Australia Mattress and Sleep Comfort Products Market Overview

- The Australia Mattress and Sleep Comfort Products Market is valued at USD 1.2 billion, based on a five-year historical analysis. Growth is primarily driven by rising consumer awareness of sleep health, increased disposable income, and higher spending on premium and technologically advanced sleep products. The market has also experienced a surge in online sales channels, which has expanded consumer access to a broader range of products and brands. Additionally, there is a notable trend toward eco-friendly and sustainable mattress materials, such as organic cotton, latex, and plant-based foams, reflecting heightened environmental and health consciousness among Australian consumers .

- Key cities such as Sydney, Melbourne, and Brisbane continue to dominate the market due to their large populations, higher income levels, and strong retail infrastructure. These urban centers feature a significant number of retail outlets and robust online platforms, catering to the growing demand for diverse mattress options. Lifestyle trends in these cities emphasize comfort, wellness, and sustainability, further propelling market growth .

- In 2023, the Australian government strengthened regulations to improve safety and quality standards for sleep products. The mandatory compliance with the Australian/New Zealand Standard AS/NZS 8811.1:2013 for mattresses, issued by Standards Australia, ensures that products are free from harmful substances, meet flammability and durability requirements, and adhere to labeling and safety protocols. These regulations are designed to protect consumers and enhance the overall quality of sleep comfort products in the market .

Australia Mattress and Sleep Comfort Products Market Segmentation

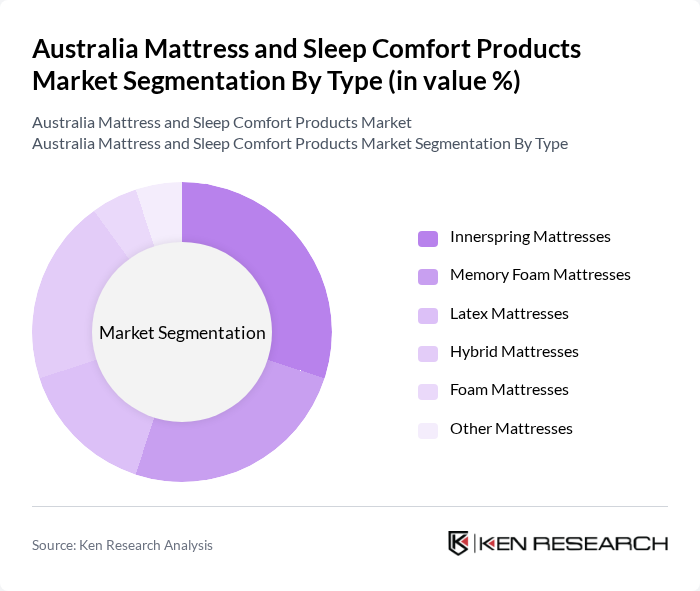

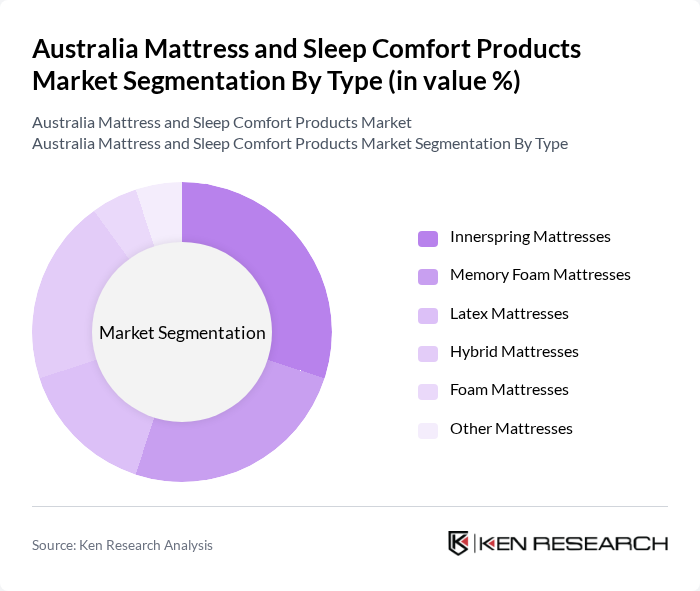

By Type:The market is segmented into various types of mattresses, including Innerspring, Memory Foam, Latex, Hybrid, Foam, and Other Mattresses. Each type addresses distinct consumer needs and preferences, with differences in comfort, support, temperature regulation, and price points. Demand for memory foam and hybrid mattresses is rising due to their ergonomic benefits and advanced features such as orthopedic support and temperature control. The shift toward sustainable materials and hypoallergenic options is also influencing consumer choice .

