India Self Drive Car Rental Market

India Self Drive Car Rental Market: Growth Driven by Urbanization and Tourism Trends 2024–2030

Region:Asia

Author(s):Aditya

Product Code:KR914

November 2019

164

About the Report

India Self Drive Car Rental Market Overview

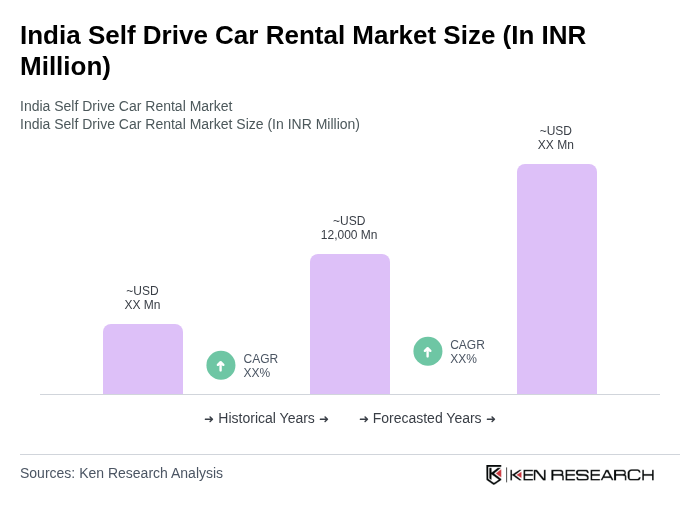

- The India Self Drive Car Rental Market is valued at INR 12,000 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for flexible travel options, urbanization, and the rise of the gig economy, which has led to a surge in the number of individuals seeking self-drive options for both leisure and business purposes.

- Key cities dominating the market include Delhi, Mumbai, Bangalore, and Hyderabad. These cities are major economic hubs with a high influx of tourists and business travelers, contributing to the demand for self-drive car rentals. The availability of a well-developed road network and increasing disposable incomes further enhance the attractiveness of self-drive options in these urban areas.

- In 2023, the Indian government implemented the Motor Vehicle (Amendment) Act, which aims to streamline the process for obtaining driving licenses and vehicle registrations. This regulation is expected to facilitate easier access to self-drive car rentals, thereby promoting growth in the sector by making it more user-friendly for consumers.

India Self Drive Car Rental Market Segmentation

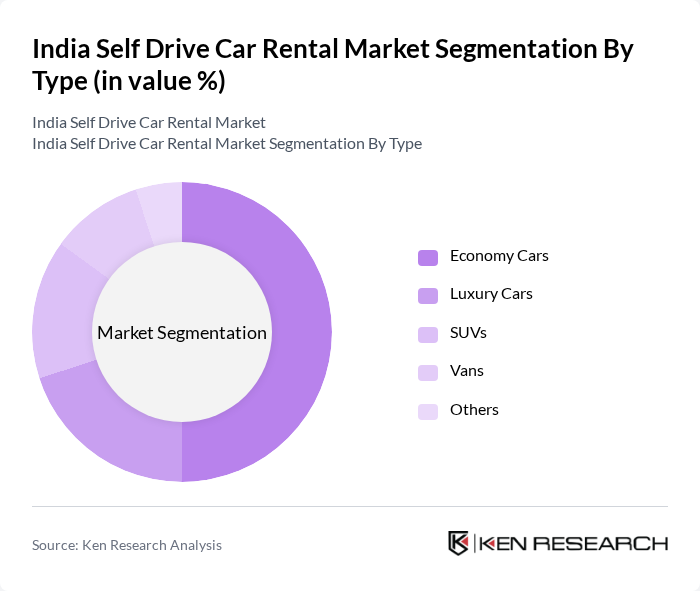

By Type:

The self-drive car rental market is segmented into various types, including Economy Cars, Luxury Cars, SUVs, Vans, and Others. Among these, Economy Cars dominate the market due to their affordability and practicality for everyday use. The rising trend of budget travel and the increasing number of young professionals seeking cost-effective transportation options have significantly contributed to the popularity of this segment. Luxury Cars and SUVs are also gaining traction, particularly among affluent customers and families looking for comfort and space during their travels.

