Malaysia Used Vehicle Market Outlook to 2025

By Type of Distribution Channel (Organized and Unorganized Dealers), By Mode of Selling (Online and Dealership Walk-Ins), By Type of Vehicle (Sedans, Hatchback, SUVs, MPVs, LCV and others), By Vehicle Age(0-3 years, 3-5 Years, 5-8 Years and More than 8 years), By Brand(Perodua, Toyota, Honda, Proton, Nissan and Others)

Region:Asia

Author(s):Nishtha Noonwal

Product Code:KR891

September 2019

121

About the Report

Malaysia Used Vehicle Overview and Size

Malaysia Used Vehicle Market Segmentation

By Organized Dealers: Multi Brand Dealership outlets are dominating in Malaysia Used Vehicle Market due to the large portfolio of vehicles provided with a huge space for negotiation on purchase.

By Mode of Selling: In Malaysia, selling and buying a used vehicle via online platform is the most convenient method for customers and dealers as sale of used vehicles via online platforms eliminates middlemen and its commission margin. Lower commission charged attracts major population to purchase through online platform.

By Type of Vehicle: Sedans and SUVs are the dominating segments in body type of used vehicle. Sedans have high average car life and lies within the budget of Malaysians. Preference to buy new MPV and LCVs was the key factor for low demand in the used vehicle segment.

By Vehicle Age: 5-8 years of vehicle age accounted for highest market share due to the average replacement rate of 6 years in Malaysia. The market share is followed by 3-5 years of vehicle age as selling of vehicle during this period generates a high resale value.

By City: Kuala Lumpur and Selengor are dominating the used vehicle market in terms of sales volume largely due to the higher percentage of people that solely depends on the passenger cars and growing working population observed in Selengor during last five years.

By Price Range: The average ticket size of Malaysia used vehicle market is growing over the years. The price range of MYR 30,000 - MYR 50,000 accounted for highest percentage share due the replacement rate along with the depreciation charged over the years on new vehicles.

By Brand: Perodua dominated the sales volume of used vehicle in Malaysia. Domestically manufactured vehicle brand include Perodua and Proton and Japanese brands that include Toyota, Honda and Nissan are the most preferred brands in the used-vehicle market due to strong brand preference, reliability, longer life span, and higher retention value of the used vehicle.

