Portugal Logistics and Warehousing Market Outlook to 2030

By Land (Road, Rail, Pipeline), Sea, Air Freight Forwarding (Domestic and International Freight), Courier and Parcel, Warehousing, Cold Transport and Storage, Third Party/ Contract Logistics (3PL) and E-Commerce Logistics

Region:Europe

Author(s):Nishika Chowcharia

Product Code:KR843

August 2019

216

About the Report

![]()

Portugal Logistics and Warehousing Market Overview and Size

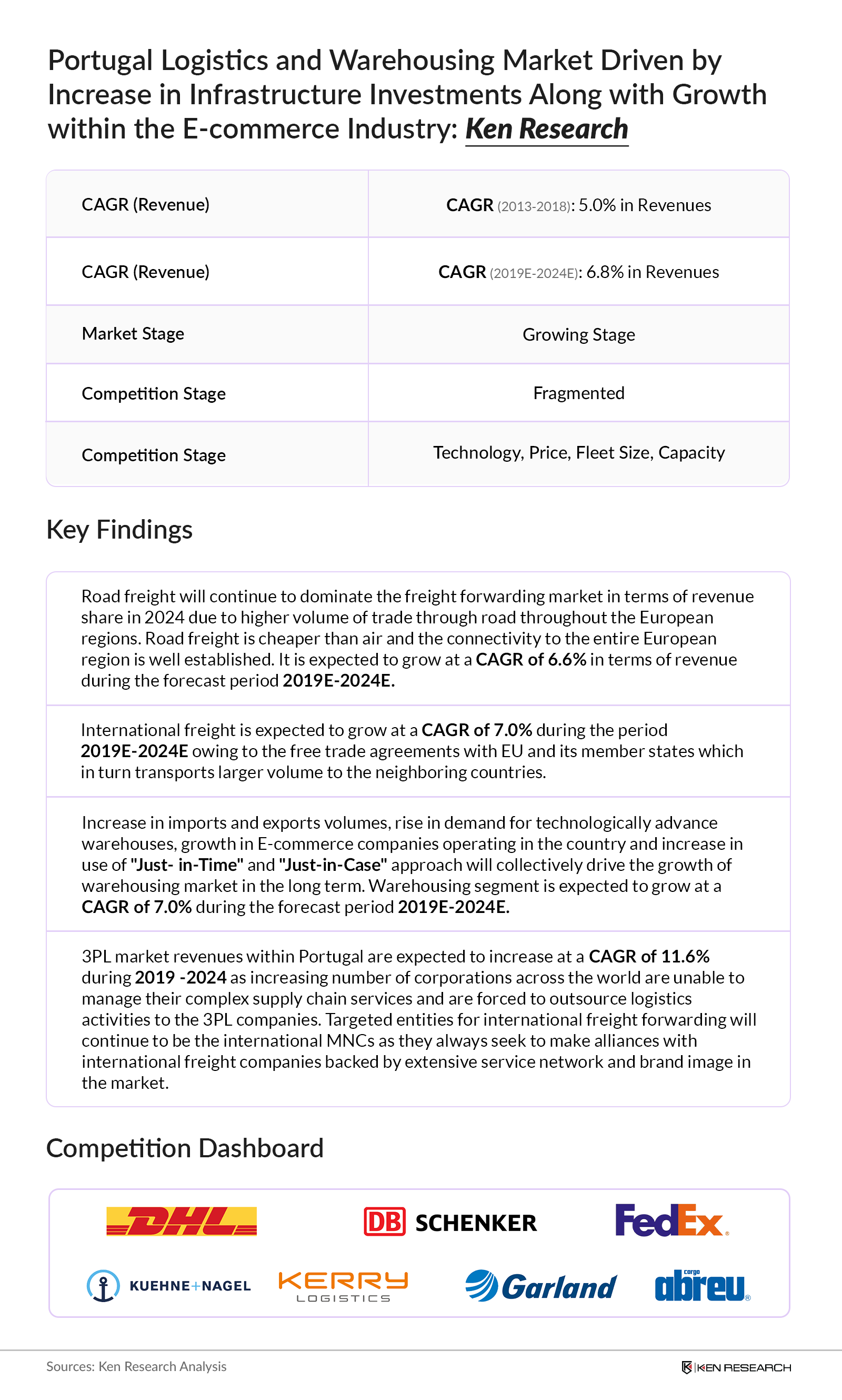

Portugal Freight Forwarding Market: Portugal freight forwarding market grew at a positive CAGR during the review period 2013-2018, driven by increase in infrastructure investments and increase in exports. On the other hand, it was observed that road freight and air freight had dominated in terms of revenue in 2018 which further led to expansion of freight forwarding services in Portugal during the above period. Road freight was observed to be the most preferred mode of transportation due to the development in the road infrastructure and relatively cheaper prices as compared to the other modes of transportation; followed by air and sea freight. Land transport has transformed with integration of multiple technologies such as RFID tools are used to track goods delivery. telematics (in-built sensors and remote diagnostics techniques), Electronic toll collection on highways (used in busy intermodal transfer points to avoid traffic congestion) and platooning technology which helps improve driving and fuel efficiency. International freight dominated the Portugal freight forwarding market in terms of revenue. Asian and European flow corridors were observed as the largest contributor in terms of revenue in Portugal freight forwarding market. FMCG and automotive industries in the country played a significant role, especially for the domestic market. The freight forwarding market in Portugal is expected to incline in future, driven by rise in trading in the country, surge in E-commerce industry along with continuous investment by the government in developing the logistics infrastructure in Portugal.

Portugal Courier and Parcel Services Market: Portugal courier and parcel services market grew at positive CAGR in terms of revenue during the review period 2013-2018 due to the rise in E-commerce industry coupled with rising customers demanding express delivery for their shipments. The products that are majorly transferred through express delivery include documents, fashion and retail, Toys, Hobby & DIY and others. In terms of delivery, one day delivery has dominated the courier and parcel services market in terms of revenue as Portugal being a small country takes relatively lesser amount of time for delivery within the country. Portugal courier and parcel services market is expected to increase at a positive CAGR during the forecast period 2019-2024. The consistently growing E-commerce industry will drive the courier and parcel market owing to the rising demand of express delivery services especially in the Business to Consumer segment.

