Region:Asia

Author(s):Geetanshi

Product Code:KRAA2019

Pages:90

Published On:August 2025

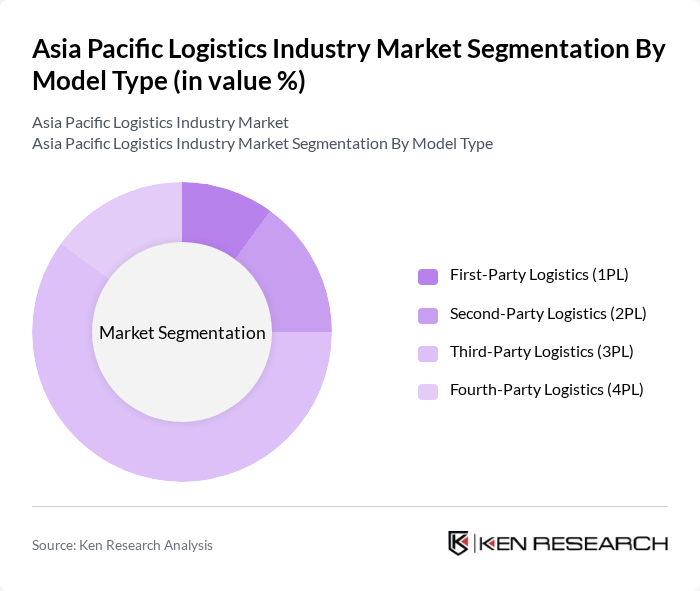

By Model Type:The logistics industry can be segmented into four primary model types: First-Party Logistics (1PL), Second-Party Logistics (2PL), Third-Party Logistics (3PL), and Fourth-Party Logistics (4PL). Each model serves distinct operational needs, with 3PL being the most widely adopted due to its flexibility, scalability, and comprehensive service offerings, especially in e-commerce and cross-border trade.

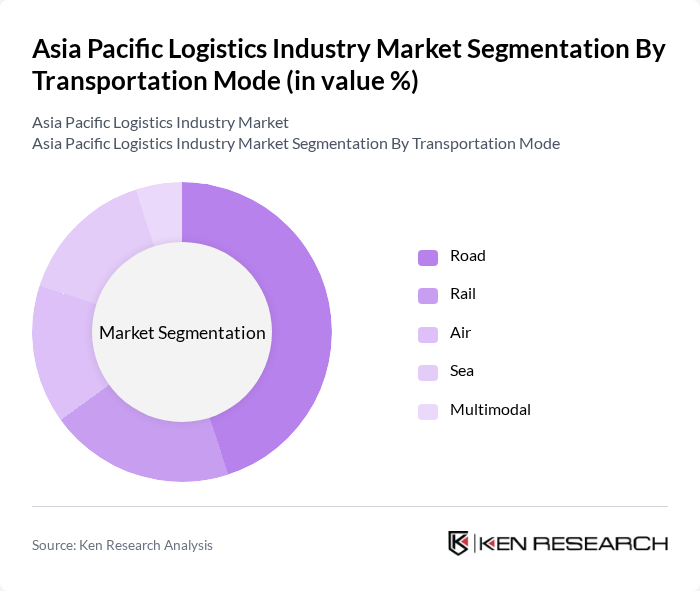

By Transportation Mode:The logistics industry is also categorized by transportation modes, including Road, Rail, Air, Sea, and Multimodal. Road transportation is the most prevalent due to its flexibility and accessibility, supporting both urban and rural supply chains. Air transport is favored for time-sensitive and high-value deliveries, while sea and rail are crucial for bulk and long-haul freight. Multimodal solutions are increasingly adopted for optimizing cost and efficiency in cross-border logistics.

The Asia Pacific Logistics Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, DSV A/S, CEVA Logistics, Nippon Express Holdings, Sinotrans Limited, Agility Public Warehousing Company, Yusen Logistics, C.H. Robinson Worldwide, Expeditors International, SF Express, Toll Group, CJ Logistics, and FedEx Express contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific logistics industry is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly focus on enhancing last-mile delivery capabilities and integrating sustainable practices. The adoption of automation and AI will streamline operations, while investments in infrastructure will support efficient supply chains. Overall, the industry is expected to adapt rapidly to meet the demands of a dynamic market landscape, ensuring resilience and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Model Type | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) |

| By Transportation Mode | Road Rail Air Sea Multimodal |

| By End-Use Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Chemicals Others |

| By Service Type | Freight Forwarding Warehousing & Distribution Express & Parcel Delivery Value-Added Services Customs Brokerage Inventory Management Others |

| By Country | China Japan India South Korea Australia Singapore Indonesia Vietnam Malaysia Thailand Philippines Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Directors, Operations Managers |

| Warehousing Solutions | 60 | Warehouse Managers, Supply Chain Coordinators |

| Last-Mile Delivery Innovations | 50 | Last-Mile Operations Heads, Delivery Managers |

| Cold Chain Logistics | 40 | Cold Chain Managers, Quality Assurance Officers |

| Logistics Technology Adoption | 45 | IT Managers, Digital Transformation Leads |

The Asia Pacific Logistics Industry Market is valued at approximately USD 4.6 trillion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and advancements in technology such as automation and data analytics.