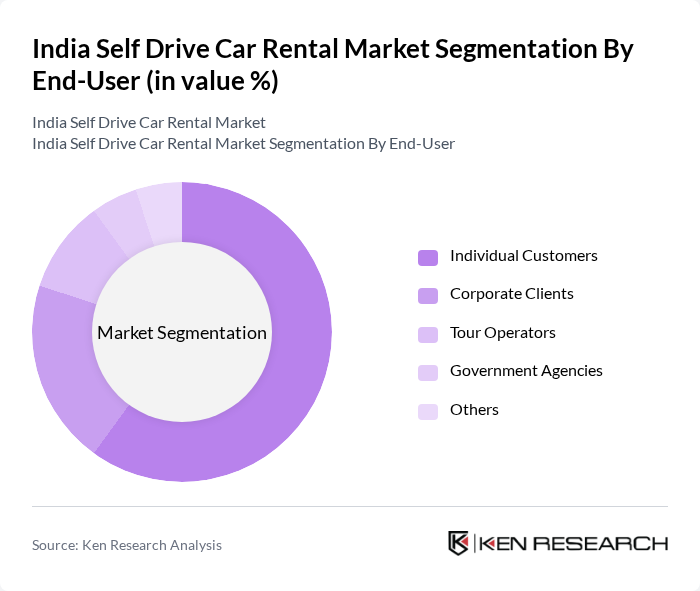

By End-User:

The market is segmented by end-users, including Individual Customers, Corporate Clients, Tour Operators, Government Agencies, and Others. Individual Customers represent the largest segment, driven by the growing trend of personal travel and the increasing preference for self-drive options among millennials and young professionals. Corporate Clients and Tour Operators also contribute significantly to the market, as businesses seek flexible transportation solutions for their employees and tourists look for convenient travel options during their trips.

India Self Drive Car Rental Market Competitive Landscape

The India Self Drive Car Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoomcar, Revv, Myles, Drivezy, Savaari Car Rentals, Ola Rentals, Carzonrent, Avis India, Hertz India, Eco Rent A Car, Trawelltag Cover-More, Gozo Cabs, Bharat Taxi, Drive India Enterprise Solutions, Car Rental India contribute to innovation, geographic expansion, and service delivery in this space.

| Zoomcar | 2013 | Bangalore, India | – | – | – | – | – | – |

| Revv | 2015 | Noida, India | – | – | – | – | – | – |

| Myles | 2013 | Gurgaon, India | – | – | – | – | – | – |

| Drivezy | 2015 | Bangalore, India | – | – | – | – | – | – |

| Savaari Car Rentals | 2006 | Bangalore, India | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, or Small as per industry convention) | Fleet Utilization Rate | Customer Satisfaction Score | Average Rental Duration | Revenue per Available Car | Pricing Strategy |

|---|

India Self Drive Car Rental Market Industry Analysis

Growth Drivers

- Increasing Urbanization: Urbanization in India is accelerating, with the urban population projected to reach 600 million in the future, according to the World Bank. This growth leads to higher demand for self-drive car rentals as urban dwellers seek convenient transportation options. The rise in urban centers, particularly in states like Maharashtra and Karnataka, is driving the need for flexible travel solutions, making self-drive rentals an attractive choice for both residents and tourists.

- Rise in Domestic Tourism: Domestic tourism in India is expected to grow significantly, with the Ministry of Tourism reporting a 20% increase in domestic tourist visits in the future, totaling over 1.8 billion trips. This surge is fueled by a growing middle class and increased disposable income, leading to a higher demand for self-drive car rentals. Tourists prefer the flexibility of self-driving to explore diverse destinations, enhancing the market's growth potential.

- Technological Advancements in Booking Systems: The self-drive car rental market is benefiting from technological innovations, with the number of mobile app users in India projected to reach 500 million in the future. Enhanced booking systems, including real-time availability and user-friendly interfaces, are attracting customers. Companies leveraging technology to streamline operations and improve customer experience are likely to capture a larger market share, driving overall growth in the sector.

Market Challenges

- High Competition Among Service Providers: The self-drive car rental market in India is characterized by intense competition, with over 100 players vying for market share. This saturation leads to price wars, reducing profit margins for companies. As new entrants continue to emerge, established players must innovate and differentiate their services to maintain competitiveness, which can strain resources and operational efficiency.