Portugal Warehousing Market: The warehousing market is at a growing stage as many freight forwarders are setting up their warehouses in Portugal. The has been mainly driven by major Portuguese large distribution retailers as well as transport companies, the latter undertaking a relevant share of logistics operations, as only a few number of worldwide logistics operators are present in the country and usually have a small footprint. The regions of Porto and Lisbon have the highest number of warehouses. Expansion of ports and manufacturing companies are further expected to drive the warehouse market revenues in the coming future. Increasing prominence of online shopping will increase the size of E-commerce industry in the country. Multiple emerging E-commerce companies would require warehousing facilities to store / stock their products thereby, creating a positive impact for warehousing space in Portugal.

Portugal E Commerce Logistics Market: E-Commerce Logistics market grew at a double digit CAGR in terms of revenue as well as in the number of orders during the period 2013-2018 majorly due to growth in digital technology, rise in cross-border e-commerce and rising internet penetration in the country. Portugal’s E-commerce logistics market is poised for strong growth in the coming years.

Portugal Third Party/ Contract Logistics Market: Third-party logistics (3PL) outsourcing has been witnessed to gain prominence as increasing number of corporations across the world are unable to manage their complex supply chain services and are forced to outsource logistics activities to the 3PL companies. Previously, 3PL service providers in Portugal offered services such as transportation, brokerage, and shipping whereas; now mostly web-based entities have emerged with better supply chain integration. have dominated the freight forwarding market of Portugal in 2018 as majority of the companies prefer to undertake third party logistics for providing freight forwarding solutions to their clients.

Comparative Landscape within Portugal Logistics and Warehousing Market

The courier and parcel market along with E-commerce logistics industry of Portugal was observed to be highly concentrated with the presence of major players such as DHL Express, FedEx express, UPS, CTT and others covering around majority of the market share in the year 2018. These companies were witnessed to compete on parameters such as shipping points, coverage area, prices, delivery boys, payment collection methods and associations with E-commerce merchants.

Portugal warehousing industry was observed to be highly fragmented with the availability of large number of large and medium scaled warehousing companies spread across the country. The market encompasses a mix of unorganized and organized players. The companies in the country are competing with each other on the basis of the size and location of the warehouse, rent rates/taxes, type of warehouses and technologies.

Portugal Logistics and Warehousing Market Future Outlook and Projections

Key Topics Covered in the Report

- Executive Summary

- Research Methodology

- Introduction to Portugal Logistics and Warehousing Market

- Portugal Logistics and Warehousing Market Infrastructure

- Cross Comparison of Portugal Logistics and Warehousing Market with EU Countries

