Region:Global

Author(s):Rebecca

Product Code:KRAB5951

Pages:92

Published On:October 2025

By Type:

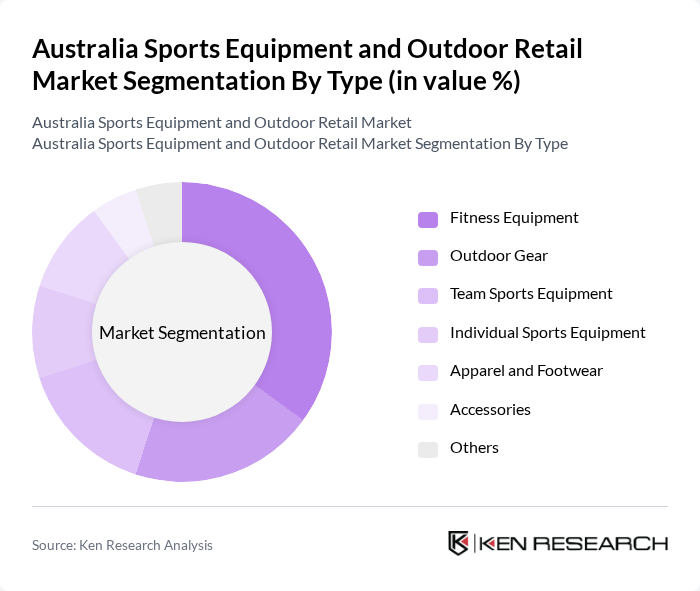

The market is segmented into various types, including Fitness Equipment, Outdoor Gear, Team Sports Equipment, Individual Sports Equipment, Apparel and Footwear, Accessories, and Others. Among these, Fitness Equipment is currently the leading sub-segment, driven by the increasing trend of home workouts and gym memberships. Consumers are investing more in personal fitness, leading to a surge in demand for items such as treadmills, weights, and yoga mats. The growing awareness of health and fitness is expected to sustain this trend, making Fitness Equipment a dominant player in the market.

By End-User:

This market is segmented by end-users, including Individual Consumers, Schools and Educational Institutions, Sports Clubs and Organizations, and Government and Military. Individual Consumers represent the largest segment, driven by the increasing focus on personal health and fitness. The rise in fitness awareness and the popularity of sports among the general population have led to a significant increase in purchases of sports equipment for personal use. This trend is expected to continue as more individuals prioritize their health and well-being.

The Australia Sports Equipment and Outdoor Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rebel Sport, Anaconda, BCF (Boating, Camping, Fishing), Decathlon Australia, Sportsmart, Kathmandu, The Athlete's Foot, Intersport, Amart Sports, Oztrail, Lorna Jane, Nike Australia, Adidas Australia, Under Armour Australia, and Puma Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian sports equipment and outdoor retail market appears promising, driven by ongoing trends in health consciousness and outdoor activities. As consumers increasingly seek sustainable and innovative products, companies are likely to invest in eco-friendly materials and smart technology integration. Additionally, the rise of e-commerce will continue to reshape retail strategies, enhancing customer experiences and expanding market reach. These factors will collectively contribute to a dynamic and evolving market landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Gear Team Sports Equipment Individual Sports Equipment Apparel and Footwear Accessories Others |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government and Military |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Retail Partnerships |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 150 | Store Managers, Sales Executives |

| Outdoor Apparel Brands | 100 | Brand Managers, Marketing Directors |

| Fitness Equipment Manufacturers | 80 | Product Development Managers, Supply Chain Analysts |

| Consumer Insights from Sports Enthusiasts | 120 | Avid Sports Participants, Outdoor Activity Groups |

| E-commerce Platforms for Sports Goods | 90 | eCommerce Managers, Digital Marketing Specialists |

The Australia Sports Equipment and Outdoor Retail Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increased health consciousness and outdoor recreational activities among consumers.