Saudi Arabia Automotive & Spare Parts Logistics Market Outlook to 2025

Lifting of Ban on Female Drivers and Growing Aftermarket for Spare Parts to Influence Market Growth

Region:Middle East

Author(s):Aashima Mendiratta and Monika Singh

Product Code:KR1020

October 2020

139

About the Report

The report titled “Saudi Arabia Automotive & Spare Parts Logistics Market Outlook to 2025: Lifting of Ban on Female Drivers and Growing Aftermarket for Spare Parts to Influence Market Growth” provides a comprehensive analysis of automotive & spare part logistics market in Saudi Arabia. The report focuses on overall market size in terms of revenue generated by automotive & spare part logistics companies; Saudi Arabia automotive & spare parts logistics market segmentation by service mix (freight forwarding, warehousing and value added services); automotive & spare parts freight forwarding market segmentation by freight mode (road freight, sea freight and air freight); by type of transport (domestic freight and international freight); by 3PL Logistics and Integrated logistics; by Cost split (last mile and first mile); by automotive segment (vehicles and spare parts); by sea flow corridors (Sudan, GCC, Egypt and others); by air flow corridors (Sudan, Egypt, Kuwait, Libya, Oman, the UAE and others); by road flow corridors (Bahrain, Jordan, Lebanon, the UAE, Kuwait, Oman and others); automotive & spare parts warehousing market segmentation by business model (industrial/retail and ICD/CFS); by cities (Jeddah, Riyadh, Dammam and others) and by type of warehouses (closed warehouse and open warehouse).

The report also covers the trade scenario, trends and developments, issues and challenges, SWOT analysis, regulatory landscape, end user analysis, value chain analysis, PESTLE analysis, COVID-19 impact on automotive & spare parts transportation industry, decision making process, snapshot on control tower market, snapshot on pre-delivery inspection market, COVID-19 impact on automotive & spare parts warehousing industry, technological advancements & innovations, comparative landscape including cross comparison of major players operating in KSA automotive & spare parts logistics market and cross comparison of major players operating in KSA automotive market. The report concludes with future market projections on the basis of overall logistics and automotive & spare parts logistics revenue, by service mix and analyst recommendations highlighting the major opportunities and cautions.