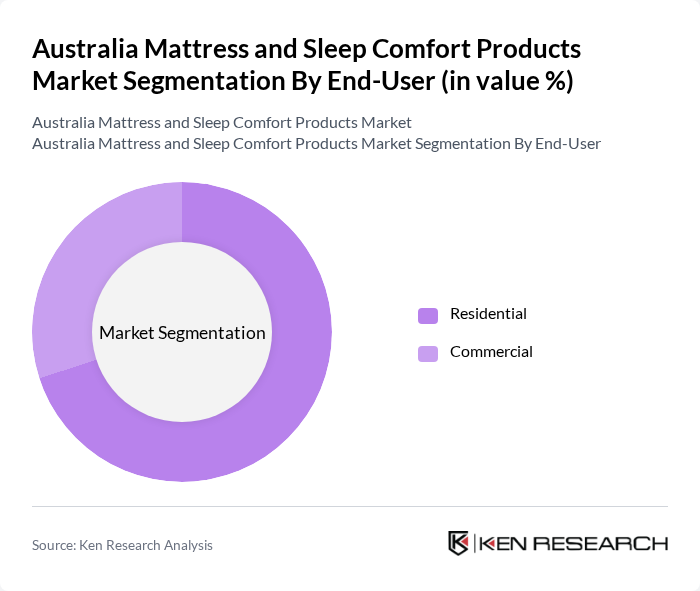

By End-User:The market is divided into Residential and Commercial segments. The residential segment is the largest, driven by increased consumer spending on home comfort, wellness, and the growing adoption of premium and sustainable sleep products. The commercial segment, which includes hotels, resorts, and healthcare facilities, is expanding as businesses recognize the importance of quality sleep for guest satisfaction and employee well-being. The hospitality sector, in particular, is investing in advanced mattress technologies to enhance guest experiences .

Australia Mattress and Sleep Comfort Products Market Competitive Landscape

The Australia Mattress and Sleep Comfort Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Sealy Australia Pty Ltd, AH Beard Holdings Pty Ltd, SleepMaker, King Koil Australia, Koala Sleep Pty Ltd, Sleeping Duck Pty Ltd, Ecosa Pty Ltd, Emma Sleep GmbH (Australia), Zinus Australia, Snooze, Forty Winks, Bambi Enterprises, IKEA Australia, Joyce Corporation Ltd contribute to innovation, geographic expansion, and service delivery in this space.

Australia Mattress and Sleep Comfort Products Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness about Sleep Health:The Australian market is witnessing a surge in consumer awareness regarding sleep health, with 75% of Australians acknowledging the importance of quality sleep for overall well-being. This awareness is driven by health campaigns and research linking sleep quality to physical and mental health. The Australian Institute of Health and Welfare reported that sleep disorders affect approximately 20% of the population, prompting consumers to invest in better sleep solutions, including high-quality mattresses and sleep comfort products.

- Rising Disposable Income and Spending on Home Comfort:In future, Australia's average disposable income is projected to reach AUD 1,300 per week, reflecting a 4% increase from the previous year. This rise in disposable income is leading consumers to prioritize home comfort, including sleep products. According to the Australian Bureau of Statistics, household expenditure on furniture and furnishings, which includes mattresses, has increased by approximately 4% annually, indicating a growing trend towards investing in quality sleep solutions as part of home improvement.

- Growth in E-commerce and Online Mattress Sales:The e-commerce sector in Australia is expected to grow by 16% in future, with online mattress sales contributing significantly to this trend. Reports indicate that online mattress sales accounted for AUD 600 million, driven by the convenience of home delivery and trial periods. The increasing penetration of smartphones and internet access, with over 92% of Australians using the internet, is facilitating this shift towards online shopping for sleep comfort products, enhancing market growth.

Market Challenges

- Intense Competition Among Established Brands:The Australian mattress market is characterized by intense competition, with over 55 established brands vying for market share. This saturation leads to aggressive pricing strategies, making it challenging for new entrants to gain traction. According to IBISWorld, the top five companies hold approximately 42% of the market share, creating a highly competitive environment that pressures profit margins and necessitates innovation to differentiate products.

- Price Sensitivity Among Consumers:Price sensitivity remains a significant challenge in the Australian mattress market, particularly among budget-conscious consumers. A survey by the Australian Retailers Association indicated that 62% of consumers consider price as the primary factor when purchasing mattresses. This sensitivity is exacerbated by economic uncertainties, leading to cautious spending habits. Brands must navigate this challenge by offering competitive pricing while maintaining product quality to attract and retain customers.

Australia Mattress and Sleep Comfort Products Market Future Outlook

The future of the Australia mattress and sleep comfort products market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart technology into mattresses is expected to enhance user experience, while the rise of subscription-based services will cater to changing purchasing behaviors. Additionally, as consumers increasingly prioritize sustainability, brands that focus on eco-friendly materials and practices will likely gain a competitive edge, positioning themselves favorably in a dynamic market landscape.

Market Opportunities

- Expansion into Rural and Underserved Markets:There is a significant opportunity for mattress brands to expand into rural and underserved markets, where access to quality sleep products is limited. With approximately 32% of Australians living in regional areas, targeting these consumers can lead to increased sales and brand loyalty, as they seek better sleep solutions that are often unavailable locally.

- Development of Eco-Friendly and Sustainable Products:The growing consumer demand for sustainable products presents an opportunity for mattress manufacturers to innovate. In future, the market for eco-friendly mattresses is projected to reach AUD 250 million, driven by consumers' increasing awareness of environmental issues. Brands that prioritize sustainable materials and manufacturing processes can attract environmentally conscious consumers, enhancing their market position.