- Regulatory Compliance Issues: Navigating regulatory compliance is a significant challenge for self-drive car rental companies in India. The government mandates various licensing and insurance requirements, which can be cumbersome and costly. For instance, the average cost of compliance can reach up to INR 1 lakh per vehicle annually. Non-compliance can lead to hefty fines and operational disruptions, posing a risk to business sustainability.

India Self Drive Car Rental Market Future Outlook

The future of the self-drive car rental market in India appears promising, driven by increasing urbanization and a growing preference for flexible travel options. As domestic tourism continues to rise, companies are likely to expand their services to meet the evolving needs of consumers. Additionally, the integration of advanced technologies and sustainable practices will play a crucial role in shaping the market landscape, ensuring that businesses remain competitive and responsive to customer demands.

Market Opportunities

- Expansion into Tier 2 and Tier 3 Cities: There is a significant opportunity for self-drive car rental services to expand into Tier 2 and Tier 3 cities, where the demand for personal mobility is increasing. With a projected growth rate of 15% in these regions, companies can tap into a largely underserved market, enhancing their customer base and revenue potential.

- Introduction of Electric Vehicles in Fleet: The shift towards sustainability presents an opportunity for self-drive car rental companies to introduce electric vehicles (EVs) into their fleets. With the Indian government aiming for 30% electric vehicle adoption in the future, companies that invest in EVs can attract environmentally conscious consumers and benefit from government incentives, positioning themselves as leaders in sustainable transportation.

Scope of the Report

| By Type |

Economy Cars Luxury Cars SUVs Vans Others |

| By End-User |

Individual Customers Corporate Clients Tour Operators Government Agencies Others |

| By Region |

North India South India East India West India |

| By Duration of Rental |

Short-Term Rentals Long-Term Rentals Hourly Rentals Others |

| By Booking Channel |

Online Platforms Offline Agencies Mobile Applications Others |

| By Customer Demographics |

Age Group Income Level Travel Purpose Others |

| By Payment Method |

Credit/Debit Cards Digital Wallets Cash Payments Others |

Products

Key Target Audience

Startups and Private car Owners

Offline Dealers

Online Self Driving Car Rental Portals

Organized Multi Brands Dealers

OEM Certified Dealerships

Corporate Clients

Private Equity and Venture Capitalist Firms

Industry Associations

OEM Manufacturers

Automotive Manufacturers

EV Service Provides

Hotel Chains

Airport Authorities

Car Auction Companies

Time Period Captured in the Report:

Historical Period – FY’2014-FY’2019

Forecast Period - FY’2019-FY’2024

Companies

Players Mentioned in the Report:

Zoomcar

Revv

Myles

Drivezy

Savaari Car Rentals

Ola Rentals

Carzonrent

Avis India

Hertz India

Eco Rent A Car

Trawelltag Cover-More

Gozo Cabs

Bharat Taxi

Drive India Enterprise Solutions

Car Rental India

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India Self Drive Car Rental Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India Self Drive Car Rental Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India Self Drive Car Rental Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization

3.1.2 Rise in Domestic Tourism

3.1.3 Growing Preference for Flexible Travel Options

3.1.4 Technological Advancements in Booking Systems

3.2 Market Challenges

3.2.1 High Competition Among Service Providers

3.2.2 Regulatory Compliance Issues

3.2.3 Vehicle Maintenance and Management Costs

3.2.4 Limited Awareness Among Potential Customers

3.3 Market Opportunities

3.3.1 Expansion into Tier 2 and Tier 3 Cities

3.3.2 Partnerships with Travel Agencies

3.3.3 Introduction of Electric Vehicles in Fleet

3.3.4 Development of Subscription-Based Models

3.4 Market Trends

3.4.1 Increasing Use of Mobile Apps for Rentals

3.4.2 Focus on Sustainable and Eco-Friendly Options

3.4.3 Growth of Peer-to-Peer Car Sharing Platforms

3.4.4 Integration of AI and Big Data for Customer Insights

3.5 Government Regulation

3.5.1 Licensing and Registration Requirements

3.5.2 Insurance Mandates for Rental Vehicles

3.5.3 Emission Norms and Environmental Regulations

3.5.4 Safety Standards for Rental Operations

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India Self Drive Car Rental Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India Self Drive Car Rental Market Segmentation

