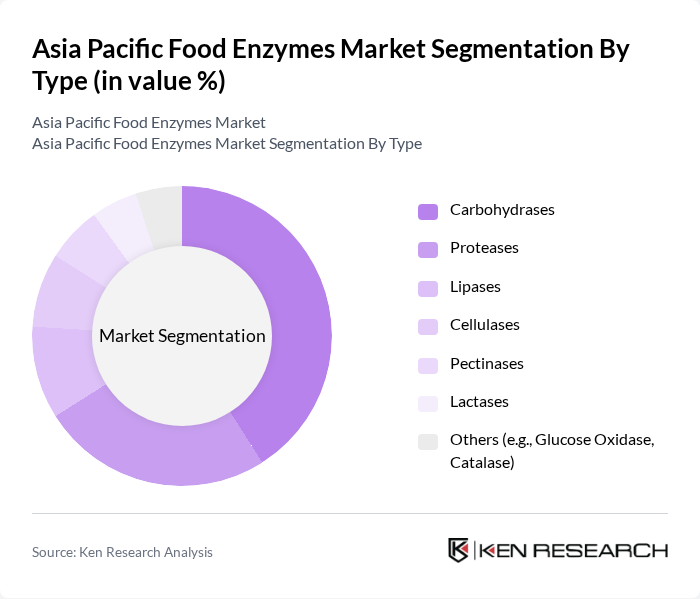

Asia Pacific Food Enzymes Market Segmentation

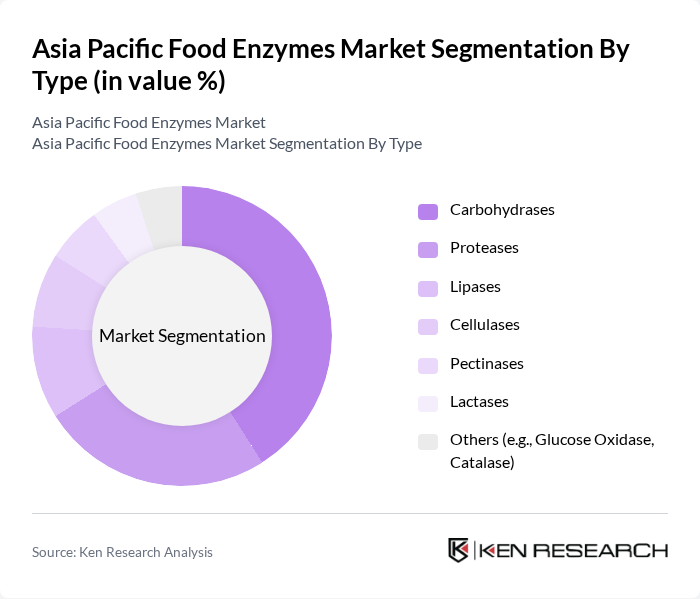

By Type:The food enzymes market can be segmented into various types, including Carbohydrases, Proteases, Lipases, Cellulases, Pectinases, Lactases, and Others (e.g., Glucose Oxidase, Catalase). Among these, Carbohydrases are leading the market due to their extensive application in the bakery and beverage industries, where they enhance texture and flavor. Proteases follow closely, being crucial in meat processing and dairy products. The demand for these enzymes is driven by consumer preferences for high-quality, nutritious food products .

