Region:North America

Author(s):Shubham

Product Code:KRAA1838

Pages:90

Published On:August 2025

By Type:The coal market can be segmented into various types, including Bituminous Coal, Sub-Bituminous Coal, Lignite, Anthracite, and Metallurgical (Coking) Coal. Each type serves different industrial needs. Bituminous and subbituminous coals are the primary fuels for U.S. power generation, while metallurgical coal is essential for blast-furnace steel production; lignite is used in a limited number of mine-mouth power plants; anthracite is used in niche industrial and heating applications .

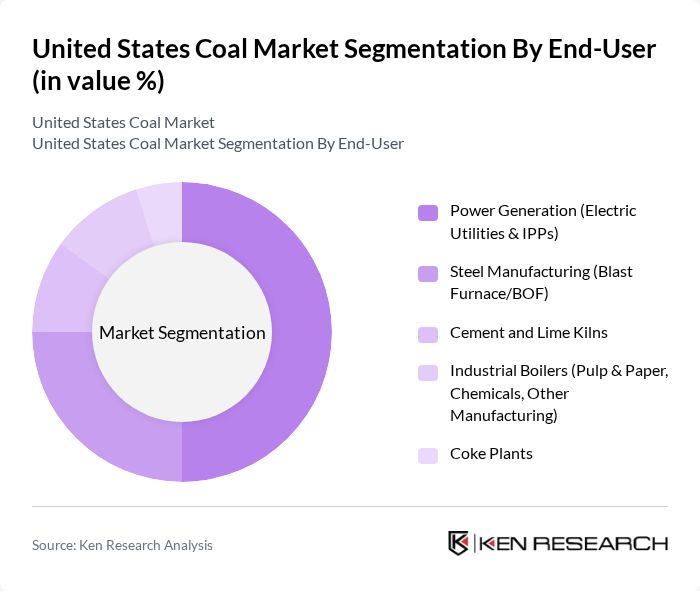

By End-User:The end-user segmentation includes Power Generation (Electric Utilities & IPPs), Steel Manufacturing (Blast Furnace/BOF), Cement and Lime Kilns, Industrial Boilers (Pulp & Paper, Chemicals, Other Manufacturing), and Coke Plants. Power generation remains the largest consumer of coal in the U.S., with the electric power sector typically accounting for the vast majority of domestic coal consumption in recent quarters .

The United States Coal Market is characterized by a dynamic mix of regional and international players. Leading participants such as Peabody Energy Corporation, Arch Resources, Inc., CONSOL Energy Inc., Alliance Resource Partners, L.P., Warrior Met Coal, Inc., Ramaco Resources, Inc., Alpha Metallurgical Resources, Inc., Corsa Coal Corp., Coronado Global Resources Inc., American Consolidated Natural Resources Inc. (formerly Murray Energy), Westmoreland Mining LLC, Signal Peak Energy, LLC, Navajo Transitional Energy Company (NTEC), Foresight Energy, LP, Hallador Energy Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. coal market is shaped by a complex interplay of demand dynamics and regulatory pressures. While energy demand is expected to rise, the coal industry must navigate stringent environmental regulations and increasing competition from renewables. However, advancements in clean coal technologies and potential international market expansion present avenues for growth. Strategic partnerships and investments in sustainable practices will be crucial for coal producers to remain competitive and relevant in the evolving energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bituminous Coal Sub-Bituminous Coal Lignite Anthracite Metallurgical (Coking) Coal |

| By End-User | Power Generation (Electric Utilities & IPPs) Steel Manufacturing (Blast Furnace/BOF) Cement and Lime Kilns Industrial Boilers (Pulp & Paper, Chemicals, Other Manufacturing) Coke Plants |

| By Application | Electricity Generation Metallurgy (Coke Making, Ironmaking) Industrial Process Heat Coal Exports (Thermal and Met Coal) |

| By Distribution Channel | Direct Offtake Contracts (Utility/Industrial) Traders and Brokers Rail and Barge Logistics Providers Export Terminals (Seaborne) |

| By Region | Appalachian Region Illinois Basin Powder River Basin Uinta Basin and Western Interior |

| By Quality | Thermal Coal (Steam Coal) Metallurgical Coal (Hard, PCI, Semi-soft) Low-Sulfur vs High-Sulfur Grades |

| By Policy Impact | Emissions Standards (MATS, NSPS) Mine Reclamation and Land Permitting (SMCRA) Federal Tax and IRA-Related Impacts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal Mining Operations | 120 | Mine Managers, Operations Directors |

| Energy Sector Coal Consumption | 90 | Energy Analysts, Utility Executives |

| Coal Transportation Logistics | 70 | Logistics Coordinators, Supply Chain Managers |

| Regulatory Impact Assessment | 60 | Policy Makers, Environmental Consultants |

| Coal Market Investment Insights | 80 | Investment Analysts, Financial Advisors |

The United States coal market is valued at approximately USD 70 billion, reflecting demand primarily from electricity generation and industrial uses, alongside a sustained need for metallurgical coal in steelmaking.