- Portugal Logistics and Warehousing Market Size, 2013-2018P

- Portugal Logistics and Warehousing Market Segmentation, 2013-2018P

- Portugal Freight Forwarding Market, 2013-2024E

- Portugal Courier and Parcel Market, 2013-2024E

- Portugal E-Commerce Logistics Market, 2013-2024E

- Portugal Third Party Logistics (3PL) Market, 2013-2024E

- Portugal Cold Chain Market, 2018P and 2024E

- Portugal Warehousing Market, 2013-2024E

- Decision Making Process for Portugal Logistics and Warehousing Market

- Regulatory Framework in Portugal Logistics and Warehousing

- SWOT Analysis of Portugal Logistics and Warehousing Market

- Trends and Developments in Portugal Logistics and Warehousing Market

- Issues and Challenges in Portugal Logistics and Warehousing Market

- Company Profiles of Major Players Operating in Portugal Logistics & Warehousing Market

- Portugal Logistics and Warehousing Market Future Outlook and Projections, 2019E-2024E

Products

Key Target Audience

Logistics Companies

Warehousing Companies

Freight Forwarding Companies

Express Logistics Companies

E-Commerce Logistics Companies

3PL Logistics Companies

E-Commerce Companies

Cold Chain Logistics Companies

Companies seeking Logistics Services

Companies seeking Warehousing Services

Companies seeking Courier and Parcel Services

Time Period Captured in the Report:

Historical Period: 2013-2018

Forecast Period: 2019-2024

Companies

Key Segments Covered

By Services

Freight Forwarding

Warehousing

Courier and Parcel Activities

Value Added Services

By Mode of Service (Freight Volume, Revenue Generated)

Road Freight and Transportation Through Pipelines

Sea Freight

Air Freight

By Mode of Freight

Domestic Freight

International Freight

By Flow Corridors

Asian Countries

European Countries

African Countries

Others (American, Australian Countries and many more)

By 3PL/ Contract Logistics and Integrated

Contract Logistics

Integrated Logistics

By End Users

Food and Beverages

Healthcare

Retail

Automotive (Spare Parts, Components)

Others (Dangerous Goods and Chemicals)

By Different Modals

Multimodal

Unimodal

By International and Domestic Express

International Express

Domestic Express

By Air and Ground Express

Air Express

Ground Express

By Delivery Period

One Day Delivery

Two Day Delivery

Three Day Delivery

More than three Day Delivery

By Inter and Intra city

Intra City

Inter City

By Market Structure

B2B

B2C

C2C

By Region

Lisbon

Porto

Gaia

Others

By Business Model

Industrial /Retail Container

Freight /Inland Container Depot

Cold Storage

Others

By Region

Sines

Lisbon

Porto

Others

By Type of Warehouses

Closed Warehouse

Open Warehouse

Cold Storage

By 3PL and Integrated

Contract Logistics Warehousing

Integrated Warehouse

By End Users

Food and Beverages

Automotive (Spare Parts, Components)

Consumer Retail

Healthcare

Others

By Storage and Transportation

Cold Transportation

Cold Storage

By Products

Food and Beverages

Pharmaceuticals

Meat and Sea Food

Confectionaries

Chemicals and Others

By Service Mix

Freight Forwarding

Warehousing

By Delivery Period

Within 2 hours

Within 24 Hours

2-3 Day Delivery

Others

Warehousing

DHL Portugal

Abreu Cargo

TAP

Garland

DB Schenker

FedEx

Rangel

DSV Portugal

TIBA

KUEHNE + NAGEL

LKW Walter

CEVA Logistics

Noatum Logistics

Kerry Logistics

Laso Transportes

Panalpina

Transcinco

Transitex

SEKO Logistics

DHL Express Portugal

FedEx Express

UPS Express

CTT

Urbanos

TNT Portugal

Logista (NACEX)

SEUR- DPD Group

Table of Contents

1. Executive Summary

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Consolidated Research Approach

2.4. Variables (Dependent and Independent)

2.5. Correlation Matrix

2.6. Regression Matrix

2.7. Limitations and Conclusion

3. Introduction to Portugal Logistics and Warehousing Market

3.1. Portugal Logistics and Warehousing Market Overview (Genesis, Market Overview and Structure

and Emerging Market Trends)

3.2. Value Chain Analysis in Portugal Logistics and Warehousing Market (Entity Level Inter-

Relationship, Value Chain Flowchart and Key Takeaways)

4. Portugal Logistics and Warehousing Market Infrastructure (Railway equipment by type, Road

vehicle fleet, Types of Aircrafts, Types of Aircrafts, Marine Shipments on the Basis of Total

Movement of Commercial Vessels in Ports, Portugal Infrastructure National Natural Gas

Transmission)

4.1. Overview

4.2. Railway

4.3. Road

4.4. Air

4.5. Sea

4.6. Pipelines

4.7. Major Projects

5. Cross Comparison of Portugal Logistics and Warehousing Market with EU Countries (LPI Rank,

LPI Score, Customs, Infrastructure, International Shipments, Logistics Competence, Tracking and

