Region:Global

Author(s):Dev

Product Code:KRAB4266

Pages:84

Published On:October 2025

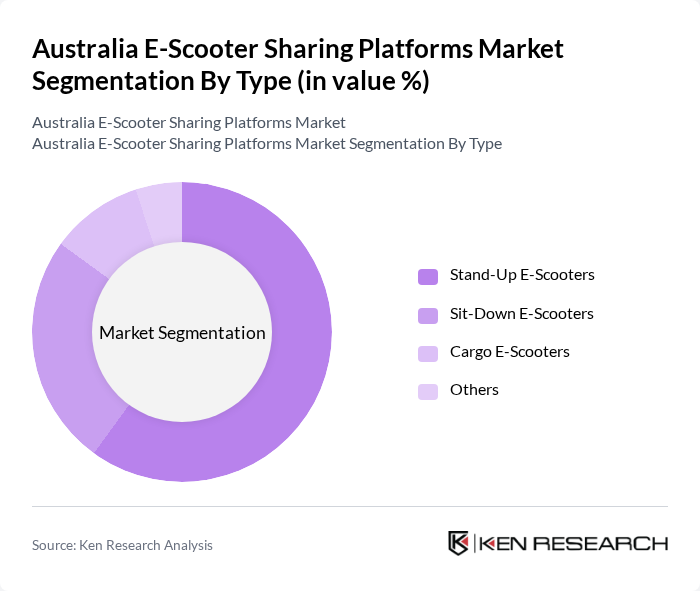

By Type:The e-scooter sharing platforms can be categorized into four main types: Stand-Up E-Scooters, Sit-Down E-Scooters, Cargo E-Scooters, and Others. Among these, Stand-Up E-Scooters dominate the market due to their popularity among individual users seeking quick and convenient transportation options. Their lightweight design and ease of use make them the preferred choice for short trips in urban areas. Sit-Down E-Scooters are gaining traction, particularly among users looking for comfort during longer rides, while Cargo E-Scooters cater to businesses needing efficient delivery solutions.

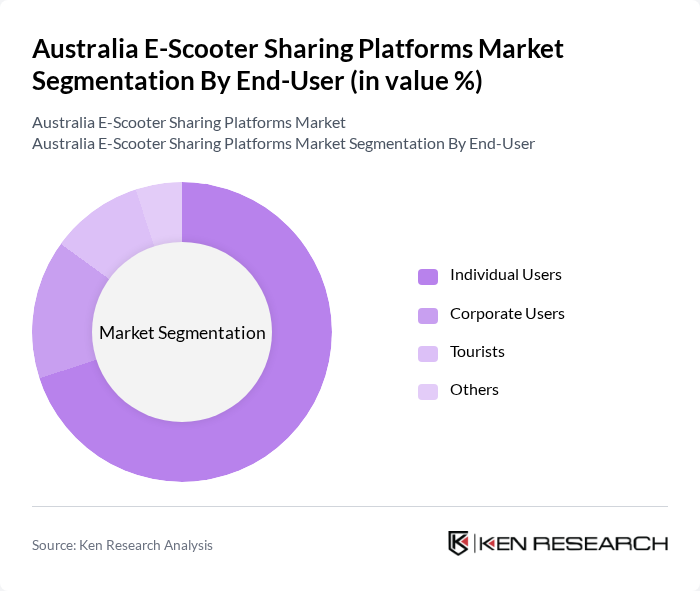

By End-User:The end-users of e-scooter sharing platforms can be segmented into Individual Users, Corporate Users, Tourists, and Others. Individual Users represent the largest segment, driven by the growing trend of urban commuting and the need for flexible transportation options. Corporate Users are increasingly adopting e-scooters for employee commuting programs, while Tourists utilize these services for exploring cities conveniently. The Others segment includes various user groups, such as students and delivery personnel, contributing to the overall market growth.

The Australia E-Scooter Sharing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lime, Bird, Neuron Mobility, Scooti, Bolt, Reddy Go, Flash, Swyft, Ride On, E-Scooter Australia, Urban E-Scooters, GoScoot, Scooteroo, Zipp, Spin contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-scooter sharing market in Australia appears promising, driven by increasing urbanization and a growing emphasis on sustainable transport solutions. As cities expand and environmental concerns rise, e-scooter platforms are likely to gain traction. Furthermore, advancements in technology, such as improved battery life and GPS tracking, will enhance user experience. Collaborations with local governments to create dedicated lanes and parking spaces will also facilitate smoother integration into urban transport systems, paving the way for broader acceptance and usage.

| Segment | Sub-Segments |

|---|---|

| By Type | Stand-Up E-Scooters Sit-Down E-Scooters Cargo E-Scooters Others |

| By End-User | Individual Users Corporate Users Tourists Others |

| By Pricing Model | Pay-Per-Ride Subscription-Based Membership Plans Others |

| By Usage Frequency | Daily Users Weekly Users Occasional Users Others |

| By Location | Urban Areas Suburban Areas Tourist Attractions Others |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets Others |

| By Service Type | Station-Based Free-Flow Hybrid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-Scooter User Demographics | 150 | Regular Users, Occasional Riders |

| Urban Mobility Stakeholders | 100 | City Planners, Transportation Officials |

| Service Providers Insights | 80 | Operations Managers, Fleet Coordinators |

| Regulatory Impact Assessment | 70 | Policy Makers, Environmental Analysts |

| Consumer Behavior Analysis | 90 | Urban Commuters, Environmental Advocates |

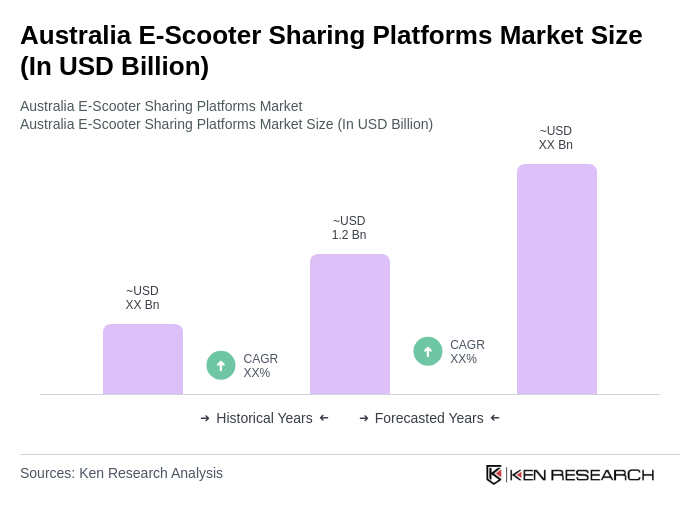

The Australia E-Scooter Sharing Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for sustainable urban mobility solutions and increased environmental awareness among consumers.