Region:Asia

Author(s):Geetanshi

Product Code:KRAA0127

Pages:90

Published On:August 2025

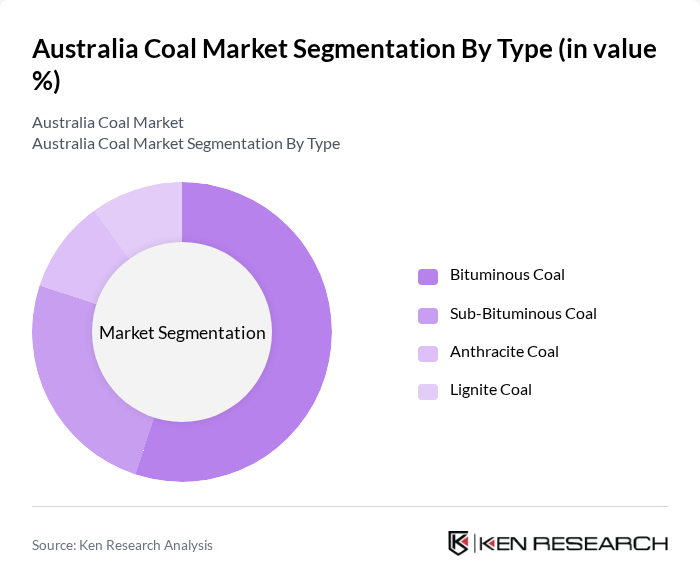

By Type:The coal market can be segmented into four primary types: Bituminous Coal, Sub-Bituminous Coal, Anthracite Coal, and Lignite Coal. Each type has distinct characteristics and applications, influencing their demand in various sectors. Bituminous coal is the most widely used due to its high energy content and is favored for both power generation and industrial applications, particularly in export markets. Lignite is primarily utilized for electricity generation within Australia. The market dynamics are shaped by the specific needs of industries, export demand, and evolving energy policies .

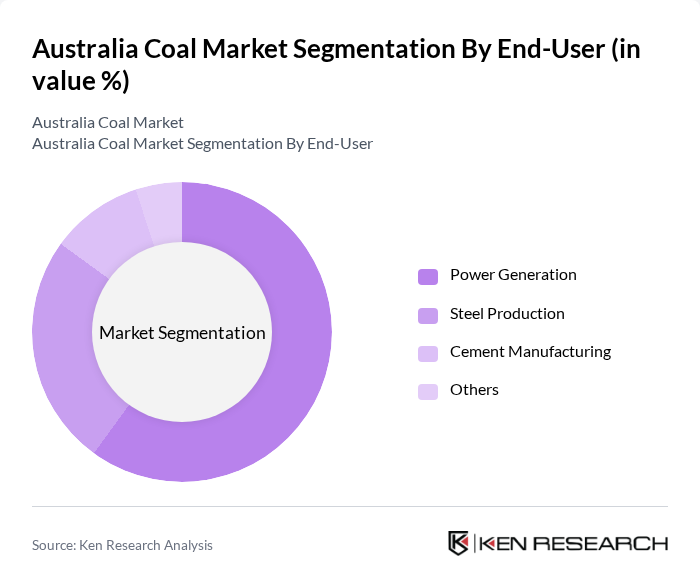

By End-User:The coal market is primarily driven by four end-user segments: Power Generation, Steel Production, Cement Manufacturing, and Others. Power generation remains the dominant end-user, as coal is a key source of electricity in Australia, providing stable baseload power for residential, commercial, and industrial sectors. The steel production sector significantly contributes to coal demand, utilizing coking coal for steelmaking processes. The cement industry relies on coal for energy, while other sectors include various industrial applications .

The Australia Coal Market is characterized by a dynamic mix of regional and international players. Leading participants such as BHP Group, Glencore, Peabody Energy, Whitehaven Coal, Yancoal Australia, New Hope Group, South32, Anglo American, Adani Australia (Bravus Mining & Resources), Stanmore Resources, Coronado Global Resources, Wollongong Coal, MACH Energy, TerraCom Limited, and Centennial Coal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian coal market is shaped by a complex interplay of demand dynamics and regulatory pressures. As global energy needs evolve, particularly in Asia, Australian coal producers must navigate environmental challenges while capitalizing on export opportunities. The focus on cleaner technologies and sustainable practices will likely drive innovation, ensuring that the industry remains competitive. Strategic partnerships and investments in infrastructure will be crucial for adapting to market changes and enhancing operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bituminous Coal Sub-Bituminous Coal Anthracite Coal Lignite Coal |

| By End-User | Power Generation Steel Production Cement Manufacturing Others |

| By Region | New South Wales Queensland Victoria Western Australia South Australia Tasmania Others |

| By Application | Electricity Iron and Steel Cement Manufacturing Others |

| By Mining Technology | Surface Mining Underground Mining Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal Mining Operations | 100 | Mine Managers, Operations Directors |

| Energy Sector Stakeholders | 60 | Energy Analysts, Utility Executives |

| Environmental Impact Assessments | 50 | Environmental Consultants, Policy Makers |

| Coal Export Market | 50 | Export Managers, Trade Analysts |

| Coal Consumption in Industry | 70 | Procurement Officers, Industry Analysts |

The Australia Coal Market is valued at approximately USD 107 billion, driven by increasing demand for coal in power generation and steel production, alongside robust export activities, particularly to Asian markets.