Region:Asia

Author(s):Shubham

Product Code:KRAA1126

Pages:98

Published On:August 2025

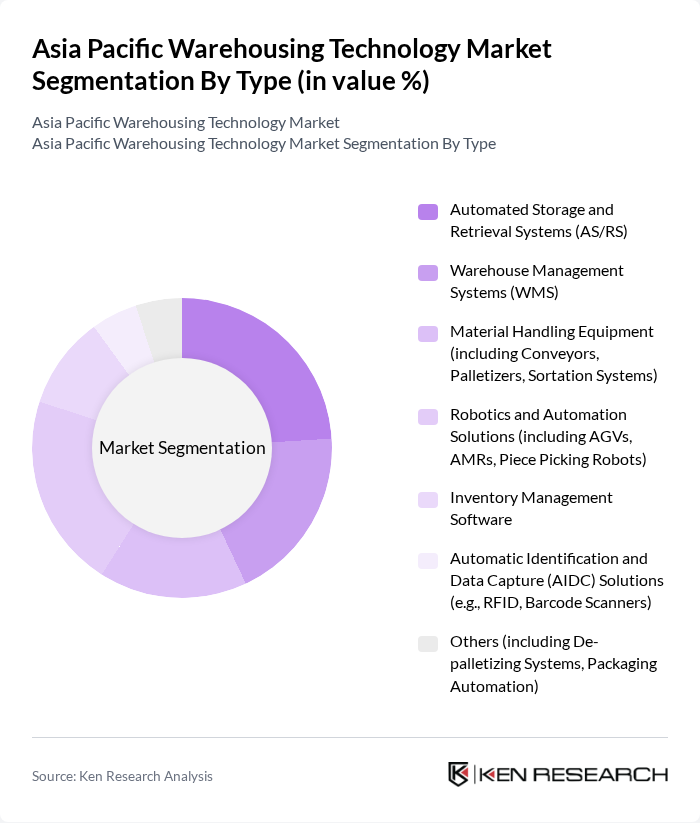

By Type:The Asia Pacific Warehousing Technology Market can be segmented into various types, including Automated Storage and Retrieval Systems (AS/RS), Warehouse Management Systems (WMS), Material Handling Equipment, Robotics and Automation Solutions, Inventory Management Software, Automatic Identification and Data Capture (AIDC) Solutions, and Others. Each of these subsegments plays a crucial role in enhancing operational efficiency, streamlining warehouse processes, and supporting real-time data-driven decision-making .

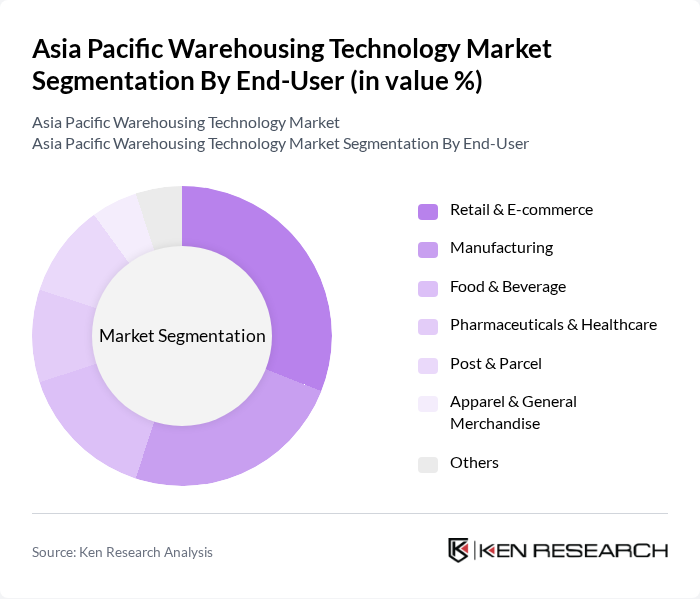

By End-User:The market can also be segmented by end-user industries, which include Retail & E-commerce, Manufacturing, Food & Beverage, Pharmaceuticals & Healthcare, Post & Parcel, Apparel & General Merchandise, and Others. Each sector has unique requirements that drive the adoption of warehousing technologies to improve efficiency, enable traceability, and meet evolving consumer demands .

The Asia Pacific Warehousing Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daifuku Co., Ltd., SSI Schaefer, Honeywell Intelligrated, Dematic, KION Group AG, Vanderlande Industries, Murata Machinery, Ltd., Knapp AG, TGW Logistics Group, Swisslog Holding AG, Interroll Holding AG, ST Engineering, Toshiba Global Logistics Solutions, Yaskawa Electric Corporation (Yaskawa Motoman), Godrej Consoveyo Logistics Automation Ltd. (GCLA) contribute to innovation, geographic expansion, and service delivery in this space.

The Asia Pacific warehousing technology market is poised for transformative growth, driven by the integration of innovative technologies and evolving consumer demands. As companies increasingly adopt automation and data analytics, operational efficiencies will improve significantly. Furthermore, sustainability initiatives will shape future investments, with a focus on eco-friendly practices. The region's logistics landscape will continue to adapt, fostering collaboration between technology providers and logistics firms to meet the challenges of a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (AS/RS) Warehouse Management Systems (WMS) Material Handling Equipment (including Conveyors, Palletizers, Sortation Systems) Robotics and Automation Solutions (including AGVs, AMRs, Piece Picking Robots) Inventory Management Software Automatic Identification and Data Capture (AIDC) Solutions (e.g., RFID, Barcode Scanners) Others (including De-palletizing Systems, Packaging Automation) |

| By End-User | Retail & E-commerce Manufacturing Food & Beverage Pharmaceuticals & Healthcare Post & Parcel Apparel & General Merchandise Others |

| By Region | China Japan India South Korea Southeast Asia (including Singapore, Malaysia, Vietnam, Thailand, Indonesia, Philippines) Oceania (Australia & New Zealand) |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By Application | Order Fulfillment Inventory Management Shipping and Receiving Returns Management Cold Chain Management |

| By Investment Source | Private Investments Government Funding Venture Capital |

| By Policy Support | Subsidies for Technology Adoption Tax Incentives Grants for Infrastructure Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 100 | IT Managers, Operations Directors |

| Inventory Management Systems | 80 | Supply Chain Analysts, Warehouse Supervisors |

| IoT in Warehousing | 60 | Technology Officers, Logistics Coordinators |

| Cold Chain Technology | 50 | Quality Control Managers, Distribution Managers |

| Robotics in Warehousing | 40 | Automation Engineers, Facility Managers |

The Asia Pacific Warehousing Technology Market is valued at approximately USD 12 billion, driven by the rapid growth of e-commerce, demand for efficient supply chain management, and the adoption of automation technologies in warehousing operations.