Region:Asia

Author(s):Geetanshi

Product Code:KRAB0110

Pages:95

Published On:August 2025

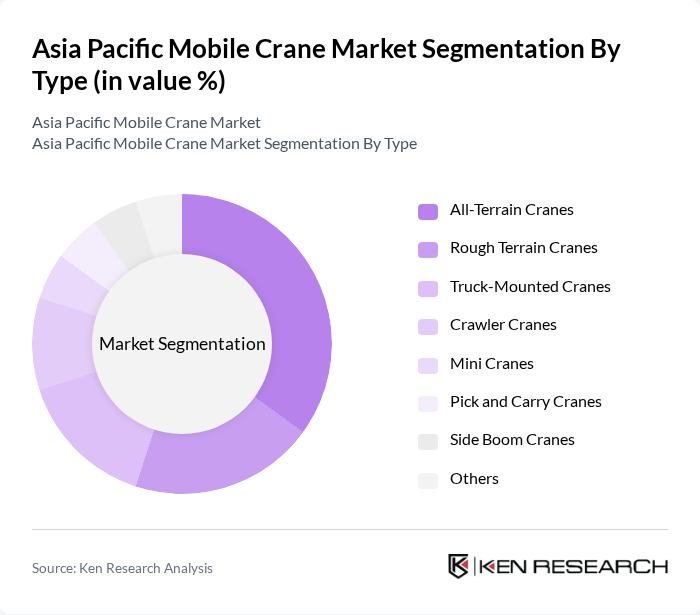

By Type:The mobile crane market is segmented into various types, including All-Terrain Cranes, Rough Terrain Cranes, Truck-Mounted Cranes, Crawler Cranes, Mini Cranes, Pick and Carry Cranes, Side Boom Cranes, and Others. All-Terrain Cranes lead the market due to their versatility and ability to operate in diverse terrains, making them ideal for construction and infrastructure projects. The demand for these cranes is driven by their efficiency, adaptability, and suitability for complex lifting operations in urban and remote locations. The adoption of advanced technologies and increased focus on safety and productivity are also influencing equipment preferences among end-users .

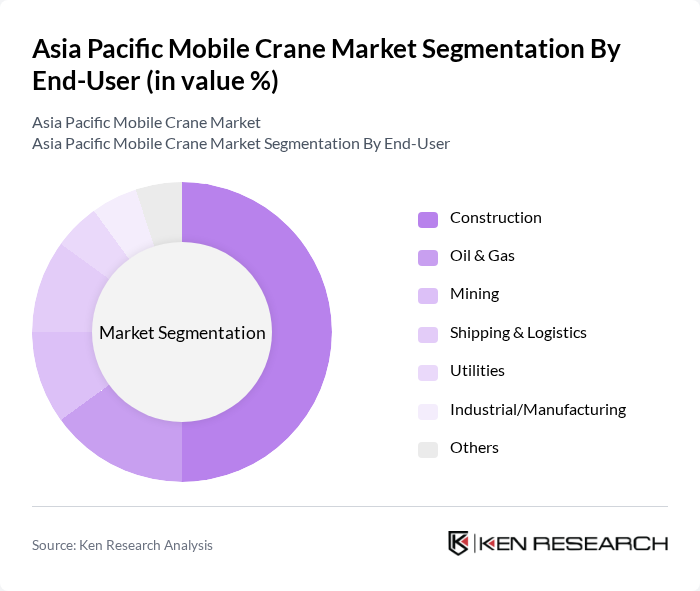

By End-User:The mobile crane market is segmented by end-users, including Construction, Oil & Gas, Mining, Shipping & Logistics, Utilities, Industrial/Manufacturing, and Others. The Construction sector is the dominant end-user, driven by the increasing number of infrastructure projects and urban development initiatives across the Asia Pacific region. The demand for mobile cranes in construction is fueled by the need for efficient lifting solutions to handle heavy materials and equipment, which is essential for timely project completion. Additionally, the Oil & Gas and Mining sectors are significant contributors, utilizing mobile cranes for equipment installation and maintenance in challenging environments. The growth of e-commerce and logistics is also boosting demand for cranes in warehousing and port operations .

The Asia Pacific Mobile Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Liebherr Group, Terex Corporation, Manitowoc Company, Inc., SANY Group, XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., Kato Works Co., Ltd., Tadano Ltd., Kobelco Construction Machinery Co., Ltd., Hitachi Construction Machinery Co., Ltd., Sumitomo Heavy Industries Construction Cranes Co., Ltd., SANY Heavy Industry Co., Ltd., Palfinger AG, Furukawa UNIC Corporation, Action Construction Equipment Ltd. (ACE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Asia Pacific mobile crane market appears promising, driven by ongoing infrastructure investments and technological advancements. As urbanization accelerates, demand for efficient construction solutions will rise, prompting manufacturers to innovate further. Additionally, the integration of smart technologies and eco-friendly practices will likely shape the market landscape, enhancing operational efficiency and sustainability. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | All-Terrain Cranes Rough Terrain Cranes Truck-Mounted Cranes Crawler Cranes Mini Cranes Pick and Carry Cranes Side Boom Cranes Others |

| By End-User | Construction Oil & Gas Mining Shipping & Logistics Utilities Industrial/Manufacturing Others |

| By Region | China India Japan South Korea Australia Southeast Asia (Indonesia, Vietnam, Thailand, Malaysia, Philippines, Singapore) Rest of Asia Pacific |

| By Application | Heavy Lifting Material Handling Construction Projects Maintenance and Repair Infrastructure Development Others |

| By Sales Channel | Direct Sales Distributors Online Sales Rental Services Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Financing Options | Lease Financing Loan Financing Cash Purchase Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Management | 120 | Project Managers, Site Engineers |

| Mobile Crane Rental Services | 80 | Rental Managers, Operations Directors |

| Heavy Machinery Distribution | 60 | Sales Managers, Product Line Directors |

| Infrastructure Development | 50 | Government Officials, Urban Planners |

| Construction Equipment Maintenance | 70 | Maintenance Supervisors, Technical Managers |

The Asia Pacific Mobile Crane Market is valued at approximately USD 8.8 billion, driven by significant investments in infrastructure projects and urbanization across the region, particularly in countries like China, India, and Japan.