Region:Middle East

Author(s):Shubham

Product Code:KRAA8766

Pages:84

Published On:November 2025

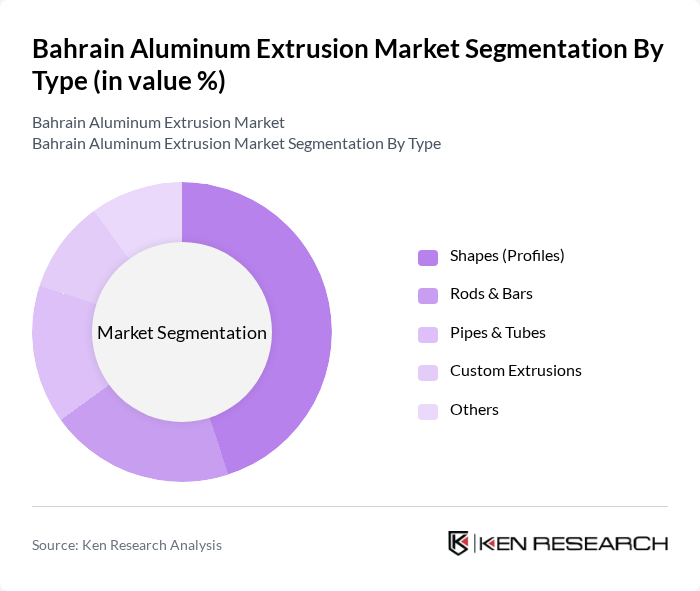

By Type:The market is segmented into Shapes (Profiles), Rods & Bars, Pipes & Tubes, Custom Extrusions, and Others. Each subsegment addresses specific industrial needs, with Shapes (Profiles) being the most prominent due to their extensive use in construction, architecture, and infrastructure projects. Rods & Bars and Pipes & Tubes are primarily utilized in transportation, energy, and mechanical applications, while Custom Extrusions cater to specialized engineering and design requirements.

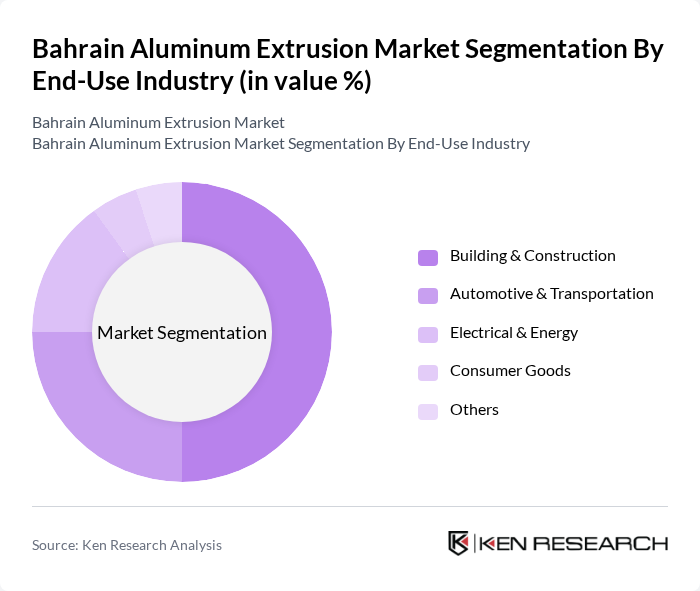

By End-Use Industry:The market is further segmented by end-use industries, including Building & Construction, Automotive & Transportation, Electrical & Energy, Consumer Goods, and Others. The Building & Construction sector leads the market, driven by ongoing infrastructure development, urbanization, and the increasing use of aluminum in modern architectural designs. Automotive & Transportation is the second largest segment, reflecting the rising demand for lightweight vehicle components and electric vehicle manufacturing. Electrical & Energy applications benefit from aluminum’s conductivity and corrosion resistance, while Consumer Goods and Others represent niche uses in furniture, appliances, and specialty products.

The Bahrain Aluminum Extrusion Market features a dynamic mix of regional and international players. Leading participants such as Bahrain Aluminum Extrusion Company (BAECO), Gulf Extrusions Co. LLC, QALEX (Qatar Aluminium Extrusion Company), Emirates Extrusion Factory LLC, Ma’aden Aluminium, Alupco (Aluminum Products Company, Saudi Arabia), AluK Middle East, Constellium N.V., Hindalco Industries Ltd., Arconic Corporation, Norsk Hydro ASA, Kaiser Aluminum, AluTech Bahrain, AluForm Bahrain, and AluVision Bahrain drive innovation, geographic expansion, and service delivery. These companies leverage advanced manufacturing processes, invest in product development, and maintain strong regional supply chains to meet the evolving demands of construction, automotive, and industrial clients.

Sources:

The Bahrain aluminum extrusion market is poised for growth, driven by increasing investments in infrastructure and a shift towards sustainable building practices. The government's commitment to reducing carbon emissions and promoting eco-friendly materials will likely enhance the demand for aluminum products. Additionally, the automotive sector's expansion, particularly in electric vehicles, presents significant opportunities for local manufacturers. As the market evolves, technological advancements in manufacturing processes will further support growth and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Shapes (Profiles) Rods & Bars Pipes & Tubes Custom Extrusions Others |

| By End-Use Industry | Building & Construction Automotive & Transportation Electrical & Energy Consumer Goods Others |

| By Application | Architectural Components (Windows, Doors, Facades) Structural Components Industrial Machinery Packaging Others |

| By Product Form | Mill-Finished Anodized Powder Coated Painted Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Aluminum Usage | 60 | Project Managers, Architects |

| Automotive Industry Applications | 50 | Manufacturing Engineers, Procurement Managers |

| Consumer Goods Packaging | 40 | Product Managers, Supply Chain Analysts |

| Architectural Aluminum Solutions | 45 | Design Engineers, Construction Consultants |

| Industrial Applications of Aluminum Extrusions | 55 | Operations Managers, Facility Managers |

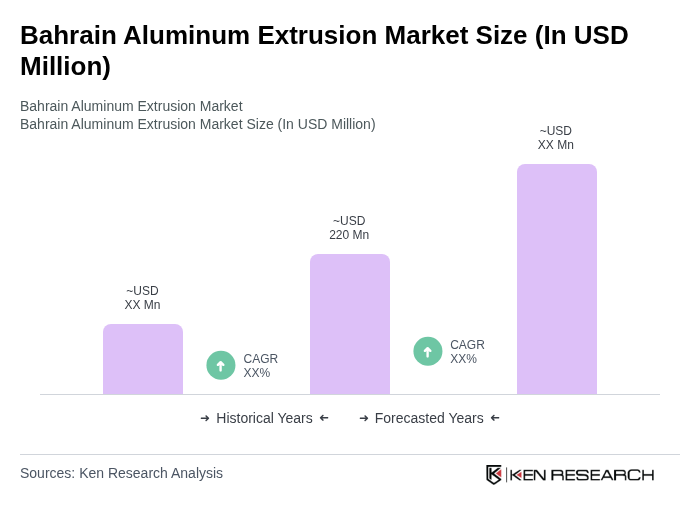

The Bahrain Aluminum Extrusion Market is valued at approximately USD 220 million, reflecting its share within the broader Middle East & Africa aluminum extrusions market, which totals around USD 2.23 billion.