Region:Asia

Author(s):Dev

Product Code:KRAA1641

Pages:91

Published On:August 2025

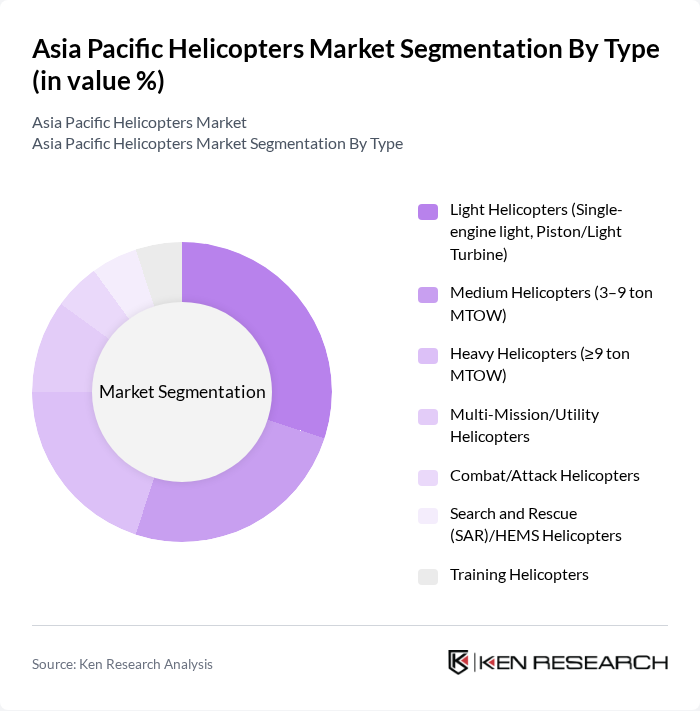

By Type:The helicopter market can be segmented into various types, including Light Helicopters, Medium Helicopters, Heavy Helicopters, Multi-Mission/Utility Helicopters, Combat/Attack Helicopters, Search and Rescue (SAR)/HEMS Helicopters, and Training Helicopters. Light helicopters are widely adopted for training, patrol, EMS, and private/corporate roles due to lower operating costs and mission flexibility, while medium and heavy classes are prominent in defense lift, SAR, and offshore energy support.

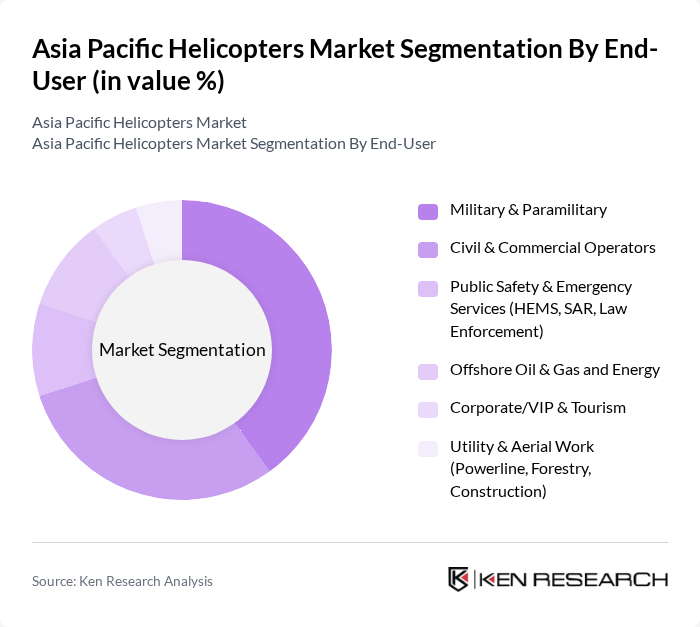

By End-User:The end-user segmentation includes Military & Paramilitary, Civil & Commercial Operators, Public Safety & Emergency Services, Offshore Oil & Gas and Energy, Corporate/VIP & Tourism, and Utility & Aerial Work. Military & Paramilitary remains the largest on account of modernization, border security, and maritime surveillance, while civil/commercial use is supported by EMS/HEMS, tourism, corporate/VIP, and offshore logistics.

The Asia Pacific Helicopters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Helicopters, Bell Textron Inc., Boeing Defense, Space & Security, Leonardo S.p.A., Sikorsky Aircraft Corporation, MD Helicopters, LLC, Russian Helicopters JSC (Rostec), Kawasaki Heavy Industries Aerospace Systems Company, Korea Aerospace Industries (KAI), Hindustan Aeronautics Limited (HAL), Aviation Industry Corporation of China (AVIC) — AVICopter, Robinson Helicopter Company, Enstrom Helicopter Corporation, Kaman Corporation (Kaman Aerospace), Mitsubishi Heavy Industries — Helicopter & Engine Division contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific helicopters market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The rise of electric and hybrid helicopters is expected to reshape operational dynamics, enhancing efficiency and reducing environmental impact. Additionally, the shift towards on-demand helicopter services will cater to urban mobility needs, reflecting a broader trend towards convenience and accessibility in transportation. These developments will likely create a more competitive landscape, fostering innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Helicopters (Single-engine light, Piston/Light Turbine) Medium Helicopters (3–9 ton MTOW) Heavy Helicopters (?9 ton MTOW) Multi-Mission/Utility Helicopters Combat/Attack Helicopters Search and Rescue (SAR)/HEMS Helicopters Training Helicopters |

| By End-User | Military & Paramilitary Civil & Commercial Operators Public Safety & Emergency Services (HEMS, SAR, Law Enforcement) Offshore Oil & Gas and Energy Corporate/VIP & Tourism Utility & Aerial Work (Powerline, Forestry, Construction) |

| By Application | Passenger Transport & VIP Offshore Support & Cargo HEMS/Medical Evacuation Aerial Surveillance & Law Enforcement Firefighting & Disaster Relief Training & Pilot Instruction |

| By Point of Sale | OEM (New Deliveries) Aftermarket (MRO, Upgrades, Spares) Leasing |

| By MTOW (Maximum Take-Off Weight) | Light (<3,175 kg) Medium (3,175–9,000 kg) Heavy (>9,000 kg) |

| By Country | China India Japan South Korea Australia & New Zealand Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore) Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Civil Helicopter Operations | 120 | Flight Operations Managers, Safety Officers |

| Military Helicopter Procurement | 100 | Defense Procurement Officers, Military Strategists |

| Helicopter Maintenance Services | 80 | MRO Managers, Technical Directors |

| Helicopter Leasing Companies | 70 | Leasing Managers, Financial Analysts |

| Helicopter Training Organizations | 60 | Training Coordinators, Chief Instructors |

The Asia Pacific Helicopters Market is valued at approximately USD 15.6 billion, reflecting strong demand driven by defense modernization, emergency medical services, offshore energy support, and fleet renewal across key economies in the region.