Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7298

Pages:99

Published On:December 2025

By Product Type:The product type segmentation includes various advanced insulation systems that cater to different building needs. The subsegments are as follows:

The leading subsegment in the product type category is the Phase Change Material (PCM)-based active insulation systems, which are gaining traction due to their ability to enhance energy efficiency by storing and releasing thermal energy. This technology is particularly appealing in Bahrain's hot climate, where temperature regulation is crucial. The increasing focus on sustainable building practices and energy conservation is driving demand for PCM systems, making them a preferred choice among builders and architects.

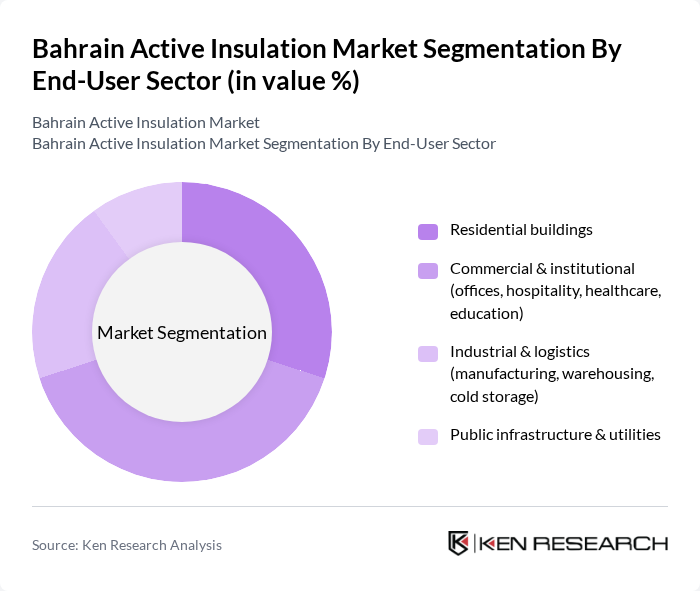

By End-User Sector:The end-user sector segmentation encompasses various applications of active insulation in different building types. The subsegments are as follows:

The commercial and institutional sector is the dominant end-user segment, driven by the rapid growth of office spaces, hotels, and educational institutions in Bahrain. The increasing emphasis on energy-efficient buildings in commercial projects is leading to a higher adoption of active insulation solutions. Additionally, government initiatives promoting sustainable construction practices are further propelling the demand in this sector, making it a key area for market growth.

The Bahrain Active Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Insulation Group (GIG), Knauf Insulation Middle East, Saint-Gobain Isover Middle East, ROCKWOOL Middle East, Kingspan Insulation LLC (Middle East & Africa), Armacell Middle East Company, BASF SE – Polyurethanes & construction solutions in GCC, Owens Corning – FOAMGLAS & fiberglass solutions, Dow Chemical – building & construction insulation materials, Huntsman Corporation – polyurethanes for insulation systems, Bahrain Insulation Company W.L.L., Arabian Fiberglass Insulation Co. Ltd. (AFICO), Saudi Rockwool Factory Co., Unipro Insulation Works W.L.L. (Bahrain), KIMMCO-ISOVER (Kuwait Insulating Material Manufacturing Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain active insulation market is poised for significant growth, driven by increasing government support and a shift towards sustainable building practices. As energy efficiency regulations tighten, the demand for innovative insulation solutions will rise. The integration of smart technologies in construction will further enhance insulation performance. Additionally, the growing trend of retrofitting existing buildings will create new opportunities for active insulation, making it a vital component of future construction projects in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Phase Change Material (PCM)-based active insulation systems Dynamic ventilated façade and cavity wall systems Sensor- and control-integrated building envelope systems Active roof and cool roof insulation systems HVAC duct and equipment active insulation Others (hybrid active–passive systems) |

| By End-User Sector | Residential buildings Commercial & institutional (offices, hospitality, healthcare, education) Industrial & logistics (manufacturing, warehousing, cold storage) Public infrastructure & utilities |

| By Application Area | Building envelope (walls, façades, roofs) HVAC and mechanical systems Cold storage and process temperature control Retrofits of existing buildings New green building projects |

| By Material / Technology | Advanced foams and aerogels PCM micro- and macro-encapsulated materials High-performance mineral wool and glass wool systems Reflective and radiant control systems Others (bio-based and recycled active insulation materials) |

| By Performance Category (Thermal & Energy) | High-performance / near-zero-energy building solutions Standard energy-efficient building solutions Code-minimum compliance solutions Specialized high-temperature / process insulation |

| By Installation / Delivery Model | Turnkey design–supply–install projects Supply to contractors / system integrators Retrofit service providers and ESCO models DIY and small-project channels |

| By Policy & Certification Linkage | Projects aligned with Bahrain building energy codes Green building certifications (e.g., LEED, BREEAM, local schemes) Government- or utility-supported energy efficiency programs Unsubsidized private sector projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Architects |

| Commercial Building Developments | 80 | Construction Managers, Facility Managers |

| Energy Efficiency Programs | 60 | Energy Auditors, Sustainability Consultants |

| Government Infrastructure Projects | 70 | Public Works Officials, Procurement Officers |

| Retail and Industrial Insulation Needs | 90 | Operations Managers, Supply Chain Directors |

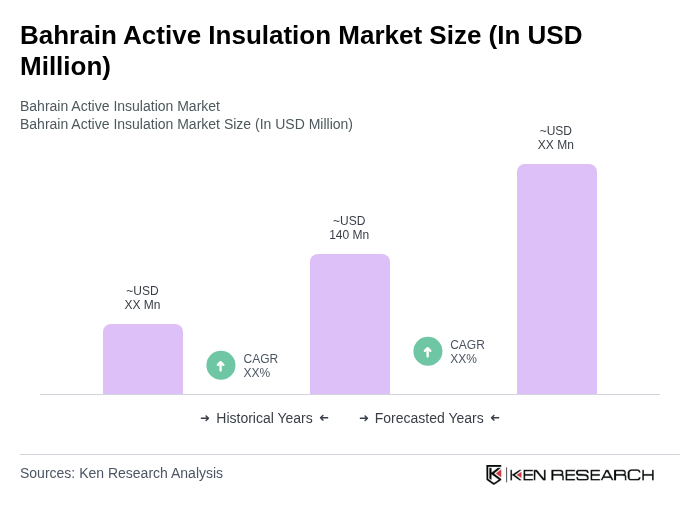

The Bahrain Active Insulation Market is valued at approximately USD 140 million, reflecting a growing demand for energy-efficient building materials and sustainable construction practices in the region.