Region:Asia

Author(s):Geetanshi

Product Code:KRAA1937

Pages:98

Published On:August 2025

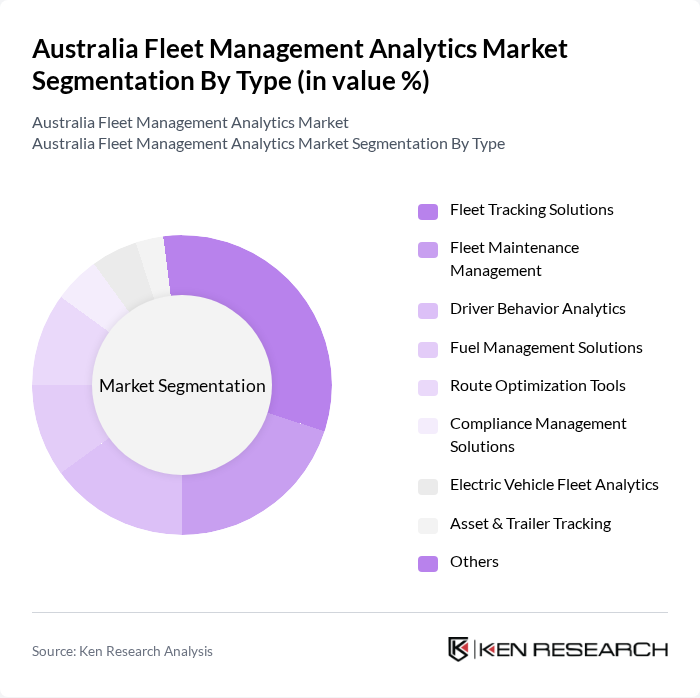

By Type:The market is segmented into various types, including Fleet Tracking Solutions, Fleet Maintenance Management, Driver Behavior Analytics, Fuel Management Solutions, Route Optimization Tools, Compliance Management Solutions, Electric Vehicle Fleet Analytics, Asset & Trailer Tracking, and Others. Fleet Tracking Solutions are currently the most dominant segment due to the increasing need for real-time visibility and control over fleet operations. Companies are increasingly adopting these solutions to enhance operational efficiency, reduce costs, and ensure regulatory compliance. The adoption of electric vehicle fleet analytics and compliance management solutions is also rising as organizations focus on sustainability and evolving regulatory requirements .

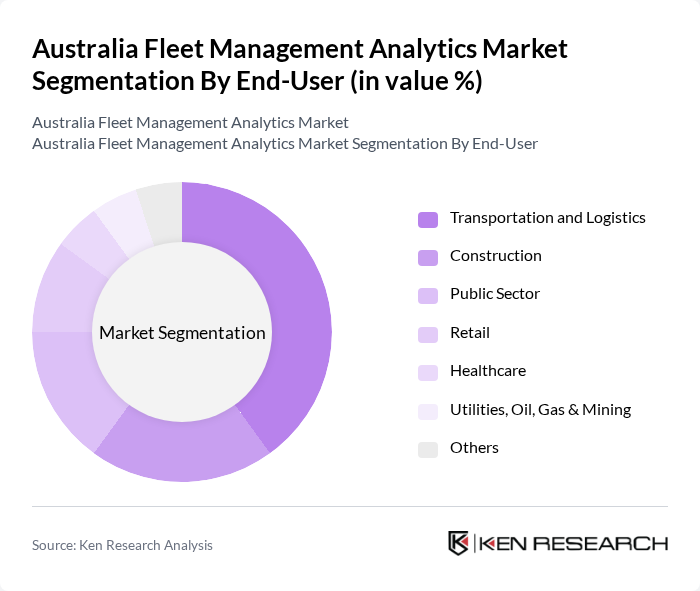

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Public Sector, Retail, Healthcare, Utilities, Oil, Gas & Mining, and Others. The Transportation and Logistics sector is the leading segment, driven by the need for efficient fleet management to handle increasing delivery demands and operational complexities. Companies in this sector are leveraging analytics to optimize routes, reduce fuel consumption, comply with regulatory frameworks, and improve overall service delivery. The construction and public sector segments are also significant adopters, focusing on asset utilization and safety compliance .

The Australia Fleet Management Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teletrac Navman, Fleet Complete, Geotab, Smartrak, Ctrack, Fleetio, Verizon Connect, Microlise, GPC Asia Pacific, Omnicomm, TomTom Telematics, Zubie, Inseego, Navman Wireless, SG Fleet Group Limited, Fleetcare Pty Ltd., Future Fleet International Pty Ltd., Summit Fleet Auto Lease Australia Pty Ltd., Linxio, McMillan Shakespeare Ltd., Telstra Group Ltd. (MTData), ORIX Corporation Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia fleet management analytics market appears promising, driven by technological advancements and increasing regulatory pressures. As businesses prioritize operational efficiency and sustainability, the demand for innovative analytics solutions is expected to rise. Furthermore, the integration of AI and machine learning will enhance predictive capabilities, allowing fleets to optimize performance. In future, the market is likely to see a significant shift towards more automated and data-driven decision-making processes, fostering a competitive edge for early adopters.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Tracking Solutions Fleet Maintenance Management Driver Behavior Analytics Fuel Management Solutions Route Optimization Tools Compliance Management Solutions Electric Vehicle Fleet Analytics Asset & Trailer Tracking Others |

| By End-User | Transportation and Logistics Construction Public Sector Retail Healthcare Utilities, Oil, Gas & Mining Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Deployment Mode | On-Premises Cloud-Based |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Australian Capital Territory Others |

| By Service Type | Software as a Service (SaaS) Managed Services Consulting Services |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 120 | Fleet Managers, Operations Directors |

| Public Transport Fleet Analytics | 90 | Transport Planners, Fleet Supervisors |

| Construction Vehicle Fleet Optimization | 60 | Project Managers, Equipment Managers |

| Technology Providers in Fleet Management | 50 | Product Managers, Sales Executives |

| Data Analytics in Fleet Operations | 70 | Data Analysts, IT Managers |

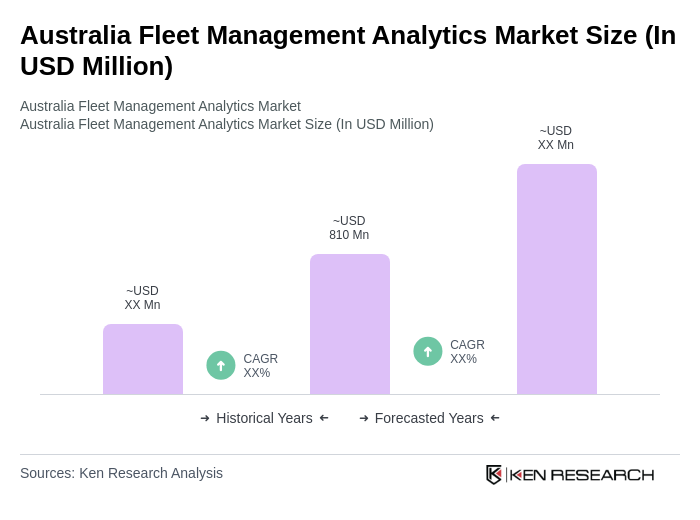

The Australia Fleet Management Analytics Market is valued at approximately USD 810 million, driven by the increasing adoption of telematics solutions and the need for operational efficiency among fleet operators.