8.1 By Type

8.1.1 Economy Cars

8.1.2 Luxury Cars

8.1.3 SUVs

8.1.4 Vans

8.1.5 Others

8.2 By End-User

8.2.1 Individual Customers

8.2.2 Corporate Clients

8.2.3 Tour Operators

8.2.4 Government Agencies

8.2.5 Others

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West India

8.4 By Duration of Rental

8.4.1 Short-Term Rentals

8.4.2 Long-Term Rentals

8.4.3 Hourly Rentals

8.4.4 Others

8.5 By Booking Channel

8.5.1 Online Platforms

8.5.2 Offline Agencies

8.5.3 Mobile Applications

8.5.4 Others

8.6 By Customer Demographics

8.6.1 Age Group

8.6.2 Income Level

8.6.3 Travel Purpose

8.6.4 Others

8.7 By Payment Method

8.7.1 Credit/Debit Cards

8.7.2 Digital Wallets

8.7.3 Cash Payments

8.7.4 Others

9. India Self Drive Car Rental Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross Comparison of Key Players

9.2.1 Company Name

9.2.2 Group Size (Large, Medium, or Small as per industry convention)

9.2.3 Fleet Utilization Rate

9.2.4 Customer Satisfaction Score

9.2.5 Average Rental Duration

9.2.6 Revenue per Available Car

9.2.7 Pricing Strategy

9.2.8 Market Penetration Rate

9.2.9 Repeat Customer Rate

9.2.10 Online Booking Conversion Rate

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 Zoomcar

9.5.2 Revv

9.5.3 Myles

9.5.4 Drivezy

9.5.5 Savaari Car Rentals

9.5.6 Ola Rentals

9.5.7 Carzonrent

9.5.8 Avis India

9.5.9 Hertz India

9.5.10 Eco Rent A Car

9.5.11 Trawelltag Cover-More

9.5.12 Gozo Cabs

9.5.13 Bharat Taxi

9.5.14 Drive India Enterprise Solutions

9.5.15 Car Rental India

10. India Self Drive Car Rental Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government Procurement Policies

10.1.2 Budget Allocations for Travel

10.1.3 Preferred Rental Providers

10.1.4 Usage Patterns

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Corporate Travel Budgets

10.2.2 Investment in Employee Mobility

10.2.3 Partnerships with Rental Services

10.2.4 Trends in Corporate Rentals

10.3 Pain Point Analysis by End-User Category

10.3.1 Individual Users

10.3.2 Corporate Clients

10.3.3 Tour Operators

10.3.4 Government Agencies

10.4 User Readiness for Adoption

10.4.1 Awareness Levels

10.4.2 Technology Adoption

10.4.3 Customer Preferences

10.4.4 Barriers to Adoption

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Measurement of ROI

10.5.2 Customer Feedback Mechanisms

10.5.3 Opportunities for Upselling

10.5.4 Case Studies of Successful Deployments

11. India Self Drive Car Rental Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Business Model Framework

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

3. Distribution Plan

3.1 Urban Retail vs Rural NGO Tie-ups

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

7. Value Proposition

7.1 Sustainability

7.2 Integrated Supply Chains

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix

9.1.2 Pricing Band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 JV

10.2 Greenfield

10.3 M&A

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 JVs

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of industry reports from the Ministry of Road Transport and Highways

- Review of market trends and consumer behavior studies from automotive associations

- Examination of online platforms and rental service websites for pricing and service offerings

Primary Research

- Interviews with executives from leading self-drive car rental companies

- Surveys targeting frequent users of self-drive car rental services

- Focus group discussions with potential customers to gauge preferences and expectations

Validation & Triangulation

- Cross-validation of findings with data from government transport agencies

- Triangulation of insights from primary interviews and secondary data sources

- Sanity checks through expert reviews from industry analysts and consultants

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of market size based on national vehicle registration statistics

- Analysis of urbanization trends and their impact on self-drive rental demand

- Incorporation of tourism growth rates and business travel statistics

Bottom-up Modeling

- Collection of rental transaction data from major self-drive car rental firms

- Estimation of average rental duration and frequency of use

- Calculation of revenue per vehicle based on operational costs and pricing strategies

Forecasting & Scenario Analysis

- Multi-variable forecasting using economic indicators and consumer spending patterns

- Scenario analysis based on potential regulatory changes and environmental policies

- Development of baseline, optimistic, and pessimistic market growth projections through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Self-Drive Rental Users | 150 | Frequent Renters, Business Travelers |

| Tourism Sector Rental Demand | 100 | Travel Agents, Tour Operators |

| Corporate Fleet Management | 80 | Corporate Travel Managers, HR Executives |

| Consumer Preferences in Vehicle Types | 120 | General Consumers, Car Enthusiasts |

| Impact of Technology on Rental Services | 90 | Tech Developers, Industry Analysts |

Frequently Asked Questions

What is the current value of the India Self Drive Car Rental Market?

