Region:Asia

Author(s):Rebecca

Product Code:KRAA1355

Pages:96

Published On:August 2025

By Fund Type:The Asia Pacific private equity market is segmented by fund type intoVenture Capital, Buyout Funds, Growth Equity, Mezzanine Financing, Distressed Assets, Fund of Funds, Secondaries,andHybrid Strategies (Equity + Private Credit). Each segment serves distinct investor profiles and risk appetites: Venture Capital targets early-stage innovation, Buyout Funds focus on established businesses, Growth Equity supports expansion-stage firms, Mezzanine Financing provides subordinated debt, Distressed Assets invest in turnaround opportunities, Fund of Funds offer diversification, Secondaries provide liquidity, and Hybrid Strategies blend equity with private credit .

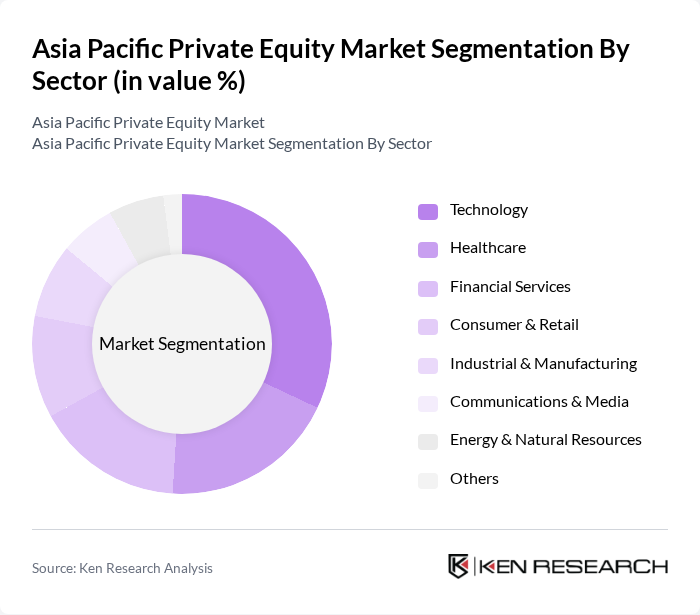

By Sector:The sector segmentation coversTechnology, Healthcare, Financial Services, Consumer & Retail, Industrial & Manufacturing, Communications & Media, Energy & Natural Resources,andOthers. Technology and healthcare remain the largest sectors, but recent years have seen increased allocations to financial services, consumer, and energy, reflecting shifting market trends and investor priorities. Sector allocations are influenced by macroeconomic shifts, regulatory changes, and evolving consumer demand .

The Asia Pacific Private Equity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hillhouse Capital Group, Temasek Holdings, PAG (Pacific Alliance Group), Baring Private Equity Asia (now EQT Asia), Affinity Equity Partners, MBK Partners, GIC Private Limited, CDH Investments, KKR & Co. Inc., Carlyle Group, Bain Capital, TPG Capital, Warburg Pincus, CVC Capital Partners, General Atlantic, Sequoia Capital China (now HongShan), IDG Capital, Vertex Ventures, Navis Capital Partners, Quadrant Private Equity contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific private equity market is poised for continued growth, driven by increasing institutional investments and a vibrant startup ecosystem. As the region's middle class expands, consumer demand will create new opportunities for private equity firms. Additionally, the shift towards sustainable and responsible investing will likely influence investment strategies, with firms focusing on environmental, social, and governance (ESG) criteria. Overall, the market is expected to adapt to evolving economic conditions and investor preferences, fostering innovation and resilience.

| Segment | Sub-Segments |

|---|---|

| By Fund Type | Venture Capital Buyout Funds Growth Equity Mezzanine Financing Distressed Assets Fund of Funds Secondaries Hybrid Strategies (Equity + Private Credit) |

| By Sector | Technology Healthcare Financial Services Consumer & Retail Industrial & Manufacturing Communications & Media Energy & Natural Resources Others |

| By Investment Stage | Seed Stage Early Stage Growth/Expansion Stage Late Stage Pre-IPO |

| By Fund Size | Small Funds ( |

| By Geographic Focus | Domestic Investments Pan-Asia/Regional Investments Global Investments |

| By Exit Strategy | IPO M&A (Trade Sale/Sponsor-to-Sponsor) Secondary Sale Recapitalization/Dividend Recap Buyback |

| By Policy Support | Tax Incentives Regulatory Frameworks Government Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Venture Capital Investments in Technology Startups | 100 | Investment Managers, Startup Founders |

| Private Equity in Healthcare Sector | 80 | Healthcare Executives, Fund Managers |

| Consumer Goods Investment Trends | 70 | Brand Managers, Private Equity Analysts |

| Impact of Regulatory Changes on Investments | 50 | Compliance Officers, Legal Advisors |

| Exit Strategies and Market Returns | 90 | Portfolio Managers, Financial Analysts |

The Asia Pacific Private Equity Market is valued at approximately USD 1.1 trillion, driven by increased investor interest in alternative assets, a dynamic startup ecosystem, and favorable macroeconomic conditions across the region.