Saudi Arabia Automotive & Spare Parts Logistics Market

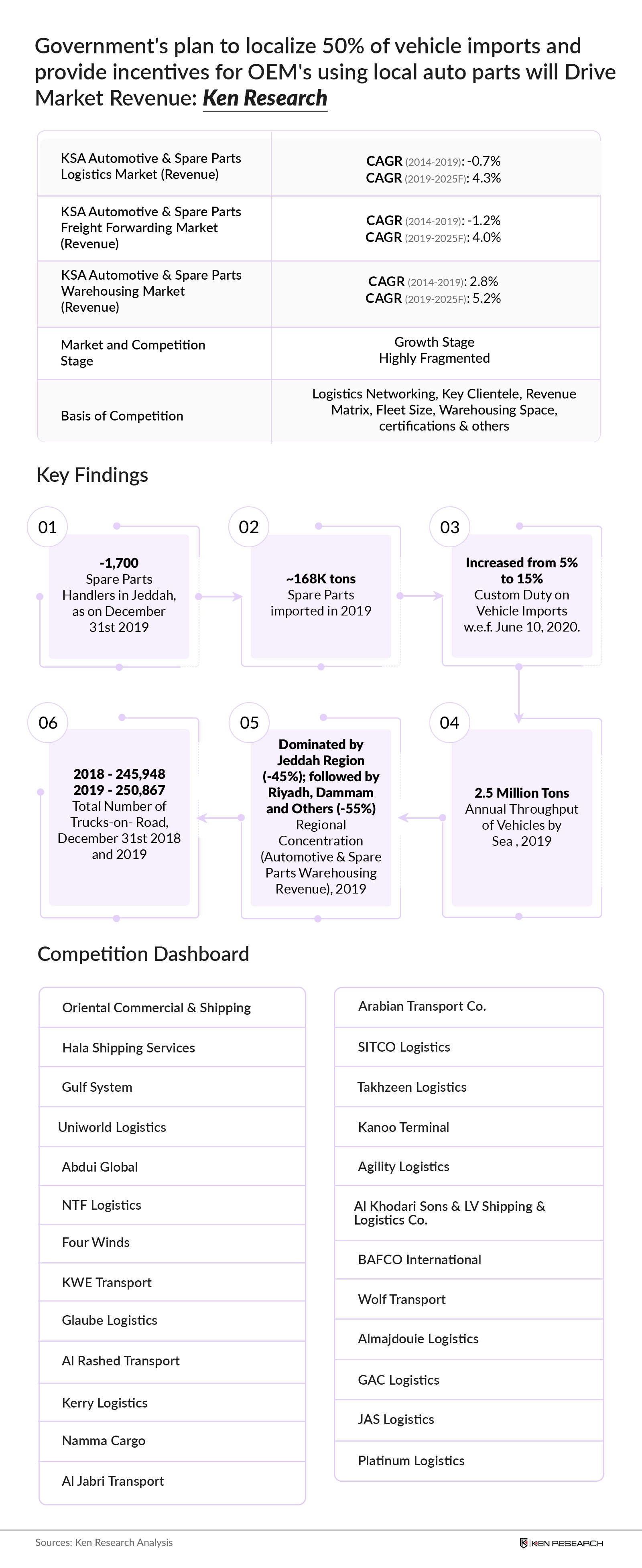

Saudi Arabia automotive & spare parts logistics market showcased a volatile growth trajectory. Automotive logistics revenue stood at USD ~ Million in 2019 and further declined at a CAGR of ~% during 2014-2019 due to oil price shock further leading to an economic slowdown during 2016-2017 period. The automotive industry in Saudi Arabia is highly depended on the imports from different countries. In April 2016, Saudi Arabia announced its Vision 2030 which includes transforming the Kingdom into a preferred logistics hub. Large investments in road infrastructure under Saudi Vision 2030, a 680 Km Saudi-Oman highway and the UAE-Saudi Mafraq-Ghuwaifat International Highway underway. The government of Saudi Arabia is working on new multi-mode logistic stations and two new railway lines to link GCC countries in the east & Yanbu-Jeddah in the west.

Saudi Arabia Automotive & Spare Parts Logistics Market Segmentation

By Service Mix (Freight Forwarding, Warehousing and Value Added Services): The is fragmented with few players majorly focusing on the automotive end users. Few automotive companies are having their own warehouses and fleet for transportation and avoid outsourcing the logistics services. The freight-forwarding segment of the automotive & spare parts logistics market is the biggest contributor to growth in this sector. The cities of Jeddah and Riyadh have been the most populous cities in the kingdom. These cities also account for most of the industrial areas and indicate a high demand for built-to-suit and automated warehouses therefore, driving revenue from automotive storage.

Saudi Arabia Automotive & Spare Parts Freight Forwarding Market:

Freight forwarder offers a range of services depending on their size, number of personnel, and number of branches. Increasing auto exports to other Gulf countries & East African countries including Sudan, Libya, Djibouti and others is stimulating the demand. Saudi Arabia launched new logistics zone in 2019 which is open to private investors in the Red Sea port city of Jeddah therefore, diversifying the economy away from oil and creating more jobs for local Saudis. Road was observed as the most prominent freight mode in Saudi Arabia for automotive and spare parts logistics, followed by sea and air in the year 2019.

Domestic freight had dominant share due to large movement of vehicles & spare parts from the ports to the cities within in KSA. Major export destinations of automotive & spare parts included GCC countries such as Bahrain, Jordan, the UAE and others.

Growth is expected to be majorly contributed by economic & industrial activities associated with logistics services such as transportation of goods & warehousing. KSA government aims to aggressively drive and position 50 islands and 100 miles of Red Sea as a global tourist destination. The expansion of Red Sea corridor in Jeddah, the minerals hub in Yanbu, King Abdullah port and NEOM project are also expected to drive the

Saudi Arabia Automotive & Spare Parts Warehousing Market:

KSA Warehousing industry ecosystem is dominated by domestic companies in terms of warehousing space, followed by international companies. Ecosystem has underscored asset monetization deal with Real Estate developers purchasing the warehousing assets to generate current income under operating lease model to warehousing operators. Most of the warehouses are concentrated in Jeddah, Riyadh and Dammam in Saudi Arabia. The major Companies include include LSC logistics, Almajdouie Logistics, Mosanada Logistics, Tamer, Agility and others. Industrial warehouses contributed the majority revenue in the automotive and spare parts warehousing market. Spare parts are majorly stored in Industrial warehouses, which are located closer to ICD’s. Majority spare parts imported into the country are stored in Closed Warehouses, and they usually arrive in Bulk quantities.

Comparative Landscape in Saudi Arabia Automotive & Spare Parts Logistics Market

Competition was observed to be highly fragmented in both freight forwarding and warehousing segment along with the presence of both international and domestic players. Nevertheless, the local / domestic players have a larger presence in the market and were observed to compete on the basis of key clientele, revenue matrix, logistics networking, average pricing, technological advancement and value added services.

