Region:Asia

Author(s):Dev

Product Code:KRAB0347

Pages:90

Published On:August 2025

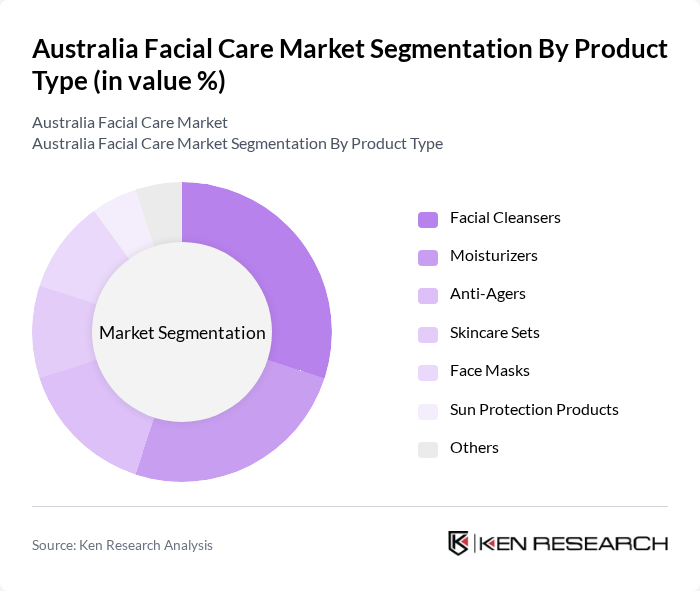

By Product Type:The product type segmentation includes various categories such as Facial Cleansers, Moisturizers, Anti-Agers, Skincare Sets, Face Masks, Sun Protection Products, and Others. Among these, Facial Cleansers and Moisturizers are the leading subsegments, driven by the increasing demand for daily skincare routines. Consumers are increasingly prioritizing skin health, leading to a surge in the use of these products. The trend towards multi-step skincare routines has also contributed to the growth of Skincare Sets and Face Masks. Sun protection products are also gaining traction due to heightened awareness of UV-related skin damage and the importance of prevention .

By Ingredient:The ingredient segmentation is categorized into Chemical and Natural products. The Natural segment is gaining traction as consumers become more conscious of the ingredients in their skincare products. This shift is driven by a growing preference for clean beauty and sustainable practices. Chemical products still hold a significant market share due to their effectiveness and established presence in the market, but the trend is clearly leaning towards natural formulations. The demand for vegan, cruelty-free, and eco-friendly products is also rising, reflecting broader sustainability concerns among Australian consumers .

The Australia Facial Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal Australia Pty Ltd., Estée Lauder Pty. Limited, Procter & Gamble Australia Pty. Ltd., Unilever Australia Ltd., Colgate-Palmolive Pty Ltd., Johnson & Johnson Pacific Pty Ltd., Shiseido Australia Pty., Ltd., Coty Australia Pty Ltd., Revlon Australia Pty Ltd., Beiersdorf Australia Ltd., NIVEA Australia (Beiersdorf), The Body Shop Australia Pty Ltd., Neutrogena (Johnson & Johnson Pacific), Clinique Laboratories, LLC (Estée Lauder), Aesop (Aesop Australia Pty Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian facial care market appears promising, driven by evolving consumer preferences and technological advancements. As personalization becomes a key trend, brands are expected to invest in tailored skincare solutions that cater to individual needs. Additionally, the integration of technology, such as AI-driven skincare assessments, will enhance consumer engagement. With a growing focus on sustainability, brands that prioritize eco-friendly practices are likely to gain a competitive edge, appealing to environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Facial Cleansers Moisturizers Anti-Agers Skincare Sets Face Masks Sun Protection Products Others |

| By Ingredient | Chemical Natural |

| By Gender | Male Female Unisex |

| By Category | Mass Premium |

| By Distribution Channel | Supermarkets and Hypermarkets Beauty Parlors and Salons Multi Branded Retail Stores Online Exclusive Retail Stores Pharmacies and Drug Stores Specialty Stores Others |

| By Region | New South Wales Victoria Queensland Western Australia Australian Capital Territory Rest of Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Skincare Preferences | 120 | Skincare Users, Beauty Enthusiasts |

| Retail Sales Insights | 60 | Store Managers, Beauty Advisors |

| Product Development Feedback | 50 | Product Managers, R&D Specialists |

| Market Trend Analysis | 40 | Industry Analysts, Market Researchers |

| Consumer Purchase Behavior | 90 | Online Shoppers, In-store Customers |

The Australia Facial Care Market is valued at approximately USD 2.9 billion, reflecting a significant growth trend driven by increasing consumer awareness of skincare, the rise of e-commerce, and a preference for natural and organic products.