Region:Global

Author(s):Shubham

Product Code:KRAA4725

Pages:99

Published On:September 2025

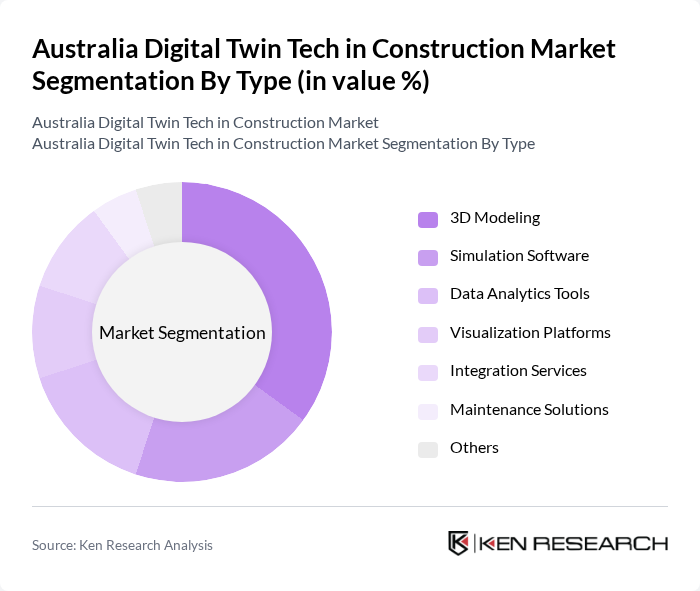

By Type:The market is segmented into various types, including 3D Modeling, Simulation Software, Data Analytics Tools, Visualization Platforms, Integration Services, Maintenance Solutions, and Others. Among these, 3D Modeling is currently the leading sub-segment due to its critical role in visualizing construction projects and facilitating better design and planning processes. The increasing demand for accurate and detailed representations of construction projects has driven the adoption of 3D modeling tools, making it a preferred choice for construction firms.

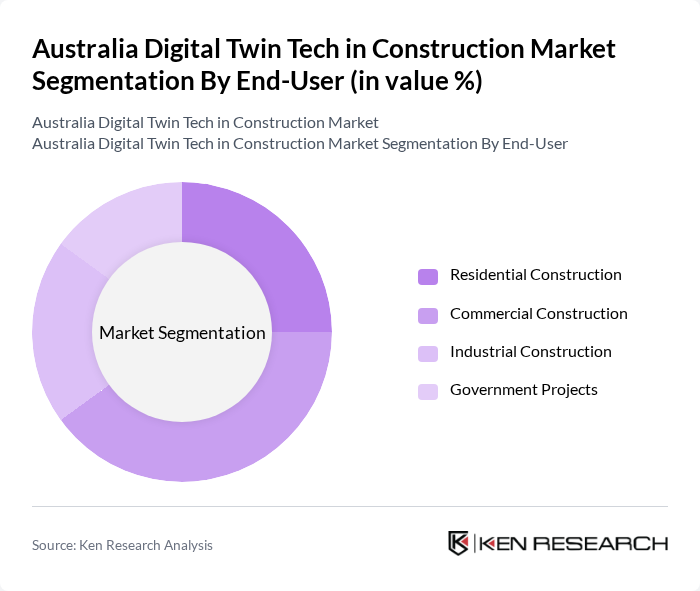

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, and Government Projects. The Commercial Construction segment is currently leading the market, driven by the increasing number of commercial projects and the need for efficient project management solutions. The growing trend of smart buildings and infrastructure development in urban areas has further propelled the demand for digital twin technologies in commercial construction.

The Australia Digital Twin Tech in Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autodesk, Inc., Bentley Systems, Incorporated, Siemens AG, Dassault Systèmes SE, Trimble Inc., Aconex Limited, IBM Corporation, Microsoft Corporation, Oracle Corporation, Hexagon AB, SAP SE, Procore Technologies, Inc., Viewpoint, Inc., PlanGrid, Inc., Esri Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of digital twin technology in Australia’s construction market appears promising, driven by ongoing advancements in artificial intelligence and machine learning. As companies increasingly adopt cloud-based solutions, the integration of digital twins into project workflows will enhance collaboration and efficiency. Furthermore, the growing emphasis on smart city initiatives will likely accelerate the adoption of digital twin technologies, enabling better urban planning and infrastructure management, ultimately transforming the construction landscape in Australia.

| Segment | Sub-Segments |

|---|---|

| By Type | D Modeling Simulation Software Data Analytics Tools Visualization Platforms Integration Services Maintenance Solutions Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Government Projects |

| By Application | Design and Planning Construction Management Asset Management Facility Management |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Platforms |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Government Subsidies Tax Incentives Grants for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 80 | Architects, Construction Engineers |

| Infrastructure Projects | 70 | Urban Planners, Civil Engineers |

| Technology Providers in Construction | 60 | Product Managers, Business Development Leads |

| Consultants Specializing in Digital Transformation | 50 | Industry Analysts, Technology Consultants |

The Australia Digital Twin Tech in Construction Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of advanced technologies like IoT and AI, which enhance project efficiency and reduce costs.