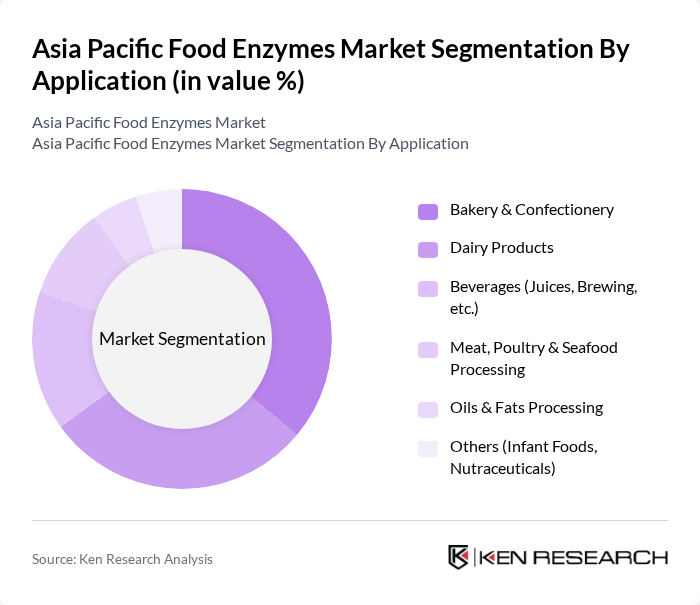

By Application:The applications of food enzymes are diverse, including Bakery & Confectionery, Dairy Products, Beverages (Juices, Brewing, etc.), Meat, Poultry & Seafood Processing, Oils & Fats Processing, and Others (Infant Foods, Nutraceuticals). The Bakery & Confectionery segment is the largest, driven by the increasing demand for baked goods and the need for improved texture and shelf life. Dairy products also represent a significant application area, with enzymes enhancing flavor and nutritional value .

Asia Pacific Food Enzymes Market Competitive Landscape

The Asia Pacific Food Enzymes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novozymes A/S, DuPont de Nemours, Inc., BASF SE, DSM-Firmenich AG, AB Enzymes GmbH, Chr. Hansen Holding A/S, Kerry Group plc, Enzyme Development Corporation, Amano Enzyme Inc., Advanced Enzyme Technologies Ltd., Biocatalysts Ltd., Aumgene Biosciences, Specialty Enzymes & Probiotics, Ginkgo Bioworks, Inc., Jiangsu Boli Bioproducts Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

Asia Pacific Food Enzymes Market Industry Analysis

Growth Drivers

- Increasing Demand for Processed Foods:The Asia Pacific region is witnessing a significant rise in processed food consumption, with the market expected to reach approximately $1.5 trillion in future. This surge is driven by urbanization, which is projected to increase the urban population by 1.2 billion in future, leading to higher demand for convenient food options. Food enzymes play a crucial role in enhancing the quality and shelf-life of these products, thus supporting this growth.

- Rising Health Consciousness Among Consumers:Health awareness is on the rise, with 60% of consumers in Asia Pacific actively seeking healthier food options. This trend is reflected in the growing demand for natural and functional foods, which are expected to account for over $300 billion in sales in future. Enzymes that improve nutritional profiles and digestibility are increasingly favored, driving their adoption in food formulations across the region.

- Technological Advancements in Enzyme Production:Innovations in enzyme production technologies, such as fermentation and biocatalysis, are enhancing efficiency and reducing costs. The global enzyme production market is projected to grow to $8 billion in future, with Asia Pacific contributing significantly due to its robust biotechnology sector. These advancements enable manufacturers to produce high-quality enzymes that meet the evolving demands of the food industry, further propelling market growth.

Market Challenges

- Stringent Regulatory Framework:The food enzymes market in Asia Pacific faces challenges due to stringent regulations imposed by authorities like the Food Safety and Standards Authority of India (FSSAI) and the China Food and Drug Administration (CFDA). Compliance with these regulations can be costly and time-consuming, with companies spending an estimated $1.2 billion annually on regulatory compliance. This can hinder market entry for new players and slow down innovation.

- High Production Costs:The production of food enzymes involves significant costs, primarily due to raw materials and advanced technology requirements. For instance, the average cost of enzyme production can range from $50 to $200 per kilogram, depending on the enzyme type. These high costs can limit profit margins for manufacturers and deter smaller companies from entering the market, posing a challenge to overall market growth.

Asia Pacific Food Enzymes Market Future Outlook

The Asia Pacific food enzymes market is poised for substantial growth, driven by increasing consumer demand for healthier and more sustainable food options. As the region's population continues to urbanize, the need for processed foods will rise, further boosting enzyme utilization. Additionally, advancements in biotechnology will likely lead to the development of innovative enzyme products that cater to evolving consumer preferences, enhancing market dynamics and competitiveness in the coming years.

Market Opportunities

- Growing Demand for Natural Ingredients:The shift towards natural ingredients presents a significant opportunity for food enzyme manufacturers. With the natural food market projected to reach $400 billion in future, companies can capitalize on this trend by developing enzymes derived from natural sources, appealing to health-conscious consumers seeking clean label products.

- Expansion into Emerging Markets:Emerging markets in Southeast Asia and India offer lucrative opportunities for food enzyme companies. With a combined population of over 1.5 billion and increasing disposable incomes, these regions are expected to see a rise in processed food consumption, creating demand for innovative enzyme solutions tailored to local tastes and preferences.