Region:Asia

Author(s):Geetanshi

Product Code:KRAB1443

Pages:91

Published On:October 2025

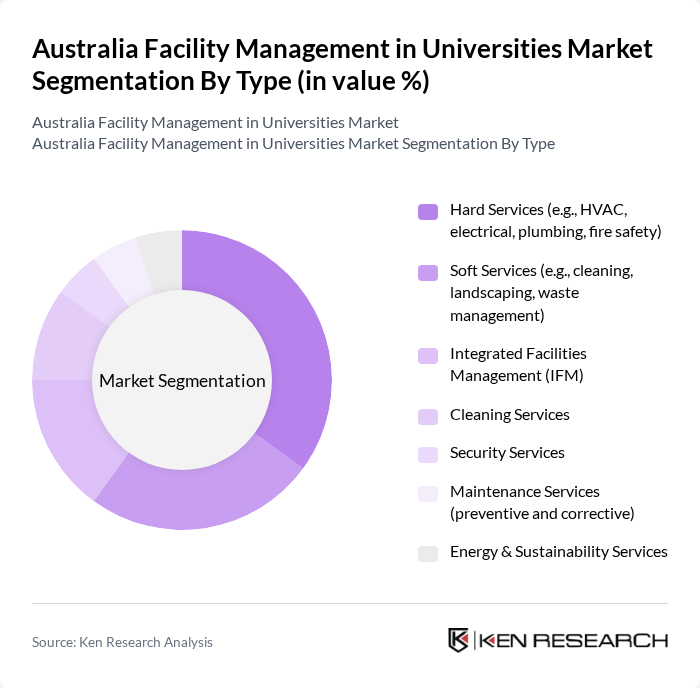

By Type:The market is segmented into various types of services that cater to the diverse needs of universities. The primary subsegments include Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance functions including HVAC systems, electrical maintenance, and structural repairs, while Soft Services focus on non-core activities that enhance the campus environment such as cleaning, catering, and security services. Integrated Services offer a bundled approach combining multiple facility management functions under single contracts, and Specialized Services address unique requirements specific to educational institutions including laboratory management and research facility maintenance.

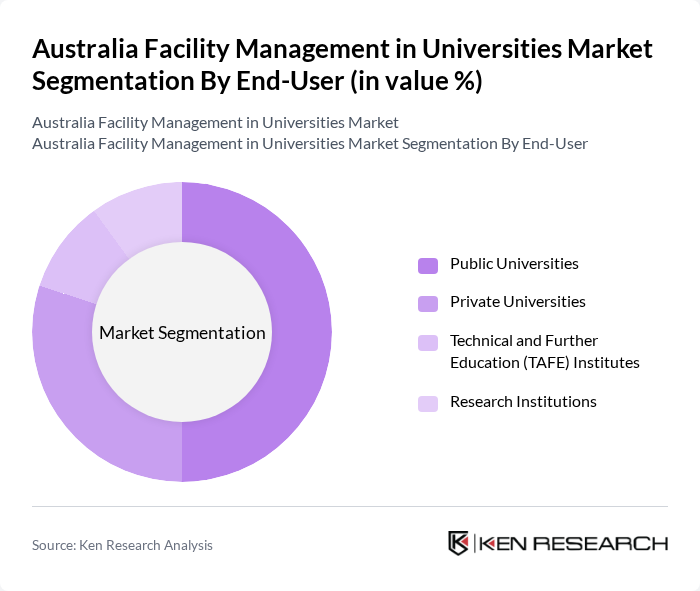

By End-User:The end-user segmentation includes Public Universities, Private Universities, Vocational Education Institutions, and Research Institutions. Public Universities, such as those in the Group of Eight, dominate the market due to their larger student populations, extensive campus infrastructure, and substantial government funding allocations. Private Universities and Vocational Institutions also contribute significantly, driven by their unique facility management needs, specialized equipment requirements, and the increasing focus on quality education delivery. Research Institutions require highly specialized facility management services for laboratory environments, clean rooms, and advanced research equipment maintenance.