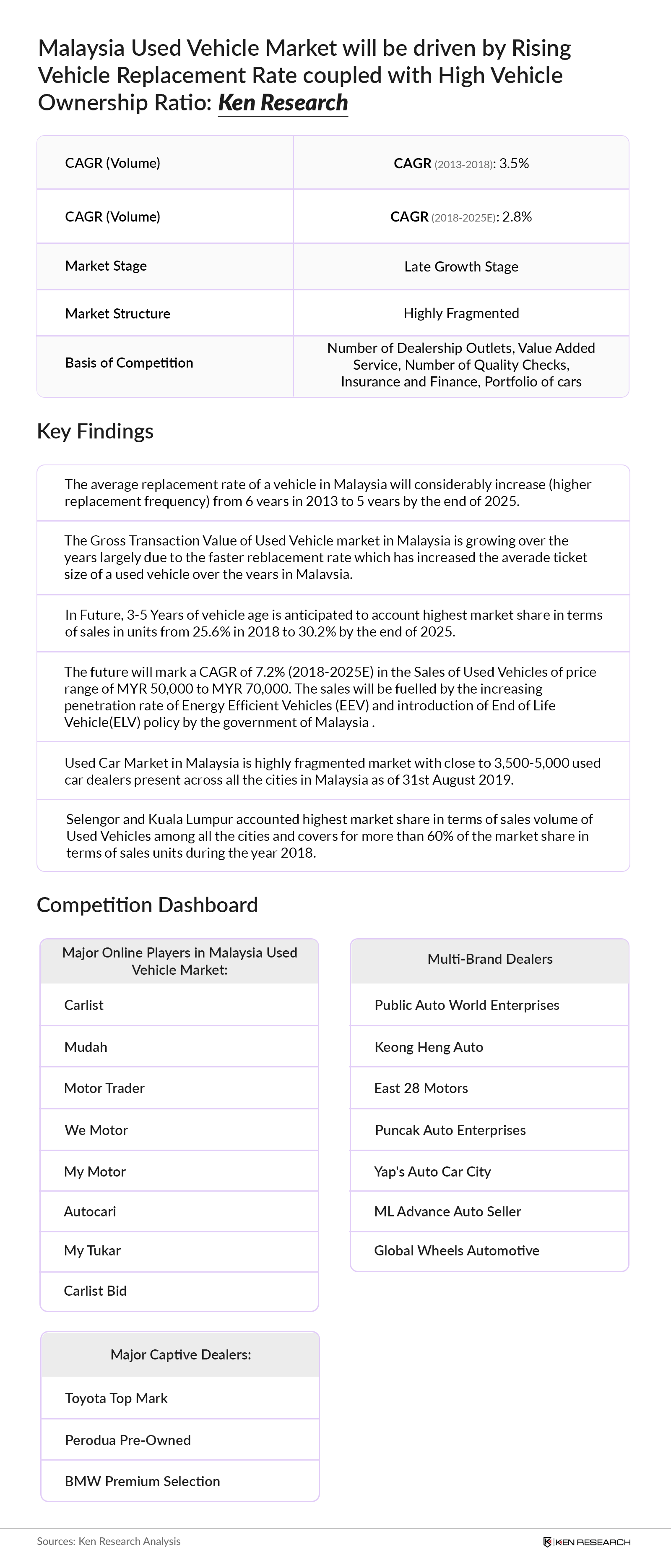

Competitive Landscape

Malaysia Used Vehicle Market Future Outlook

Key Topics Covered in the Report

- Malaysia Used Vehicle Market Introduction (Overview, Genesis, Business Cycle)

- Malaysia Used Vehicle Market Ecosystem

- Malaysia Used Vehicle Market Business Model

- Used Vehicle Market Size Malaysia

- Malaysia Used Vehicle Auto Finance

- Malaysia Used Vehicle Market Segmentation

- Trends and Developments in Malaysia Used Vehicle Market

- Issues and Challenges in Malaysia Used Vehicle Market

- Malaysia Used Vehicle Market Regulations

- SWOT Analysis Malaysia Used Vehicle

- Buying Decision Parameters in Malaysia Used Vehicle Market

- Malaysia Used Vehicle Market Competition Scenario

- Malaysia Used Vehicle Market Future Projection, 2018-2025E

- Future Outlook of Malaysia Used Vehicle Market Segmentations, 2018-2025E

- Analyst Recommendations

Products

Key Target Audience

OEM’S Companies

Multi Brand Dealers

Captive Dealers

Venture Capitalist Firms

Government/ Regulatory Authorities

Online Auto-Classifieds

Time Period Captured in the Report:

Historical Period: 2013-2018

Forecast Period: 2019E-2025E

Companies

Key Segments Covered

Organized Dealers

Multi Brand Retailers

Direct Dealership Sales Agent

Unorganized Dealers

Online

Dealership Walk-Ins

Sedans

Hatchback

4WD/SUVs

MPVs

LCV

Others

0 – 3 Years

3 – 5 Years

5 – 8 Years

More than 8 Years

Kuala Lumpur

Selengor

Johor

Perak

Others

MYR 0 – MYR 30,000

MYR 30,000 – MYR 50,000

MYR 50,000 – MYR 70,000

MYR 70,000 – MYR 90,000

More than MYR 90,000

Perodua

Toyota

Honda

Proton

Nissan

Others

Carlist

Mudah

Motor Trader

We Motor

MyMotor

Autocari

myTukar

CarlistBid

Toyota TopMark

Perodua Pre-Owned

BMW Premium Selection

Public Auto World Enterprises

Keong Heng Auto

East 28 Motors

Puncak Auto Enterprises

Yap’s Auto Car City

ML Advance Auto Seller

Global Wheels Automotive

Table of Contents

1. Executive Summary

Competition Scenario

2. Research Methodology

2.1. Market Definitions and Size

2.2. Abbreviations

2.3. Market Sizing And Modeling

Research Methodology

Market Sizing Approach

Variables Dependent And Independent

Multifactor Based Sensitivity Model

Limitations

Conclusion

3. Malaysia Used Vehicle Market Introduction (Overview and Genesis, Business Cycle Graph)

3.1. Overview and Genesis (Overview, Popular Brands, Market Stage, Ratio of New Vehicle sold to Used Vehicle, Market Size, Comparison with other markets and Major Entities in Value Chain)

