Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4088

Pages:86

Published On:December 2025

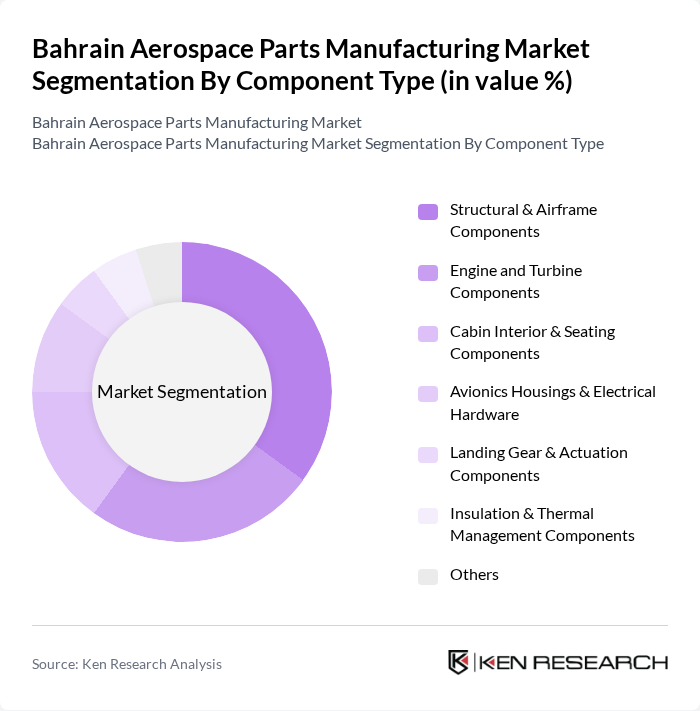

By Component Type:The Bahrain Aerospace Parts Manufacturing Market is segmented into various component types, including structural and airframe components, engine and turbine components, cabin interior and seating components, avionics housings and electrical hardware, landing gear and actuation components, insulation and thermal management components, and others. Among these, structural and airframe components dominate the market due to their critical role in aircraft safety and performance, driven by the increasing production of commercial and military aircraft.

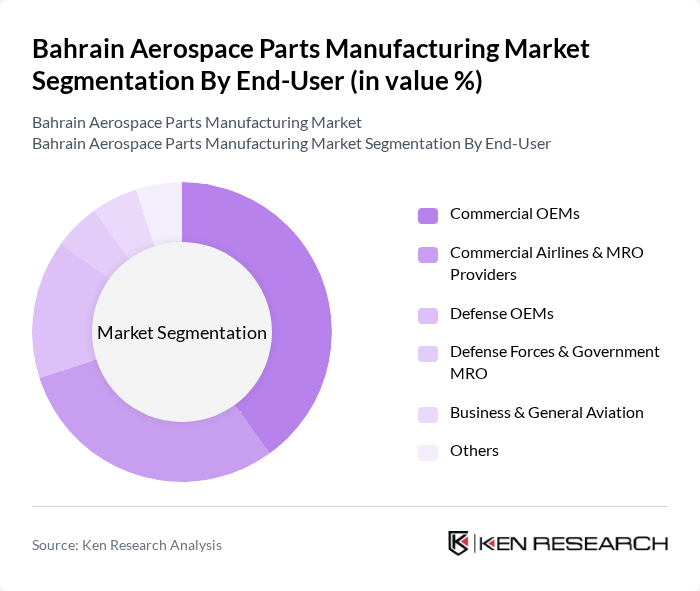

By End-User:The market is also segmented by end-user, which includes commercial OEMs, commercial airlines and MRO providers, defense OEMs, defense forces and government MRO, business and general aviation, and others. The commercial OEMs segment is the leading end-user, driven by the increasing demand for new aircraft and the need for high-quality parts to ensure safety and reliability in aviation operations.

