Region:Asia

Author(s):Geetanshi

Product Code:KRAB3439

Pages:93

Published On:October 2025

By Type:The market is segmented into various types of AI-driven products that enhance sleep quality and wellness. The subsegments include Smart Mattresses, AI-Enabled Sleep Trackers, AI-Enhanced Pillows, Sleep Wellness Apps & Platforms, Smart Sleep Accessories, AI-Driven Sleep Environment Solutions, and Others. Each of these subsegments caters to different consumer needs and preferences, contributing to the overall market growth.

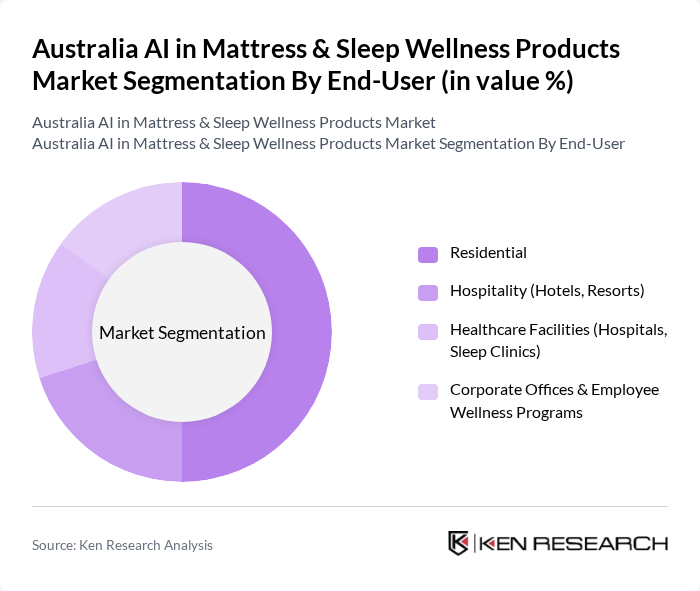

By End-User:The market is segmented based on end-users, which include Residential, Hospitality (Hotels, Resorts), Healthcare Facilities (Hospitals, Sleep Clinics), and Corporate Offices & Employee Wellness Programs. Each segment has unique requirements and preferences, influencing the types of AI-driven sleep products they adopt.

The Australia AI in Mattress & Sleep Wellness Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as AH Beard Holdings Pty Ltd, Sealy of Australia, Koala Sleep Pty Ltd, Sleeping Duck Pty Ltd, Ecosa Pty Ltd, Tempur Sealy International, Inc., Sleep Number Corporation, Eight Sleep, Emma Sleep GmbH, Purple Innovation, Inc., ResMed Inc., Bedgear, Simba Sleep Limited, Sleepace, Withings SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia AI in mattress and sleep wellness products market appears promising, driven by technological advancements and increasing consumer demand for personalized solutions. As more consumers recognize the importance of sleep health, the integration of AI technologies will likely enhance product offerings. Additionally, the rise of e-commerce platforms will facilitate broader access to innovative sleep products, enabling companies to reach untapped markets and expand their customer base effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Mattresses AI-Enabled Sleep Trackers AI-Enhanced Pillows Sleep Wellness Apps & Platforms Smart Sleep Accessories (e.g., AI-powered eye masks, sound machines) AI-Driven Sleep Environment Solutions (e.g., temperature, lighting control) Others |

| By End-User | Residential Hospitality (Hotels, Resorts) Healthcare Facilities (Hospitals, Sleep Clinics) Corporate Offices & Employee Wellness Programs |

| By Distribution Channel | Online Retail (Brand Websites, Marketplaces) Brick-and-Mortar Stores (Specialty, Departmental) Direct Sales (B2B, Institutional) Wholesale Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Material | Memory Foam Latex Innerspring Hybrid |

| By Application | Sleep Improvement & Optimization Health & Vital Sign Monitoring Stress & Anxiety Relief |

| By User Demographics | Age Group (Children, Adults, Seniors) Gender Lifestyle Preferences (Athletes, Shift Workers, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Sleep Products | 100 | General Consumers, Sleep Enthusiasts |

| Healthcare Professionals' Perspectives | 60 | Sleep Specialists, General Practitioners |

| Retailer Feedback on AI Sleep Products | 40 | Retail Managers, Product Buyers |

| Product Development Insights | 50 | R&D Managers, Innovation Leads |

| Market Trends and Consumer Behavior | 50 | Market Analysts, Trend Forecasters |

The Australia AI in Mattress & Sleep Wellness Products Market is valued at approximately AUD 1.2 billion, reflecting significant growth driven by consumer awareness of sleep health and advancements in AI technology.