Australia Sports Equipment and Athletic Apparel Market Overview

- The Australia Sports Equipment and Athletic Apparel Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in participation in sports and fitness activities, and the growing trend of athleisure wear. The market has seen a significant uptick in demand for high-quality, innovative products that enhance performance and comfort.

- Key cities such as Sydney, Melbourne, and Brisbane dominate the market due to their large populations, vibrant sports culture, and access to various sporting events. These urban centers are also home to numerous fitness facilities and retail outlets, making them hotspots for sports equipment and athletic apparel consumption.

- In 2023, the Australian government implemented regulations aimed at promoting sustainable practices in the sports equipment and apparel industry. This includes guidelines for manufacturers to reduce waste and improve the recyclability of their products, encouraging a shift towards eco-friendly materials and production processes.

Australia Sports Equipment and Athletic Apparel Market Segmentation

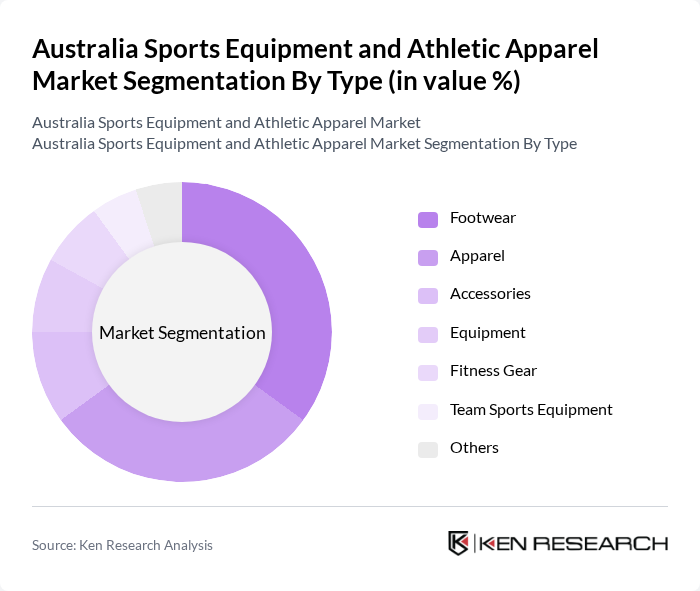

By Type:The market is segmented into various types, including Footwear, Apparel, Accessories, Equipment, Fitness Gear, Team Sports Equipment, and Others. Among these, Footwear and Apparel are the leading segments, driven by consumer preferences for comfort and style. The demand for innovative designs and technology in footwear, such as cushioning and support, has made it a dominant category. Apparel, particularly athleisure, has gained popularity due to its versatility and fashion appeal.

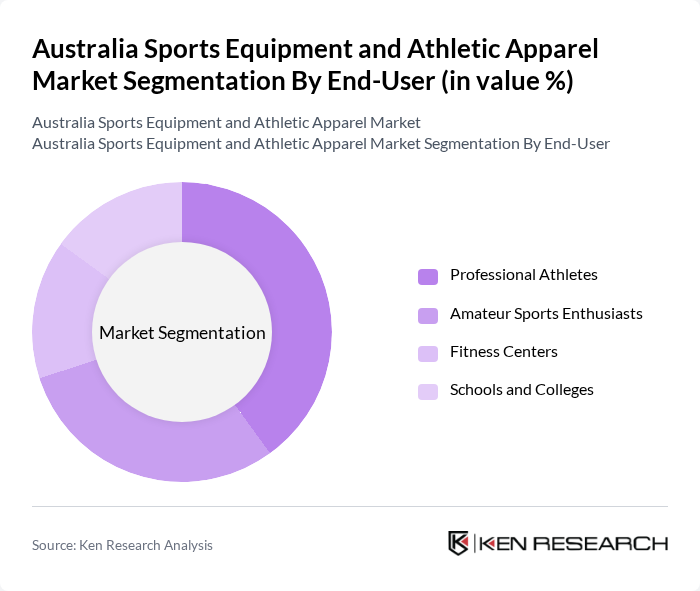

By End-User:The end-user segmentation includes Professional Athletes, Amateur Sports Enthusiasts, Fitness Centers, and Schools and Colleges. Professional Athletes represent a significant portion of the market, as they require specialized equipment and apparel to enhance their performance. Amateur Sports Enthusiasts are also a growing segment, driven by the increasing popularity of recreational sports and fitness activities. Fitness Centers and educational institutions contribute to the demand for bulk purchases of equipment and apparel.

