Region:Asia

Author(s):Geetanshi

Product Code:KRAA0278

Pages:88

Published On:August 2025

Market.png)

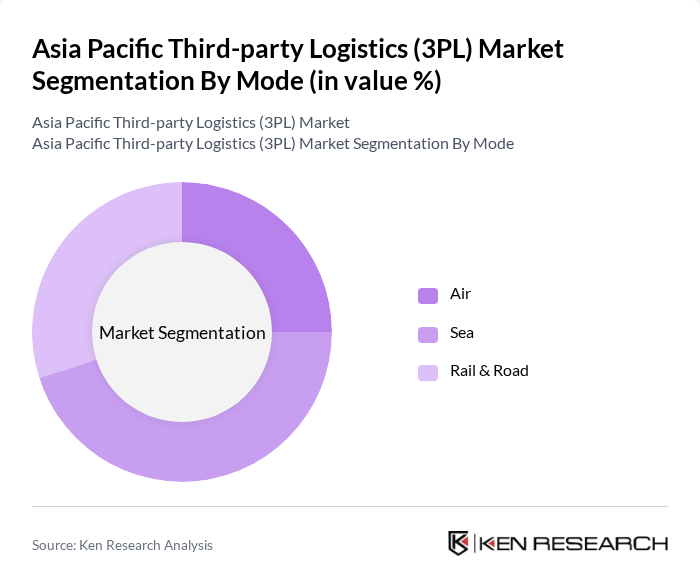

By Mode:The market is segmented into Air, Sea, and Rail & Road. Each mode serves distinct logistical needs, with air transport being preferred for time-sensitive deliveries, sea transport for bulk goods, and rail & road for cost-effective land-based logistics. The sea segment currently leads the market, driven by the high volume of international trade and bulk shipments across the region. Air transport is increasingly important for rapid delivery services, particularly in the e-commerce sector, while rail & road remain essential for domestic distribution and last-mile connectivity .

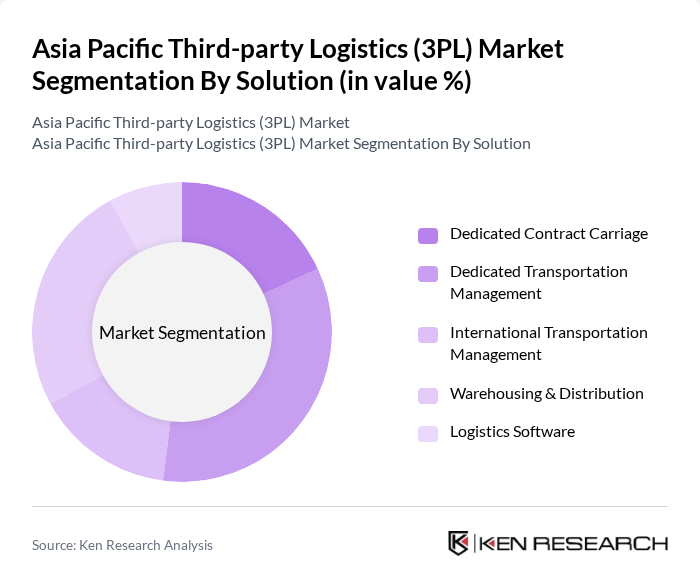

By Solution:The market is categorized into Dedicated Contract Carriage, Dedicated Transportation Management, International Transportation Management, Warehousing & Distribution, and Logistics Software. The Dedicated Transportation Management segment is currently the most dominant, reflecting the increasing complexity of supply chains and the need for specialized management of transportation networks. Warehousing & Distribution remains a critical segment, driven by the need for efficient storage solutions and inventory management, especially as e-commerce and omnichannel retailing expand across the region .

The Asia Pacific Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, CEVA Logistics, Nippon Express, Sinotrans Limited, Yusen Logistics, Kerry Logistics Network, CJ Logistics, FedEx Express, SF Express, Agility Logistics, Toll Group, Hitachi Transport System, and DSV contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Asia Pacific 3PL market appears promising, driven by technological advancements and evolving consumer preferences. The integration of automation and AI in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the growing emphasis on sustainability will likely lead to increased investments in eco-friendly logistics solutions. As e-commerce continues to expand, 3PL providers will need to adapt to changing market dynamics to remain competitive and meet customer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Mode | Air Sea Rail & Road |

| By Solution | Dedicated Contract Carriage Dedicated Transportation Management International Transportation Management Warehousing & Distribution Logistics Software |

| By Application | Food & Beverages Healthcare Retail Automotive Manufacturing Others |

| By End-Use | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Country | China Japan India Australia South Korea Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 100 | Logistics Coordinators, Supply Chain Analysts |

| Manufacturing Supply Chain Solutions | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Strategies | 90 | eCommerce Operations Managers, Logistics Supervisors |

| Pharmaceutical Distribution Networks | 60 | Supply Chain Directors, Compliance Officers |

| Automotive Logistics Services | 50 | Warehouse Managers, Logistics Engineers |

The Asia Pacific Third-party Logistics (3PL) Market is valued at approximately USD 465 billion, reflecting significant growth driven by factors such as e-commerce expansion, efficient supply chain management, and the adoption of advanced digital tools.