Tracing and Timeliness)

6. Portugal Logistics and Warehousing Market Size, 2013-2018P

6.1. By Revenue, 2013-2018P

7. Portugal Logistics and Warehousing Market Segmentation, 2013-2018P

7.1. By Service Mix, 2013-2018P

8. Portugal Freight Forwarding Market, 2013-2024E

8.1 Portugal Freight Forwarding Market Overview (Timeline of Major Players and Genesis)

8.2. Portugal Freight Forwarding Market Size, 2013-2018P

8.3. Portugal Freight Forwarding Market Segmentation, 2013-2018P

8.3.1. By Freight Movement (Road, Air and Sea), 2013-2018P

8.3.2. By International and Domestic Freight Forwarding, 2018P

8.3.3. By Type of Modals (Multimodal and Unimodal), 2018P

8.3.4. By Air and Sea Flow Corridors (Europe Countries, Asian Countries, African Countries and

Others), 2018P

8.3.5. By End Users (Food and Beverage, Healthcare, Retail, Automotive and Others), 2018P

8.3.6. By 3PL and Integrated Freight Forwarding, 2018P

8.4. Competitive Scenario in the Portugal Freight Forwarding Market (CAGR, Market Stage,

Competitive Structure, Competitors and Competing Parameters)

8.5. Portugal Freight Forwarding Market Future Outlook and Projections, 2019E-2024E

8.5.1. By Revenue, 2019E-2024E

8.5.2. By Segments, 2019E-2024E

8.5.2.1. By Freight Movement and International and Domestic Freight Forwarding, 2024E

8.5.2.2. By End User and Type of Delivery, 2024E

8.6. Analyst Recommendations for Portugal Freight Forwarding Market

9. Portugal Courier and Parcel Market, 2013-2024E

9.1. Portugal Courier and Parcel Market Flowchart

9.2. Portugal Courier and Parcel Market Overview and Genesis (Timeline of Major Players, Past

Scenario and Current Scenario)

9.3. Value Chain Analysis for Portugal Courier and Parcel Logistics Market (Value Chain Flow

Chart and Entity Inter-relationship)

9.4. Portugal Courier and Parcel Logistics Market Size, 2013-2018P

9.5. Portugal Courier and Parcel Logistics Market Segmentation, 2013-2018P

9.5.1. By Delivery Type (Domestic and International), 2013-2018P

9.5.2. By Express Movement (Air and Road), 2018P

9.5.3. By Delivery Period (1 Day, 2 Day, 3 Day and More than 3 Days), 2018P

9.5.4. By Intra City and Inter City Shipments, 2018P

9.5.5. By Business Mode (B2C, B2B and C2C), 2018P

9.5.6. By Region (Lisbon, Porto, Gaia and Others), 2018P

9.6. Portugal Courier and Parcel Logistics Market Future Outlook and Projections, 2019E-2024E

9.6.1. By Revenue and Total Number of Orders, 2019E-2024E

9.6.2. By Express Movement and Delivery Type, 2024E

10. Portugal E-Commerce Logistics Market, 2013-2024E

10.1. Portugal E-Commerce Logistics Market Overview and Genesis

10.2. Portugal E-Commerce Logistics Market Size, 2013-2018P

10.3. Portugal E-Commerce Logistics Market Segmentation, 2018P

10.3.1. By Time Duration (Within 2 Hours, Within 24 Hours, Within 2-3 Day Delivery and Others),

2018P

10.4. Cross Comparison of Portugal E-Commerce Logistics Market with Other Countries E-Commerce

Logistics Market (UK, US, Japan, China, Brazil and India) Including Population, Internet Users,

E-Shoppers, E-GDP and E-Shopper Growth

10.5. Comparative Landscape for the Portugal E-Commerce Logistics Market

10.5.1. Competitive Scenario for Portugal E-Commerce Logistics Market (Competitive Stage,

Market Stage, CAGR, Factors for Choosing an E-Commerce Logistics Company, Major E-Commerce

Companies and Competition Parameters)

10.5.2. Company Profiles of Major Players Operating in the Portugal E-Commerce Logistics Market

(Company Overview, USP, Recent Developments, Business Strategies, Optional Services, Service

Offering, Catered Sectors, Employee Base, Logistics Partners, Average Price, Commodities,

Counterfeit Goods, Required Documents and Pricing Analysis)

