Pakistan Logistics Market Outlook to 2027F

Segmented by Type of End Users (F&B, Industrial & Construction, And Others), Type of Warehousing Space (Tech/ Non-Tech, Organized/ Unorganized, And Racked/ Unracked)

Region:Asia

Product Code:KROD73

December 2022

70

About the Report

Market Overview:

Government initiated Vision 2025 to create an efficient, competitive and environmentally friendly logistics system in accordance with regional and international perspectives which will boost the Pakistan Logistics Industry.

Government initiated Vision 2025 to create an efficient, competitive and environmentally friendly logistics system in accordance with regional and international perspectives which will boost the Pakistan Logistics Industry.- Development of six logistics corridors, including major transport and cargo systems, such as roads and rivers linking to border gates and ports will stimulate the economic growth of the country.

Key Trends by Market Segment:

Competitive Landscape

Future Outlook

Scope of the Report

|

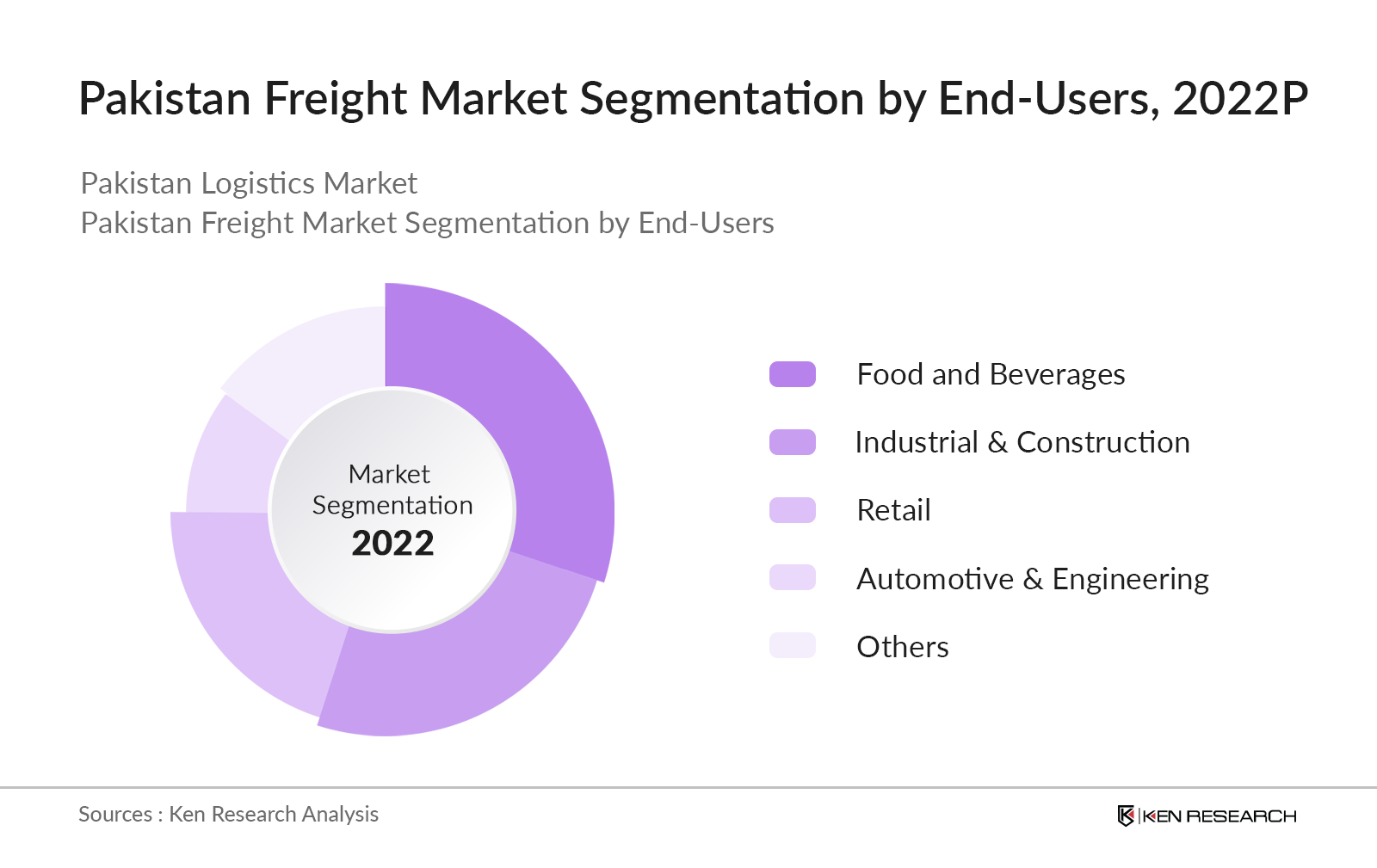

By End-Users |

Food and Beverages Industrial & Construction Retail (Garment, Cosmetics) Automotive & Engineering Others (include telecom, Horticulture) |

