Region:Asia

Author(s):Shubham

Product Code:KRAA0794

Pages:98

Published On:August 2025

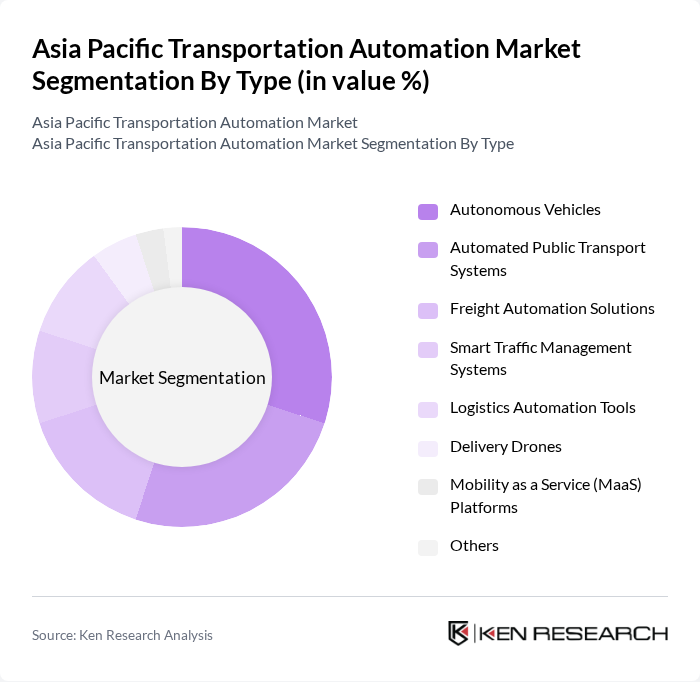

By Type:The market is segmented into Autonomous Vehicles, Automated Public Transport Systems, Freight Automation Solutions, Smart Traffic Management Systems, Logistics Automation Tools, Delivery Drones, Mobility as a Service (MaaS) Platforms, and Others. These segments collectively drive improvements in transportation efficiency, safety, and sustainability by leveraging automation, data analytics, and real-time connectivity .

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Government Agencies, Retail and E-commerce, Public Transport Authorities, Manufacturing Industries, Healthcare and Pharmaceuticals, and Others. Each end-user group leverages automation to address unique operational challenges, improve service delivery, and enhance supply chain resilience .

The Asia Pacific Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Mobility, ABB Ltd., Hitachi, Ltd., Alstom S.A., Bombardier Inc., Hyundai Motor Company, Toyota Motor Corporation, Denso Corporation, ZF Friedrichshafen AG, Baidu, Inc., Nuro, Inc., Yutong Group, CRRC Corporation Limited, Grab Holdings Inc., Gojek, JD Logistics, Kakao Mobility, SGMW (SAIC-GM-Wuling Automobile), Sensetime Group, and TuSimple contribute to innovation, geographic expansion, and service delivery in this space.

The future of transportation automation in Asia Pacific appears promising, driven by technological advancements and increasing urbanization. Urban populations are expected to rise by 1.5 billion in future, necessitating efficient transportation solutions. The integration of electric and autonomous vehicles is anticipated to reshape logistics, while real-time data analytics will enhance operational efficiency. As governments continue to support smart infrastructure development, the region is poised for significant transformation in transportation automation, fostering innovation and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Vehicles Automated Public Transport Systems Freight Automation Solutions Smart Traffic Management Systems Logistics Automation Tools Delivery Drones Mobility as a Service (MaaS) Platforms Others |

| By End-User | Logistics and Transportation Companies Government Agencies Retail and E-commerce Public Transport Authorities Manufacturing Industries Healthcare and Pharmaceuticals Others |

| By Region | China Japan India Southeast Asia South Korea Australia & New Zealand Rest of Asia Pacific |

| By Application | Freight Transportation Passenger Transportation Urban Mobility Solutions Supply Chain Management Cold Chain & Temperature-Controlled Logistics Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships (PPP) Foreign Direct Investment (FDI) Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Automation Grants for Research and Development Regulatory Support for Innovation Others |

| By Distribution Mode | Direct Sales Online Platforms Distributors and Resellers Partnerships with Logistics Firms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Automation | 120 | Fleet Managers, Logistics Directors |

| Rail Automation Technologies | 60 | Operations Managers, Safety Compliance Officers |

| Maritime Automation Solutions | 50 | Port Authorities, Shipping Line Executives |

| Air Cargo Automation | 40 | Airline Operations Managers, Cargo Supervisors |

| Last-Mile Delivery Automation | 70 | eCommerce Logistics Managers, Delivery Service Providers |

The Asia Pacific Transportation Automation Market is valued at approximately USD 2.2 trillion, driven by advancements in automation technologies, urbanization, and the demand for efficient transportation solutions across logistics, public transit, and freight management sectors.