10.5.2.1. DHL Express

10.5.2.2. FedEx Express

10.5.2.3. FedEx Express

10.5.2.4. UPS Express

10.5.2.5. CTT

10.5.2.6. Urbanos

10.5.2.7. TNT Portugal

10.5.2.8. Logista (NACEX)

10.5.2.9 SEUR- DPD Group

10.6. Portugal E-Commerce Logistics Market Future Outlook and Projections, 2019E-2024E

10.6.1. By Revenue, 2019-2024E

10.6.2. By Time Duration (Within 2 Hours, Within 24 Hours, 2-3 Day Delivery and Others), 2024E

10.7. Analyst Recommendations for Portugal Express Logistics Market

11. Portugal Third Party Logistics (3PL) Market, 2013-2024E

11.1. Portugal 3PL Market Overview (Flowchart and Key Takeaways)

11.2. Value Chain Analysis for Portugal 3PL Market (Flow Chart and Entity-Relationship)

11.3. Portugal Third Party Logistics (3PL) Market Size and Future Projections by Revenue, 2018P

and 2024E

11.4. Portugal Third Party Logistics (3PL) Market Segmentation and Future Projections by

Service Mix (Freight Forwarding and Warehousing), 2018P and 2024E

12. Portugal Cold Chain Market, 2018P and 2024E

12.1. Portugal Cold Chain Market Size and Future Projections, 2018P and 2024E

12.2. Portugal Cold Chain Market Segmentation and Future Projections by Cold Storage and Cold

Transportation, 2018P and 2024E

13. Portugal Warehousing Market, 2013-2024E

13.1. Portugal Warehousing Market Flowchart

13.2. Portugal Warehousing Market Overview (Market Evolution, Genesis, Market Stage, Growth

Drivers and Current Scenario)

13.3. Value Chain Analysis for Portugal Warehousing Market (Flow Chart and Entity Inter-

Relationship)

13.4. Portugal Warehousing Market Size, 2013-2018P

13.5. Portugal Warehousing Market Segmentation, 2018P

13.5.1. By Business Model (Industrial / Retail, Container Freight / Inland Container Depot,

Cold Storage and Others), 2018P

13.5.2. By Region (Sienes, Lisbon, Porto and Others), 2018P

13.5.3. By End Users (Automotive, Food and Beverage, Consumer Retail, Healthcare and Others),

2018P

13.5.4. By Type of Warehouses (Closed/Bonded Warehouse, Open and Cold Storage), 2018P

13.5.5. By 3PL and Integrated Warehousing, 2018P

13.6. Competitive Scenario of Portugal Warehousing Market (Regional Concentration of

Warehousing Companies, CAGR, Competition Stage, Competing Parameters, Market Share, Strengths

and Weaknesses)

13.7. Portugal Warehousing Market Future Outlook and Projections, 2019E-2024E

13.7.1 By Revenue, 2019E-2024E

13.7.2. By Segments, 2019-2024E

13.7.2.1. By Business Model (Industrial / Retail, Container Freight / Inland Container Depot,

Cold Storage and Others), 2024E

13.7.2.2. By End Users (Automotive, Food and Beverage, Consumer Retail, Healthcare and Others),

2024E

13.8. Emerging Future Technologies for Portugal Warehousing Market

13.9. Analyst Recommendations for Portugal Warehousing Market

14. Decision Making Process for Portugal Logistics and Warehousing Market

15. Regulatory Framework in the Portugal Logistics and Warehousing Market (Government

Regulations, Restricted Commodities, Import/Export procedure, Packaging and Labeling

Requirements)

16. SWOT Analysis of Portugal Logistics and Warehousing Market

17. Trends and Developments in Portugal Logistics and Warehousing Market

18. Issues and Challenges in Portugal Logistics and Warehousing Market

19. Company Profiles of Major Players Operating in the Portugal Logistics and Warehousing

Market (Including Company Overview, USP, Business Strategies, Recent Developments, Strengths,

Optional Services, Service Offering, Catered Sectors, Employee Base, Logistics Partner, Price and Clientele)

19.1. DHL Portugal

19.2. Abreu Cargo

19.3. TAP

19.4. Garland

19.5. DB Schenker

19.6. FedEx

19.7. Rangel

19.8. DSV Portugal

19.9. TIBA

19.10. KUEHNE + NAGEL

19.11. LKW Walter

19.12. CEVA Logistics

19.13. Noatum Logistics

19.14. Kerry Logistics

19.15. Laso Transportes

19.16. Others (Panalpina, Transcinco, Transitex and SEKO Logistics)

20. Portugal Logistics and Warehousing Market Future Outlook and Projections, 2019E-2024E

20.1. By Revenue, 2019E-2024E

20.2. By Service Mix (Freight Forwarding, Warehousing and Courier and Parcel), 2019E-2024E

DisclaimerContact US

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.