Region:Global

Author(s):Geetanshi

Product Code:KRAA3735

Pages:83

Published On:September 2025

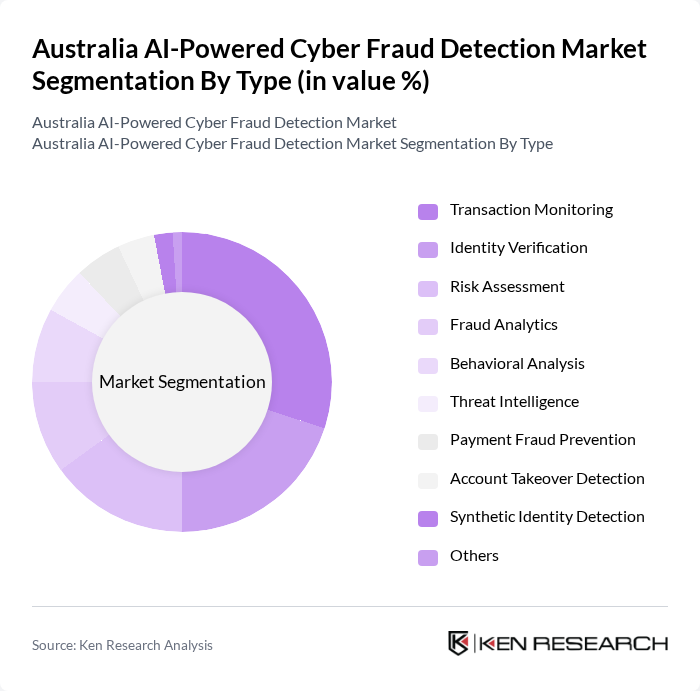

By Type:The market is segmented into a range of AI-powered solutions targeting diverse aspects of fraud detection. Subsegments include Transaction Monitoring, Identity Verification, Risk Assessment, Fraud Analytics, Behavioral Analysis, Threat Intelligence, Payment Fraud Prevention, Account Takeover Detection, Synthetic Identity Detection, and Others. Transaction Monitoring remains the leading subsegment, reflecting its critical role in real-time detection and prevention of fraudulent activities, especially in the context of instant payments and evolving fraud patterns .

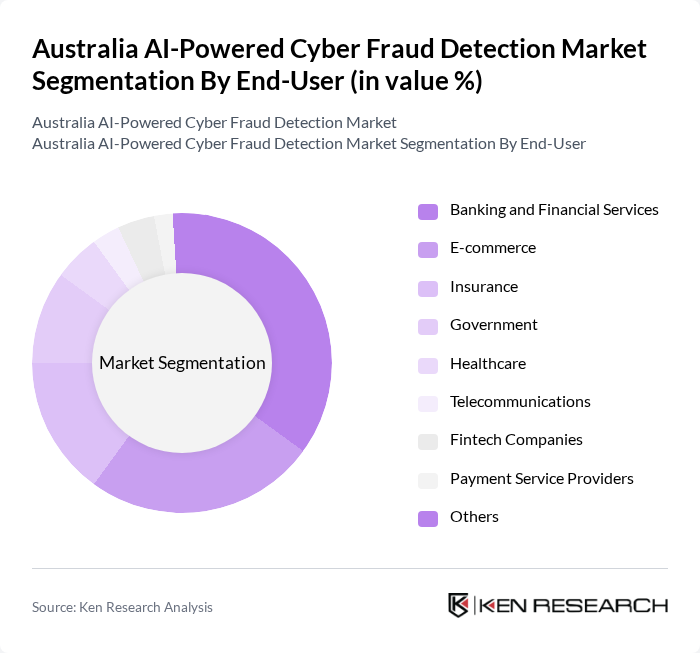

By End-User:The end-user segmentation encompasses industries leveraging AI-powered fraud detection solutions. Key segments include Banking and Financial Services, E-commerce, Insurance, Government, Healthcare, Telecommunications, Fintech Companies, Payment Service Providers, and Others. The Banking and Financial Services sector is the largest end-user, driven by the imperative to protect financial assets and comply with stringent regulatory standards. The rapid growth of digital banking and instant payments has further intensified the sector’s reliance on AI-driven fraud prevention .

The Australia AI-Powered Cyber Fraud Detection Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAS Institute Inc., FICO, Palantir Technologies, Darktrace, Splunk Inc., RSA Security LLC, Fortinet Inc., McAfee Corp., Check Point Software Technologies Ltd., CyberArk Software Ltd., Proofpoint Inc., Trend Micro Incorporated, FireEye Inc., NortonLifeLock Inc., Experian plc, ACI Worldwide, SAP SE, Tookitaki Holding Pte. Ltd., Nuix Ltd., VeroGuard Systems Pty Ltd., Auraya Systems Pty Ltd., Sift Science, Inc., BioCatch Ltd., ThreatMetrix (LexisNexis Risk Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered cyber fraud detection market in Australia appears promising, driven by increasing investments in cybersecurity and the growing sophistication of cyber threats. As organizations prioritize real-time fraud detection, the integration of AI technologies will become more prevalent. Additionally, the shift towards cloud-based solutions will facilitate scalability and accessibility, enabling businesses to enhance their security measures efficiently. The collaboration between technology providers and financial institutions will further strengthen the market landscape, fostering innovation and resilience against cybercrime.

| Segment | Sub-Segments |

|---|---|

| By Type | Transaction Monitoring Identity Verification Risk Assessment Fraud Analytics Behavioral Analysis Threat Intelligence Payment Fraud Prevention Account Takeover Detection Synthetic Identity Detection Others |

| By End-User | Banking and Financial Services E-commerce Insurance Government Healthcare Telecommunications Fintech Companies Payment Service Providers Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Application | Fraud Detection Risk Management Compliance Management Data Protection Incident Response Anti-Money Laundering (AML) Know Your Customer (KYC) Others |

| By Sales Channel | Direct Sales Distributors Online Sales Resellers |

| By Industry Vertical | Retail Manufacturing Energy and Utilities Transportation and Logistics Financial Services Public Sector Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Australian Capital Territory Northern Territory Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Sector | 100 | Risk Managers, IT Security Officers |

| E-commerce Platforms | 60 | Fraud Prevention Analysts, Operations Managers |

| Healthcare Providers | 50 | Compliance Officers, IT Managers |

| Telecommunications Companies | 40 | Network Security Engineers, Product Managers |

| Government Agencies | 40 | Cybersecurity Policy Makers, IT Directors |

The Australia AI-Powered Cyber Fraud Detection Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increasing cyber threats and the adoption of digital payment systems.