Saudi Arabia Automotive & Spare Parts Logistics Market Future Outlook and Projections

The automotive and spare parts logistics is expected to witness negative growth in 2020, due to lockdown measures, restriction on various businesses and ban on transportation in the initial phase. Demand revival for the logistics services is expected to take close to 10-12 months, before the Industry will get back to normal levels. The government is planning to pump investment into economic cities and other industrial projects to boost logistics and transportation centers. KSA government is highly promoting the integration of multi-modal hubs across the country. FDI within logistics infrastructure development, constructing regional & international logistics service centers and improving the efficiency of trade routes can collectively help the country in becoming a hub over long term. Development of New Economic Zones / Cities such as KAEC to attract foreign investments by providing special incentives is another program by KSA government. The economic cities are planned to be located near to sea ports and major consumption bases, which is expected to bring manufacturing closer to these bases.

Key Topics Covered in the Report

- Saudi Arabia Overview and Major Economic & Logistics Zones

- Automotive Import Procedure (Import Procedure for Automobiles and Impact of VAT & Custom Duty Increase)

- Trade Scenario

- Regulatory Landscape

- End-User Analysis (Automotive)

- End-User Analysis (Spare Parts)

- Saudi Arabia Automotive & Spare Parts Logistics Market

- Saudi Arabia Automotive & Spare Parts Freight Forwarding Market

- Saudi Arabia Automotive & Spare Parts Warehousing Market

- Industry Analysis (SWOT Analysis, PESTLE Analysis, Government initiatives)

- Covid-19 Impact on the Automotive Transportation Industry

- Snapshot on Control Tower Market

- Snapshot on Pre-Delivery Inspection Market

- Covid-19 Impact on Automotive Warehousing Industry

- Comparative Landscape – KSA Automotive & Spare Parts Logistics Market

- Comparative Landscape in Saudi Arabia Automotive Market

- Recommendations / Success Factors

- Research Methodology

- Appendix

Products

Key Target Audience

International Domestic Freight Forwarders

Warehousing Companies

Logistics Companies

Logistics Consultants

Automotive OEMs

Automotive Dealers/Distributors

Spare Parts Manufacturers

Spare Parts Dealers/Distributor

Time Period Captured in the Report:

Historical Period: 2014-2019

Forecast Period: 2019–2025

Companies

Key Segments Covered in KSA Automotive & Spare Parts Logistics Market

By Service Mix

Freight Forwarding

Warehousing

Value Added Services

KSA Automotive & Spare Parts Freight Forwarding Market

By Mode of Freight

Road Freight

Air Freight

Sea Freight

By Type of Transport

Domestic Freight

International Freight

By 3PL & Integrated Logistics

3PL Logistics

Integrated Logistics

By Cost Split

Last Mile

First Mile

By Automotive Segment

Vehicles

Spare Parts

By Sea Flow Corridors

Sudan

GCC

Egypt

Others

By Air Flow Corridors

Sudan

Egypt

Kuwait

Libya

Oman

UAE

Others

By Road Flow Corridors

Bahrain

Jordan

Lebanon

UAE

Kuwait

Oman

Others

KSA Automotive & Spare Parts Warehousing Market

By Business Model

Industrial / Retail

Container Freight / Inland Container Depots

By Cities

Jeddah

Riyadh

Dammam

Others

By Type of Warehouse

Closed Warehouse

Open Warehouse

Companies Covered:

Oriental Commercial & Shipping Co.

Hala Shipping Services

Gulf System

Uniworld Logistics

Abdui Global

NTF Logistics

Four Winds

KWE Transport

Glaube Logistics

Al Rashed Transport

Arabian Transport Co.

SITCO Logistics

Takhzeen Logistics

Kanoo Terminal

Agility Logistics

Al Khodari Sons & LV Shipping & Logistics Co.

BAFCO International

Wolf Transport

Almajdouie Logistics

GAC Logistics

JAS Logistics

Platinum Logistics

Kerry Logistics

Namma Cargo

Al Jabri Transport

Automotive & Spare Parts Companies Covered:

Audi

Mercedes

Isuzu motors

Nissan

Kia Motors

Toyota

Hyundai

Mazda

General Motors

Mitsubishi

Ford

Changan

Table of Contents

1. Executive Summary (Current and Future Scenario of Automotive and Spare Parts Logistics in Saudi Arabia)

2. Socio-Economic Overview

2.1. Country Overview (Country Demographics, GDP, Major Industries, Geographical Location and

Trade Scenario)

2.2. Logistics Sector Overview (Competitive Advantage, Cost Advantage and Statistical

Information, 2019)

2.3. Popular Economic & Logistics Zones - King Abdullah Economic City, Prince Abdul Aziz Bin

Mousaed Economic City, Knowledge Economic City & Jizan Economic City, Integrated Logistics

Bonded Zone and Al Khomra Logistics Zone

2.4. Logistics Parks & Bonded Re-Exports Zones in the Kingdom (Agility Logistics Park, The

Logistics Park, LogiPoint & the Eastern Gateway)

