Region:Global

Author(s):Geetanshi

Product Code:KRAE1008

Pages:114

Published On:December 2025

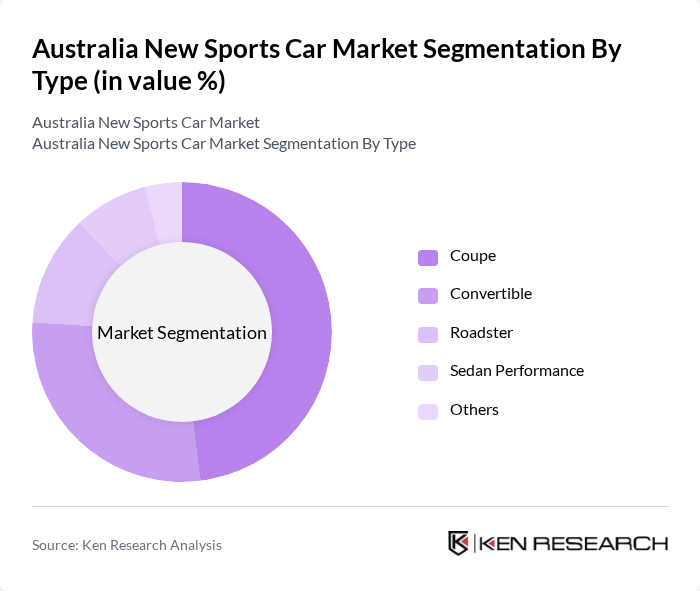

By Type:The market is segmented into various types of sports cars, including Coupe, Convertible, Roadster, Sedan Performance, and Others. The Coupe segment is currently leading the market due to its popularity among consumers who prefer a blend of performance and style. Coupes are often seen as the quintessential sports car, appealing to enthusiasts and collectors alike. The Convertible segment also holds a significant share, driven by the desire for open-top driving experiences, especially in Australia's favorable climate. Roadsters and Sedan Performance vehicles cater to niche markets, while the Others category includes unique models that attract specific consumer preferences.

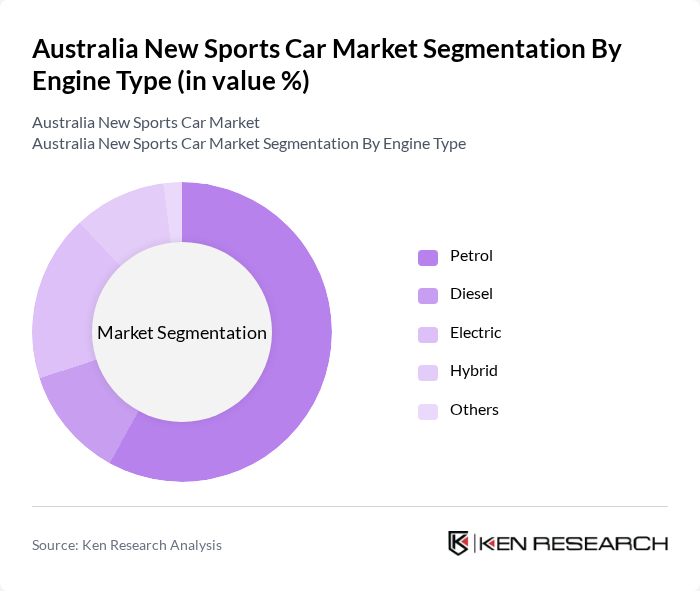

By Engine Type:The segmentation by engine type includes Petrol, Diesel, Electric, Hybrid, and Others. The Petrol segment dominates the market, favored for its performance and availability. Diesel engines are less common in the sports car segment but still hold a niche market due to their efficiency. The Electric segment is gaining significant traction as manufacturers introduce high-performance electric sports cars, appealing to environmentally conscious consumers and supported by government incentives for electric vehicle adoption. Hybrid vehicles combine the benefits of both petrol and electric engines, attracting buyers looking for versatility. The Others category includes unique engine configurations that cater to specific consumer preferences.

The Australia New Sports Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Porsche Australia, BMW Australia, Mercedes-Benz Australia, Audi Australia, Tesla Australia, Subaru Australia, Nissan Australia, Jaguar Land Rover Australia, Aston Martin Australia, Ferrari Australia, Lamborghini Australia, Maserati Australia, Volkswagen Australia, Toyota Australia, Ford Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian new sports car market appears promising, driven by evolving consumer preferences and technological advancements. As electric sports cars gain traction, manufacturers are expected to invest heavily in electric vehicle technology, aligning with sustainability trends. Additionally, the rise of online sales channels will facilitate broader market access, allowing consumers to explore and purchase vehicles conveniently. These trends indicate a dynamic shift in the market landscape, fostering innovation and expanding consumer choices in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Coupe Convertible Roadster Sedan Performance Others |

| By Engine Type | Petrol Diesel Electric Hybrid Others |

| By Price Range | Below AUD 50,000 AUD 50,000 - AUD 100,000 AUD 100,000 - AUD 150,000 Above AUD 150,000 Others |

| By Brand | Domestic Brands International Mainstream Brands Luxury Brands Ultra-Luxury Performance Brands Others |

| By Distribution Channel | Authorized Dealerships Online Sales Platforms Direct Manufacturer Sales Auctions and Secondary Market Others |

| By Customer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level (High Net Worth Individuals) Lifestyle Preferences (Enthusiasts, Collectors, Status-Seekers) Others |

| By Usage Type | Personal Use Track/Racing Leisure and Weekend Driving Corporate Fleet Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potential Sports Car Buyers | 120 | Car Enthusiasts, Luxury Vehicle Owners |

| Automotive Dealership Managers | 45 | Sales Managers, General Managers |

| Automotive Industry Experts | 30 | Market Analysts, Automotive Consultants |

| Current Sports Car Owners | 65 | Vehicle Owners, Brand Loyalists |

| Automotive Enthusiast Groups | 50 | Club Members, Event Organizers |

The Australia New Sports Car Market is valued at approximately AUD 5.2 billion, driven by increasing consumer demand for high-performance vehicles and advancements in automotive technology, particularly in urban areas with affluent populations.