Region:Asia

Author(s):Dev

Product Code:KRAB3114

Pages:90

Published On:October 2025

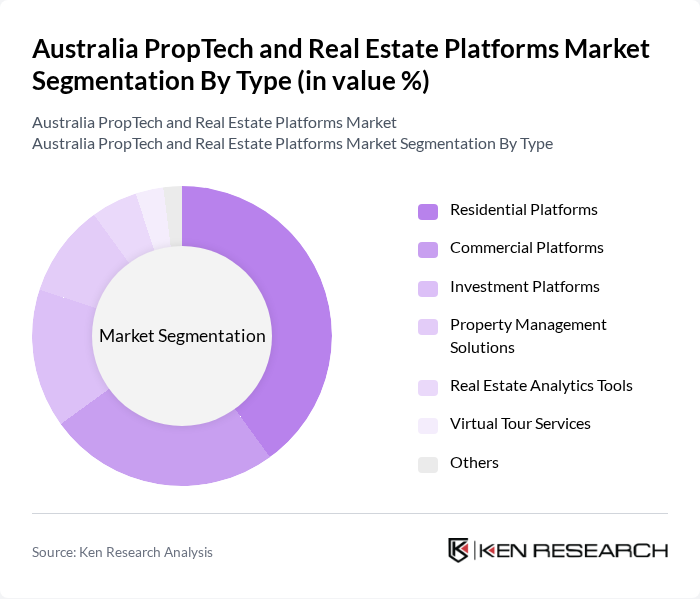

By Type:The market is segmented into various types, including Residential Platforms, Commercial Platforms, Investment Platforms, Property Management Solutions, Real Estate Analytics Tools, Virtual Tour Services, and Others. Among these, Residential Platforms are currently leading the market due to the increasing demand for housing solutions and the growing trend of online property searches. The convenience and accessibility offered by these platforms have made them the preferred choice for homebuyers and renters alike.

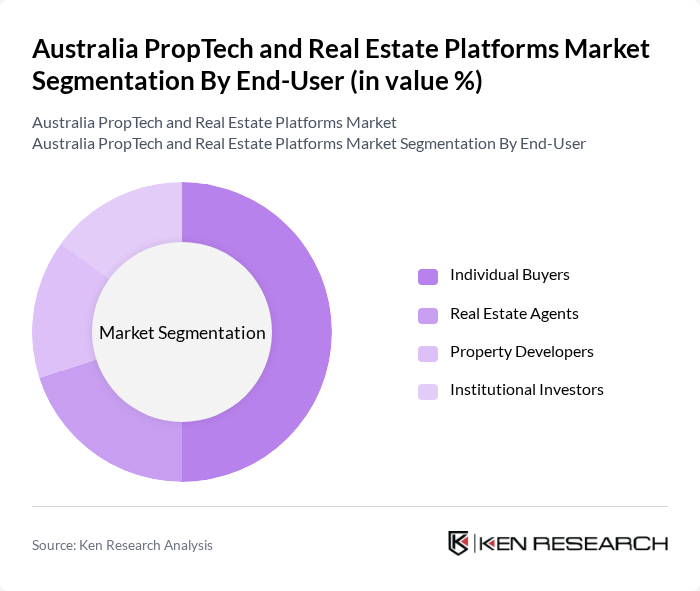

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Institutional Investors. Individual Buyers dominate the market, driven by the increasing trend of homeownership and the growing reliance on digital platforms for property searches. The ease of access to information and the ability to compare properties online have significantly influenced consumer behavior, making this segment a key driver of market growth.

The Australia PropTech and Real Estate Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as REA Group, Domain Group, PropertyGuru, Homely, Rent.com.au, Realestate.com.au, CoreLogic, BMT Tax Depreciation, UrbanX, Inspect Real Estate, PropTrack, OpenAgent, Flatmates.com.au, Homestay.com, BoxBrownie contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian PropTech and real estate platforms market appears promising, driven by technological advancements and changing consumer preferences. As remote work continues to influence housing demands, there will be a growing need for flexible living spaces. Additionally, the integration of AI and machine learning in property management is expected to enhance operational efficiency, allowing firms to better meet customer needs and streamline processes, ultimately shaping a more responsive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Investment Platforms Property Management Solutions Real Estate Analytics Tools Virtual Tour Services Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Institutional Investors |

| By Application | Residential Sales Commercial Leasing Property Investment Property Management |

| By Sales Channel | Online Marketplaces Direct Sales Partnerships with Real Estate Agencies |

| By Distribution Mode | Digital Platforms Mobile Applications Traditional Media |

| By Price Range | Low-Cost Solutions Mid-Range Solutions Premium Solutions |

| By Customer Segment | First-Time Home Buyers Luxury Property Buyers Investors Renters |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 150 | Real Estate Agents, Property Managers |

| Commercial Real Estate Solutions | 100 | Commercial Property Developers, Investment Analysts |

| Real Estate Investment Platforms | 80 | Real Estate Investors, Financial Advisors |

| Property Management Software | 70 | Property Managers, IT Managers in Real Estate |

| Real Estate Marketplaces | 90 | Online Platform Operators, Marketing Directors |

The Australia PropTech and Real Estate Platforms Market is valued at approximately USD 5 billion, reflecting significant growth driven by technological adoption in real estate transactions and increased consumer demand for digital solutions.