Region:Asia

Author(s):Dev

Product Code:KRAA0453

Pages:89

Published On:August 2025

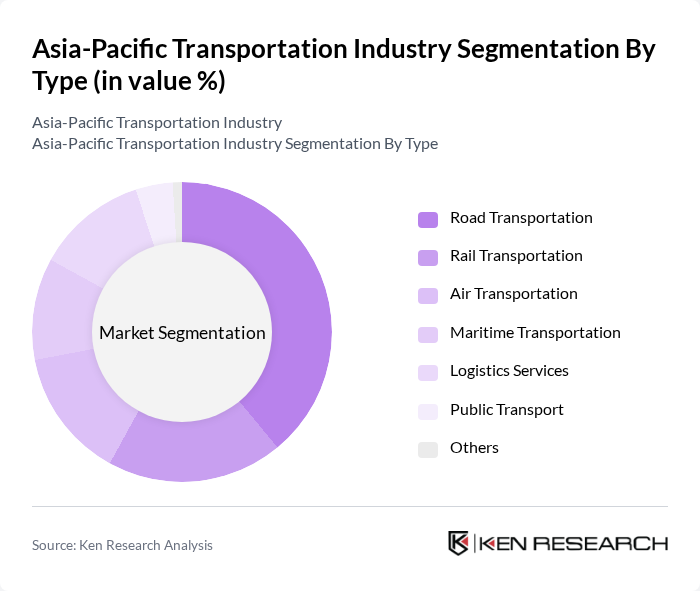

By Type:The Asia-Pacific Transportation Industry can be segmented into various types, including Road Transportation, Rail Transportation, Air Transportation, Maritime Transportation, Logistics Services, Public Transport, and Others. Among these, Road Transportation is the most dominant segment, driven by the increasing number of vehicles and the expansion of road networks across urban and rural areas. Rail Transportation is also significant, particularly in countries like China and India, where high-speed rail projects and freight corridors are gaining traction. Air Transportation has seen growth due to rising air travel demand and increased air cargo movements, while Maritime Transportation remains crucial for international trade, especially with the region’s major ports. Logistics Services are increasingly important due to the e-commerce boom and the need for integrated supply chain solutions, and Public Transport is vital for urban mobility amid growing urban populations .

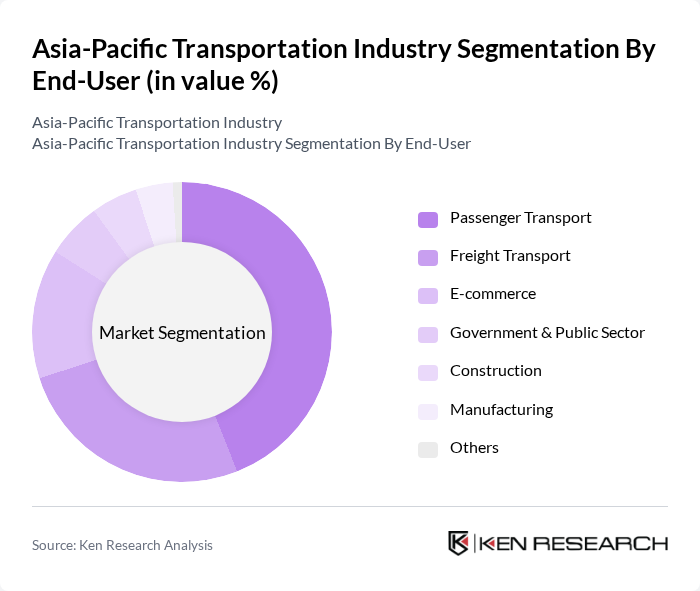

By End-User:The Asia-Pacific Transportation Industry is also segmented by end-user categories, including Passenger Transport, Freight Transport, E-commerce, Government & Public Sector, Construction, Manufacturing, and Others. The Passenger Transport segment is the largest, driven by urbanization and increasing disposable incomes, leading to higher demand for personal and public transport services. Freight Transport is also significant, fueled by the growth of trade, industrialization, and logistics. E-commerce has emerged as a key driver, with companies seeking efficient delivery and last-mile solutions. The Government & Public Sector plays a crucial role in infrastructure development and public mobility, while Construction and Manufacturing sectors contribute to the demand for both bulk and specialized transportation services .

The Asia-Pacific Transportation Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Maersk Line, Nippon Express, Singapore Airlines Cargo, China COSCO Shipping, Yamato Holdings, Kuehne + Nagel, FedEx Express, SF Express, Blue Dart Express, Allcargo Logistics, Grab Holdings, Gojek, Lalamove, Toll Group contribute to innovation, geographic expansion, and service delivery in this space.

The Asia-Pacific transportation industry is poised for transformative growth driven by urbanization, technological advancements, and government initiatives. As cities expand and populations increase, the demand for efficient transportation solutions will intensify. Investments in smart technologies and infrastructure will enhance connectivity and sustainability. However, addressing regulatory challenges and infrastructure deficiencies will be crucial for realizing the full potential of the sector. Overall, the future landscape will be characterized by innovation and strategic investments aimed at improving transportation efficiency and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation Rail Transportation Air Transportation Maritime Transportation Logistics Services Public Transport Others |

| By End-User | Passenger Transport Freight Transport E-commerce Government & Public Sector Construction Manufacturing Others |

| By Region | North Asia (China, Japan, South Korea) Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines, etc.) South Asia (India, Bangladesh, Sri Lanka, Pakistan, etc.) Oceania (Australia, New Zealand, Pacific Islands) |

| By Technology | Autonomous Vehicles Electric Vehicles Smart Traffic Management Systems Fleet Management Software GPS Tracking Systems Mobility as a Service (MaaS) Others |

| By Application | Urban Transport Intercity Transport Freight and Logistics Public Transport Systems Last-Mile Delivery Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Transportation Projects Grants for Infrastructure Development Green Logistics Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Transportation Services | 120 | Logistics Managers, Operations Directors |

| Public Transport Systems | 90 | Transit Authority Officials, Urban Planners |

| Maritime Shipping Operations | 60 | Shipping Line Executives, Port Authority Managers |

| Rail Freight Management | 50 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Services | 70 | Airline Cargo Managers, Freight Forwarding Specialists |

The Asia-Pacific Transportation Industry is valued at approximately USD 4.6 trillion, driven by rapid urbanization, increasing demand for logistics services, and advancements in transportation technologies, particularly in e-commerce and supply chain solutions.