|

By Domestic/International |

Domestic International |

|

By type of Mode |

Sea Road Air Rail |

|

By 3PL/Integrated |

3PL Integrated |

|

By Type of Fleet |

Small Fleet Operators Medium Fleet Operator Large Fleet Operators |

|

Pakistan Warehousing Market |

|

|

By Warehouse Space |

Tech Enabled Warehouse Space Non-Tech Warehouse Space Organized Warehouse Space Unorganized Warehouse Space Racked Warehouse Space Unracked Warehouse Space |

|

By Business Model |

Industrial / Retail ICD/ CFS Cold Storage |

|

By Area |

Closed Open |

|

By 3PL/Integrated |

3PL Integrated |

|

By End-Users |

Food and Beverages Industrial & Construction Retail (Garment, Cosmetics) Automotive & Engineering Others (include telecom, Horticulture) |

|

By Region |

Karachi Lahore Islamabad |

|

Pakistan CEP Market |

|

|

By Domestic/International |

Domestic International |

|

By Business Model |

B2B B2C C2C |

|

By Type of Shipment |

Same Day Next Day Two Days More than 2 Days |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

E-commerce Companies

Third-Party Logistic Providers

Potential Market Entrants

Freight Forwarding Companies

Warehousing Companies

Cold Storage Companies

Industry Associations

Consulting Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report

Historical Year: 2017-2022P

Base Year: 2022P

Forecast Period: 2022P– 2027F

Companies

Major Players Mentioned in the Report

Sprint Packers n Movers

Bismillah Logistics Pvt. Ltd

Speedaf Logistics Pakistan

KMW Domestic & International Courier & Cargo (Pvt.) Limited

Atlas Logistics

PK Logistics & Supply Chain Management (Pvt) Ltd.

Simply Logistic Services

MAERSK

DHL Express

Fed Ex

Hertz

XPO

Blue EX

Table of Contents

1. Executive Summary

2. Pakistan Logistics Market Overview

2.1 Taxonomy of the Pakistan Logistics Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for the Pakistan Logistics Market

2.5 Growth Drivers of the Pakistan Logistics Market

2.6 Issues and Challenges of the Pakistan Logistics Market

2.7 Impact of COVID-19 on the Pakistan Logistics Market

2.8 SWOT Analysis

3. Pakistan Logistics Market Size, 2017 – 2022

4. Pakistan Logistics Market Segmentation

4.1 By Service Mix, 2017 - 2022

4.2 By End User, 2017 - 2022

4.3 By Regional Split (North/East/West/South/Central), 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles – (Top 5 - 7 Major Players)

5.3.1 Sprint Packers n Movers

5.3.2 Bismillah Logistics Pvt. Ltd

5.3.3 Speedaf Logistics Pakistan

5.3.4 KMW Domestic & International Courier & Cargo (Pvt.) Limited

5.3.5 Atlas Logistics

5.3.6 PK Logistics & Supply Chain Management (Pvt) Ltd.

5.3.7 Simply Logistic Services

6. Pakistan Logistics Future Market Size, 2022 – 2027

7. Pakistan Logistics Future Market Segmentation

7.1 By Service Mix, 2017 - 2022

7.2 By End User, 2017 - 2022

7.3 By Regional Split (North/East/West/South/Central), 2017 - 2022

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Our team will initially create an ecosystem for all the major entities in the Logistics Market that are providing logistics services in Pakistan.

Step 2: Market Building:

In the next step, we will refer to multiple secondary and proprietary databases to perform deck research around the market and collate industry-level information such as type of market structure, freight volume, warehousing size and fleet size other areas to create an initial level hypothesis. We will also explore company-level info by referring press releases, annual reports, financial statements, and other documents to understand basic information about the companies and market level.

Step 3: Validating and Finalizing:

Later our team will conduct a series of Interviews with multiple C-Level Executive and other stakeholders belonging to different companies to confirm the market hypothesis, validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Furthermore, to validate this data our team will pitch each company as a potential customer through a mystery shopping exercise and will confirm the operational and financial performance of Pakistan logistics Market Entities which have been shared by company executives and available on secondary databases. We will be conducting another set of CATIs with the respective entities to understand customer behavior, channel preference, and other factors. We will also assess customer analysis in terms of their preferences and pain points.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Pakistan Logistics Market is covered from 2017–2027F in this report, including a forecast for 2022-2027F.

02 What is the Future Growth Rate of the Pakistan Logistics Market?

The Pakistan Logistics Market is expected to witness a CAGR of ~% over the next years.

03 What are the Key Factors Driving the Pakistan Logistics Market?

New Government Policies, China–Pakistan Economic Corridors (CPEC) and increasing regional connections.

04 Which is the Largest End User Type Segment within the Pakistan Logistics Market?

The Food and Beverages type segment held the largest share of the Pakistan Logistics Market in 2022.

05 Who are the Key Players in the Pakistan Logistics Market?

MAERSK, DHL Express, Fed Ex, Hertz and XPO are major players in Pakistan logistics market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.