The Bahrain Aerospace Parts Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aluminium Bahrain B.S.C. (Alba), Bahrain Steel B.S.C., Bahrain Titanium (BTI), Arab Shipbuilding & Repair Yard (ASRY), Roboze S.p.A., Magellan Aerospace Corporation, Safran Group, Rolls?Royce Holdings plc, GE Aerospace, Honeywell Aerospace, Raytheon Technologies Corporation (RTX) – including Pratt & Whitney, Airbus SE, Boeing Company, Spirit AeroSystems Holdings, Inc., Liebherr?Aerospace contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain aerospace parts manufacturing market is poised for significant growth, driven by increased defense spending and a burgeoning aviation sector. As technological advancements continue to reshape manufacturing processes, local companies are expected to enhance their production capabilities. However, challenges such as supply chain disruptions and labor shortages may hinder progress. Overall, the market is likely to evolve, presenting new opportunities for innovation and collaboration within the aerospace industry in Bahrain.

| Segment | Sub-Segments |

|---|---|

| By Component Type | Structural & Airframe Components (wings, fuselage sections, brackets, fasteners) Engine and Turbine Components (discs, blades, casings, hot?section hardware) Cabin Interior & Seating Components Avionics Housings & Electrical Hardware Landing Gear & Actuation Components Insulation & Thermal Management Components Others (tooling, ground support components) |

| By End-User | Commercial OEMs (airframe and engine manufacturers) Commercial Airlines & MRO Providers Defense OEMs Defense Forces & Government MRO Business & General Aviation Others |

| By Application | OEM Production (line?fit parts) Aftermarket & MRO (spares and repairs) Prototyping & R&D (including additive manufacturing) Tooling, Jigs & Fixtures Others |

| By Material | Aluminum Alloys Titanium Alloys Nickel?based Superalloys Steel & Specialty Alloys Polymer Matrix Composites High?performance Thermoplastics & Engineering Plastics Others |

| By Manufacturing Process | CNC Machining & Turning Casting (sand, investment, and die casting) Forging & Forming (including extrusion and stamping) Additive Manufacturing (metal and polymer 3D printing) Surface Treatment & Coating (anodizing, plating, thermal spray) Assembly & Integration Others |

| By Certification & Compliance Level | AS9100 / Aerospace?grade Certified Facilities OEM?Approved / Qualified Suppliers Defense & ITAR / Export?Controlled Work Non?certified / Industrial?grade Production |

| By Degree of Localization | Fully Local Production (design and manufacturing in Bahrain) Imported Designs with Local Manufacturing Assembly & Finishing of Imported Parts Distribution & Logistics Only |

| By Cross Comparison of Key Players | Company Name Scale of Operations (installed capacity, shop-floor area) Aerospace Certification Status (AS9100, NADCAP, OEM approvals) Share of Revenue from Aerospace Parts (%) Export Share of Aerospace Revenue (%) –5 Year Revenue CAGR in Aerospace Installed Advanced Manufacturing Capability (CNC, 5?axis, AM cells) Average OEE / Capacity Utilization in Aerospace Lines On?time Delivery Rate to OEMs and MROs Non?conformance / Rejection Rate (PPM) for Aerospace Customers R&D and Tooling Spend as % of Aerospace Revenue Local Content Ratio (Bahrain?sourced materials and processes) Contract Tenure and Diversification (number of active aerospace OEM/MRO customers) Average Price Realization per Kg / per Part by Material Class |

| By Detailed Profile of Major Companies | Aluminium Bahrain B.S.C. (Alba) Bahrain Steel B.S.C. Bahrain Titanium (BTI) Arab Shipbuilding & Repair Yard (ASRY) Roboze S.p.A. Magellan Aerospace Corporation Safran Group Rolls?Royce Holdings plc GE Aerospace Honeywell Aerospace Raytheon Technologies Corporation (RTX) – including Pratt & Whitney Airbus SE Boeing Company Spirit AeroSystems Holdings, Inc. Liebherr?Aerospace |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Parts Manufacturing | 85 | Manufacturing Managers, Production Supervisors |

| Aviation Supply Chain Management | 75 | Supply Chain Directors, Logistics Coordinators |

| Quality Assurance in Aerospace | 65 | Quality Control Managers, Compliance Officers |

| Research & Development in Aerospace | 55 | R&D Engineers, Product Development Managers |

| Regulatory Compliance in Manufacturing | 45 | Regulatory Affairs Specialists, Legal Advisors |

The Bahrain Aerospace Parts Manufacturing Market is valued at approximately USD 1.0 billion, reflecting a five-year historical analysis. This growth is driven by increased demand for aircraft components and government initiatives to enhance local manufacturing capabilities.