The India Self Drive Car Rental Market is valued at approximately INR 12,000 million, reflecting a significant growth driven by urbanization, increased disposable incomes, and the demand for flexible travel options among consumers.

Which cities are the key players in the India Self Drive Car Rental Market?

Key cities dominating the India Self Drive Car Rental Market include Delhi, Mumbai, Bangalore, and Hyderabad. These urban centers are major economic hubs with a high influx of tourists and business travelers, enhancing the demand for self-drive rentals.

What factors are driving the growth of the self-drive car rental market in India?

Growth drivers include increasing urbanization, a rise in domestic tourism, and technological advancements in booking systems. These factors contribute to a higher demand for flexible and convenient transportation options among consumers.

How has the Indian government influenced the self-drive car rental market?

The Indian government implemented the Motor Vehicle (Amendment) Act in 2023, streamlining the process for obtaining driving licenses and vehicle registrations. This regulation facilitates easier access to self-drive car rentals, promoting market growth.

What types of vehicles are most popular in the self-drive car rental market?

The self-drive car rental market is segmented into Economy Cars, Luxury Cars, SUVs, Vans, and Others. Economy Cars dominate due to their affordability, while Luxury Cars and SUVs are gaining popularity among affluent customers seeking comfort.

Who are the primary end-users of self-drive car rentals in India?

The primary end-users include Individual Customers, Corporate Clients, Tour Operators, and Government Agencies. Individual Customers represent the largest segment, driven by the growing trend of personal travel and the preference for self-drive options.

What challenges do self-drive car rental companies face in India?

Challenges include high competition among service providers, regulatory compliance issues, and vehicle maintenance costs. The intense competition can lead to price wars, affecting profit margins and operational efficiency for companies in the market.

What opportunities exist for growth in the self-drive car rental market?

Opportunities include expanding services into Tier 2 and Tier 3 cities, introducing electric vehicles into fleets, and developing subscription-based models. These strategies can help companies tap into underserved markets and meet evolving consumer demands.

How is technology impacting the self-drive car rental market?

Technological advancements, such as mobile app usage and enhanced booking systems, are transforming the self-drive car rental market. Companies leveraging technology can streamline operations, improve customer experience, and attract a larger customer base.

What is the expected future outlook for the self-drive car rental market in India?

The future outlook for the self-drive car rental market in India is promising, driven by increasing urbanization and a growing preference for flexible travel options. Companies are likely to expand services and integrate advanced technologies to remain competitive.

What payment methods are commonly used in the self-drive car rental market?

Common payment methods in the self-drive car rental market include Credit/Debit Cards, Digital Wallets, and Cash Payments. The availability of multiple payment options enhances convenience for customers during the rental process.

How do self-drive car rental companies ensure customer satisfaction?

Self-drive car rental companies focus on customer satisfaction by offering a variety of vehicle options, competitive pricing, and user-friendly booking systems. Additionally, they often implement feedback mechanisms to continuously improve their services.

What role do corporate clients play in the self-drive car rental market?

Corporate clients significantly contribute to the self-drive car rental market by seeking flexible transportation solutions for employees. Companies often utilize rental services for business travel, enhancing the demand for self-drive options in the corporate sector.

What are the key players in the India Self Drive Car Rental Market?

Key players in the India Self Drive Car Rental Market include Zoomcar, Revv, Myles, Drivezy, and Savaari Car Rentals. These companies are known for their innovative services and geographic expansion within the market.

How does urbanization affect the self-drive car rental market in India?

Urbanization increases the demand for self-drive car rentals as urban dwellers seek convenient transportation options. The growth of urban centers leads to a higher need for flexible travel solutions, making self-drive rentals an attractive choice for residents and tourists alike.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.