Region:Asia

Author(s):Dev

Product Code:KRAA2226

Pages:81

Published On:August 2025

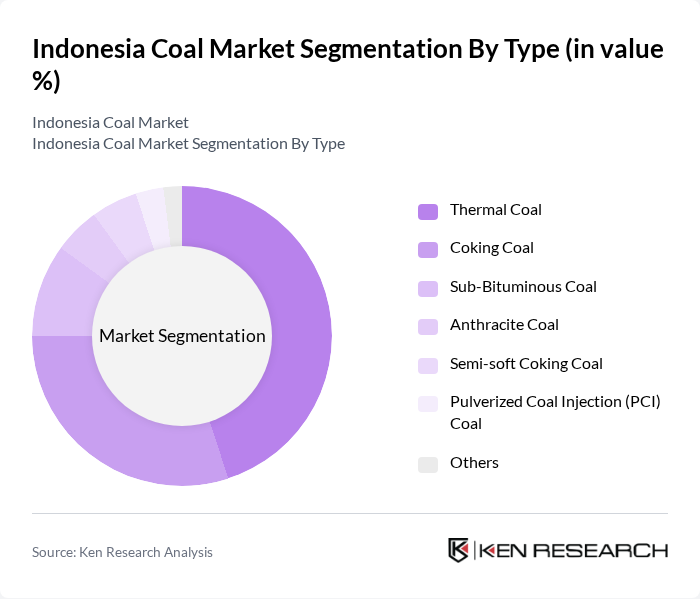

By Type:The coal market is segmented intoThermal Coal,Coking Coal,Sub-Bituminous Coal,Anthracite Coal,Semi-soft Coking Coal,Pulverized Coal Injection (PCI) Coal, andOthers. Thermal coal is predominantly used for electricity generation, while coking coal is essential for steel production. Demand for these types is shaped by global energy trends, industrial growth, and domestic energy policies. Indonesia is the world’s largest exporter of thermal coal, and domestic power generation remains the largest consumer segment.

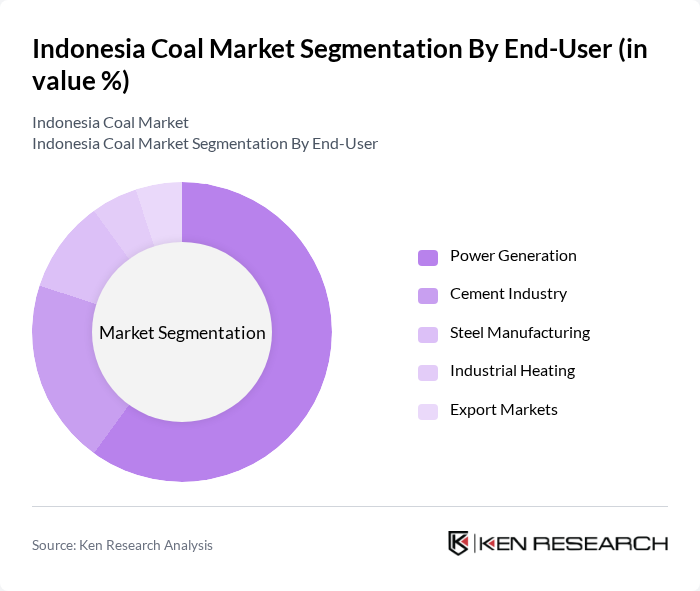

By End-User:The coal market is also segmented by end-users:Power Generation,Cement Industry,Steel Manufacturing,Industrial Heating, andExport Markets. Power generation is the largest end-user, accounting for the majority of domestic coal consumption due to Indonesia’s reliance on coal-fired power plants. The cement and steel sectors are also significant consumers, using coal as a primary energy source and feedstock. Export markets remain vital, with Indonesia being a leading supplier to Asia.

The Indonesia Coal Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Adaro Energy Tbk, PT Bumi Resources Tbk, PT Kaltim Prima Coal, PT Berau Coal Energy Tbk, PT Indika Energy Tbk, PT Bukit Asam Tbk, PT Tambang Batubara Bukit Asam, PT Bayan Resources Tbk, PT Indo Tambangraya Megah Tbk, PT Golden Energy Mines Tbk, PT Toba Bara Sejahtra Tbk, PT Multi Harapan Utama, PT Mitrabara Adiperdana Tbk, PT Cipta Kridatama, PT Sumberdaya Sewatama contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian coal market is shaped by a complex interplay of demand, regulatory pressures, and technological advancements. As energy consumption continues to rise, coal will remain a vital energy source, albeit under increasing scrutiny. The shift towards cleaner technologies and the integration of carbon capture solutions will be crucial for the industry. Additionally, strategic partnerships with international players may enhance market resilience and open new avenues for growth, ensuring coal's relevance in Indonesia's energy future.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermal Coal Coking Coal Sub-Bituminous Coal Anthracite Coal Semi-soft Coking Coal Pulverized Coal Injection (PCI) Coal Others |

| By End-User | Power Generation Cement Industry Steel Manufacturing Industrial Heating Export Markets |

| By Application | Electricity Generation Industrial Processes Residential Heating |

| By Distribution Mode | Direct Sales Wholesale Distribution Retail Sales |

| By Pricing Strategy | Competitive Pricing Premium Pricing Discount Pricing |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal Mining Operations | 100 | Mining Executives, Operations Managers |

| Energy Sector Stakeholders | 60 | Energy Analysts, Utility Managers |

| Logistics and Transportation Providers | 50 | Logistics Coordinators, Supply Chain Managers |

| Regulatory and Policy Makers | 40 | Government Officials, Policy Advisors |

| End-User Industries (Cement, Power) | 80 | Procurement Managers, Plant Managers |

The Indonesia Coal Market is valued at approximately USD 211 billion, driven by abundant coal reserves and increasing energy demand, particularly from the power generation sector. This market significantly contributes to Indonesia's economy through employment and infrastructure development.