3.2. Business Cycle (Emerging, Growing and Declining phase)

4. Malaysia Used Vehicle Market Ecosystem (Major Online Companies, Dealers and Banks)

5. Malaysia Used Vehicle Market Value Chain Analysis (Value Chain Process and Role of Entities)

5.1. Role of Entities in Value Chain

6. Malaysia Used Vehicle Market Business Model

6.1.1. Multi Brand Dealers

6.1.2. Captive Dealers

6.1.3. Online Auto - Classified

7. Malaysia Used Vehicle Market Size, 2013-2018

7.1. By Volume and Value, 2013-2018

8. Snapshot on Malaysia Used Vehicle Auto Finance (Features, Guidelines, Documents Required and Payment Methods)

9. Malaysia Used Vehicle Market Segmentation

9.1. By Distribution Channel (Organized Dealers and Unorganized Dealers), 2018

9.1.1. By Organized Dealers (Multi Brand Dealers and Direct Dealership Sales Agents), 2018

9.2. By Mode of Selling (Online, Dealership Walk-ins), 2013 and 2018

9.3. By Type of Vehicle (Sedans, Hatchback, 4WD/SUVs, MPVs, LCV and Others), 2013 and 2018

9.4. By Vehicle Age (0-3 Years, 3-5 Years, 5-8 Years and More than 8 Years), 2013 and 2018

9.5. By City (Kuala Lumpur, Selengor, Johor, Perak and Others), 2018

9.6. By Price Range (0- MYR 30,000, MYR 30,000- MYR 50,000, MYR 50,000 – MYR 70,000, MYR 70,000 – MYR 90,000 and More than MYR 90,000), 2018

9.7. By Brand (Perodua, Toyota, Honda, Proton, Nissan and Others), 2018

10. Trends and Development in Malaysia Used Vehicle Market

High Vehicle Ownership

Lower Prices as compared to New Vehicles

Building Customer Confidence

Improving Used to New Vehicle Ratio

Strong presence of Online Platforms

11. Issues and Challenges in Malaysia Used Vehicle Market

Increasing Average Ticket Size

Irregular Prices

Less Warranty on Used Cars

Tightening of Financial Guidelines

Registration Process

Lack of Confidence oN Small Unorganized Dealers

12. Government Regulations in Malaysia Used Vehicle Market (Shipping Port, Age Restrictions, Right-Hand Drive Vehicle, Process, Documents required for AP, Documents required for importing vehicle and Vehicle Registration)

13. SWOT Analysis of Malaysia Used Car Market

14. Buying Decision Parameters for Used Vehicle Market in Malaysia

15. Competition Scenario of Malaysia Used Vehicle Market

15.1. Market Share of Online Auto-Classified Companies on the Basis of Number of Listings, as of 31st august 2019

15.2. Heat Map and Cross Comparison of Online Auto-Classified Companies, captive Dealers and Multi Brand Dealer

15.2.1. Online Auto-Classifieds

15.2.2. Captive and Multi-Brand Dealers

15.3. Strength and Weakness of Top 5 Major Online Auto- Classified Players in Malaysia Used Vehicle Market

15.4. Company Profile of Major Auto-Classifieds, Captive Finance Companies and Multi Brand Retailers

15.4.1. Company Profile of Major Auto-Classifieds in Malaysia Used Vehicle Market (Overview,

Business Segments, Number of Car Dealers and Features)

WeMotor

Mudah.my

MyMotor

carsome

iCar Asia

15.4.2. Company Profile of Major Captive Dealers of Used Cars in Malaysia (Overview, Services,

Locations and Number of Cars Listed)

Toyota Topmark

Perodua Pre Owned

BMW Premium Selection

15.4.3. Company Profile of Major (Top 7) Multi Brand Dealers of Used Cars in Malaysia (Public

Auto World Enterprises, Keong Heng Auto Sdn Bhd., East 28 Motors (M) Sdn Bhd, Puncak Auto

Enterprise, Yap’s Auto Car City Sdn Bhd., ML Advance Auto Seller Sdn Bhd. and Global Wheels

Automotive Sdn Bhd.)

16. Malaysia Used Car Market Future Outlook and Projections, 2018 – 2025E

17. Malaysia Used Vehicle Market Segmentation Future Outlook and Projections

17.1. By Distribution Channel (Organized and Unorganized Dealers), 2025E

17.1.1. By Organized Dealers (Direct Dealership Sales Agents and Multi Brand Dealers), 2025E

17.2. By Mode of Selling (Online and Dealership Walk-ins), 2025E

17.3. By Vehicle Age (0-3 Years, 3-5 Years, 5-8 Years, More than 8 Years), 2025E

17.4. By Price (0- MYR 30,000, MYR 30,000- MYR 50,000, MYR 50,000 – MYR 70,000, MYR 70,000 – MYR 90,000 and More than MYR 90,000), 2025E

17.5. By Brand (Perodua, Toyota, Honda, Proton, Nissan and Others), 2025E

18. Analyst Recommendation

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.