Australia Sports Equipment and Athletic Apparel Market Competitive Landscape

The Australia Sports Equipment and Athletic Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, ASICS Corporation, New Balance Athletics, Inc., Lululemon Athletica Inc., Columbia Sportswear Company, The North Face, Inc., Reebok International Ltd., Champion Athleticwear, Skechers USA, Inc., Gymshark Ltd., Fabletics, Inc., Decathlon S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Australia Sports Equipment and Athletic Apparel Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Australian population is increasingly prioritizing health, with 63% of adults engaging in regular physical activity as of 2023. This trend is supported by the Australian Institute of Health and Welfare, which reported that 55% of Australians aged 18-64 are meeting the recommended physical activity guidelines. This growing health consciousness drives demand for sports equipment and athletic apparel, as consumers seek products that enhance their fitness experiences and support active lifestyles.

- Rise in Participation in Sports Activities:Participation in organized sports has surged, with over 8 million Australians involved in various sports as of 2023, according to Sport Australia. This increase is particularly notable among youth, with a 20% rise in participation rates in sports like soccer and basketball. This growing engagement fuels demand for specialized sports equipment and apparel, as consumers invest in quality gear to enhance their performance and enjoyment of sports.

- Technological Advancements in Equipment:The sports equipment sector is witnessing rapid technological innovations, with the global sports tech market projected to reach AUD 30 billion in the future. Innovations such as smart wearables and performance-tracking devices are gaining traction among Australian consumers. These advancements not only improve athletic performance but also attract tech-savvy consumers, driving sales in the sports equipment and athletic apparel market as individuals seek cutting-edge products to enhance their training.

Market Challenges

- Intense Competition:The Australian sports equipment and athletic apparel market is characterized by fierce competition, with over 1,200 companies operating in the sector as of 2023. Major global brands like Nike and Adidas dominate, making it challenging for smaller players to gain market share. This intense rivalry often leads to price wars, which can erode profit margins and hinder the ability of companies to invest in innovation and marketing strategies.

- Economic Fluctuations:Economic instability poses a significant challenge, with Australia's GDP growth projected at 2.5% in the future, according to the IMF. Fluctuations in consumer spending power can directly impact discretionary purchases, including sports equipment and apparel. Additionally, inflation rates, which are expected to remain around 3.5%, may lead consumers to prioritize essential goods over non-essential sports products, affecting overall market growth.

Australia Sports Equipment and Athletic Apparel Market Future Outlook

The future of the Australian sports equipment and athletic apparel market appears promising, driven by ongoing trends in health and fitness. As more Australians embrace active lifestyles, the demand for innovative and high-quality products is expected to rise. Additionally, the integration of technology in sports gear will likely enhance consumer engagement, while sustainability trends will push brands to develop eco-friendly products. These factors will shape a dynamic market landscape, fostering growth and innovation in the coming years.

Market Opportunities

- Expansion of Online Retail:The shift towards online shopping is a significant opportunity, with e-commerce sales in the sports sector projected to reach AUD 5 billion in the future. This growth is driven by increased internet penetration and consumer preference for convenience. Brands that enhance their online presence and optimize user experience can capture a larger share of this expanding market segment.

- Increasing Demand for Sustainable Products:There is a growing consumer preference for sustainable sports products, with 70% of Australians willing to pay more for eco-friendly options. This trend presents an opportunity for brands to innovate and develop sustainable materials and practices. Companies that align their offerings with environmental values can differentiate themselves and attract a loyal customer base focused on sustainability.