The Australia Facility Management in Universities Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services Australia, Ventia Services Group, Sodexo Australia, CBRE Group, JLL (Jones Lang LaSalle), Cushman & Wakefield, Compass Group Australia, Serco Asia Pacific, Australian Facilities Management, Vinci Facilities, Apleona HSG, Downer EDI Limited, Programmed Maintenance Services, Spotless Group, Savills Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Australian universities is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As institutions increasingly adopt integrated facility management solutions, operational efficiencies are expected to improve, leading to enhanced service delivery. Furthermore, the rising demand for smart campus initiatives will likely create new opportunities for innovation, positioning universities to better meet the evolving needs of students and staff while optimizing resource utilization.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., HVAC, electrical, plumbing, building fabric maintenance) Soft Services (e.g., cleaning, catering, security, landscaping, waste management) Integrated Services (bundled hard and soft services under a single contract) Specialized Services (e.g., laboratory maintenance, IT infrastructure, event management) Others (e.g., sustainability consulting, energy management, asset lifecycle services) |

| By End-User | Public Universities (e.g., Group of Eight, regional universities) Private Universities (e.g., Bond University, University of Notre Dame Australia) Vocational Education Institutions (e.g., TAFE, private colleges) Research Institutions (e.g., CSIRO, university-affiliated research centers) |

| By Service Model | Outsourced Services (third-party providers managing all or part of FM operations) In-House Services (university-employed staff managing FM operations) |

| By Facility Type | Academic Buildings (lecture halls, laboratories, libraries) Residential Halls (student accommodation, staff housing) Recreational Facilities (sports centers, student unions, gyms) Administrative Buildings (offices, conference centers, IT hubs) |

| By Geographic Presence | Urban Areas (major cities: Sydney, Melbourne, Brisbane, Perth, Adelaide) Suburban Areas (regional campuses, satellite facilities) |

| By Contract Type | Fixed-Price Contracts (predetermined fee for defined scope) Time and Materials Contracts (pay-as-you-go based on actual work) |

| By Investment Source | Government Funding (federal/state grants, infrastructure programs) Private Investments (endowments, corporate partnerships) Public-Private Partnerships (PPPs for major campus developments) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public University Facility Management | 100 | Facility Managers, Operations Directors |

| Private University Facility Management | 60 | Procurement Officers, Campus Services Managers |

| Technology Integration in Facilities | 50 | IT Managers, Facility Technology Coordinators |

| Sustainability Practices in Facilities | 40 | Sustainability Officers, Environmental Managers |

| Student Satisfaction with Facilities | 80 | Student Representatives, Faculty Members |

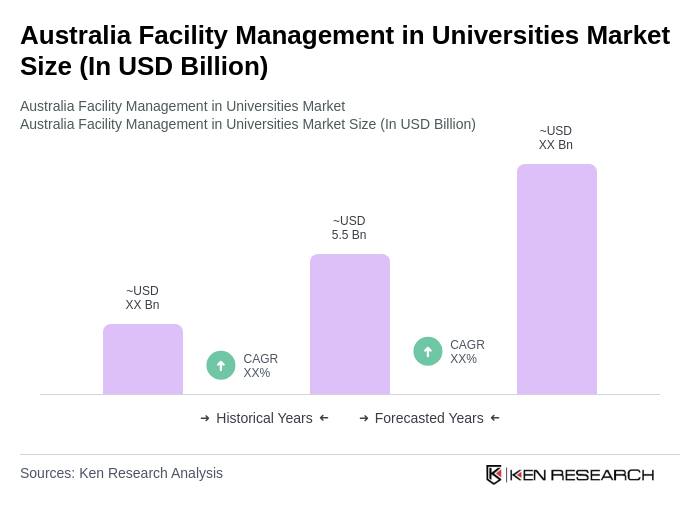

The Australia Facility Management in Universities Market is valued at approximately USD 5.5 billion, driven by investments in educational infrastructure, demand for efficient services, and sustainable practices within university campuses.