3. Automotive Sector Overview

3.1. Automotive Import Procedure (Import Procedure for Automobiles and Impact of VAT & Custom

Duty Increase)

3.2. Import-Export Scenario (Import of Vehicles- Value and Volume, Export of Vehicles by Value,

Total Import of Vehicles, 2014-2018, Total Annual Throughput from Ports, Imports by Type of

Vehicles, 2014-2018)

3.3. Regulatory Landscape (Government Policies and Initiatives)

3.4. End-User Analysis (Automotive) (Ecosystem, Value Chain, Demand Analysis, Dealers, Sales

Volume of Cars (2019), Dealership Network, Sales by Car Models, Regional Clusters, End User

Analysis , Future Scenario, Impact of Addition of Women Drivers and Government Initiatives in

the Automotive Sector)

3.5. End-User Analysis (Spare Parts) (Ecosystem, Value Chain, Market Size (Spare Parts), Market

Segmentation, Clusters and End User Analysis)

4. Saudi Arabia Automotive & Spare Parts Logistics Industry

4.1. Overview and Genesis (Business Cycles in Automotive & Spare Parts Logistics Industry)

4.2. Supply Side Ecosystem (Companies and Dealers in the Market)

4.3. Value Chain Analysis (Supply chain models and Margin)

4.4. Market Size, 2014-2019 (Overall Market Size by Spent; By Type of Services – Freight

Forwarding (Transportation), Warehousing, VAS)

4.5. SWOT Analysis (Strengths, Weakness, Opportunities and Threats in Automotive Logistics

Industry)

4.6. Industry PESTLE Analysis

4.7. Government Initiatives in the Logistics Industry

5. Saudi Arabia Automotive Transportation Industry

5.1. Executive Summary of Saudi Arabia Automotive and Spare Parts Transportation Industry

(Overall Scenario, Future Trends, Competition and Analysis)

5.2. Automotive Transportation Market Size (Market Size on the basis of Spending in USD

Million), 2014-2019

5.3. By Automotive Segment (Spare Parts and Automotive), 2014-2019

5.4. By Mode of Transport (Road, Air and Sea, 2014 and 2019

5.5. By Cost Split (First Mile and Last Mile), 2014 and 2019

5.6. By Integrated & 3PL Transportation, 2014-2019

5.7. By Type of Freight (Domestic and International Freight), 2014 and 2019

5.8. By International Road Flow Corridors, 2019 (Share of Countries)

5.9. By International Sea Flow Corridors, 2019 (Share of Countries)

5.10. By International Air Flow Corridors, 2019 (Share of Countries)

5.11. Issues & Challenges in Automotive Transportation Industry

5.12. Future Market Size (By Transportation Spent in USD Million), 2019-2025F

5.13. Covid-19 Impact on the Automotive Transportation Industry

5.14. Future Market Segmentations, 2019 & 2025F

5.15. Future Technology-Enabled Roadmap

5.16. Snapshot on Control Tower Market (Definition, Process of Integration, Value Add, Setting

up Control Tower, Impact on Overall Business, Impact on Supply Chain, Impact on Last Mile

Delivery)

5.17. Snapshot on Pre-Delivery Inspection Market

6. Saudi Arabia Automotive Warehousing Industry

6.1. Executive Summary of Saudi Arabia Automotive and Spare Parts Logistics Industry

6.2. Automotive Warehousing Market Size (By spending), 2014-2019

6.3. Warehousing Segmentation (Regional Clusters, Open Yards and Closed Yards, ICD and

Industrial Warehouses, Cost), 2014 and 2019

6.4. Issues & Challenges in Automotive Warehousing Industry

6.5. Future Market Size & Segmentations (2019-2025F)

6.6. Covid-19 Impact on Automotive Warehousing Industry

6.7. Technological Advancements & Innovations

7. Competitive Landscape

7.1. Cross Comparison (By Services offered; Transportation, Open Yards and Closed Yards)

7.2. Strength and Weakness of Major Players in the Industry

7.3. Cross Comparison between Major Logistics Companies (Year of establishment, Employee base,

Number of Offices, Fleet Size, Type of Vehicle Fleet, Avg Volume per month (2019), Type of

Warehouse, Avg Occupancy Rate, Warehousing Space, Avg Price for Transportation, Avg Warehousing

Price, Average custom clearance price, Major Clientele, Services Offered, Industries catered,

Technologies and Certifications)

8. Future Outlook

8.1. Future Market Size of Automotive Logistics Industry (By Total Spending in the future,

2019-2025F)

9. Recommended Market Entry Strategy for a New Entrant

Disclaimer Contact UsWhy Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.