Region:Middle East

Author(s):Rebecca

Product Code:KRAD7435

Pages:100

Published On:December 2025

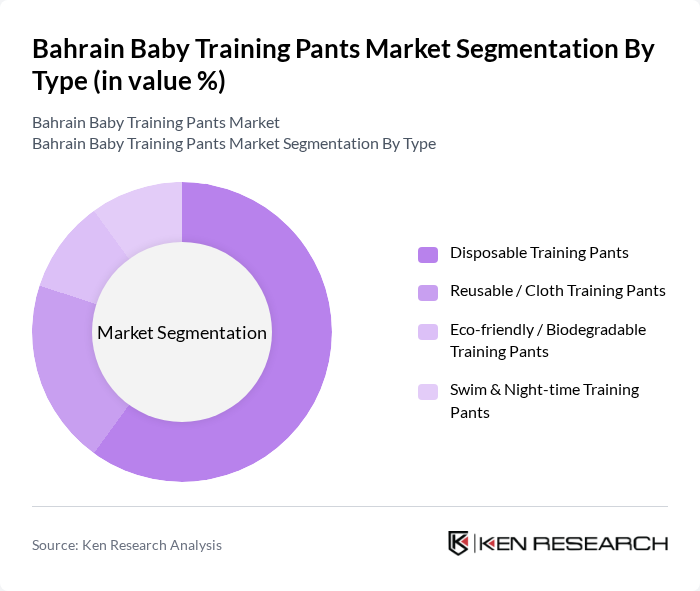

By Type:The market is segmented into various types of baby training pants, including disposable, reusable, eco-friendly, and swim & night-time training pants. Disposable training pants are currently the most popular choice among parents due to their convenience and ease of use. Reusable or cloth training pants are gaining traction among environmentally conscious consumers, while eco-friendly options are increasingly sought after as sustainability becomes a priority for many families. Swim and night-time training pants cater to specific needs, further diversifying the market.

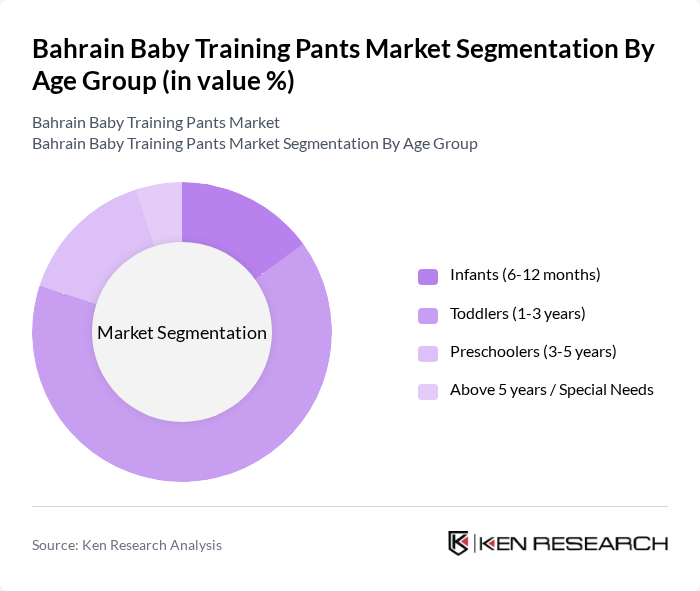

By Age Group:The age group segmentation includes infants, toddlers, preschoolers, and children above 5 years or with special needs. The toddler segment (1-3 years) dominates the market, as this is the primary age range for toilet training. Parents are increasingly investing in products that facilitate this transition, leading to a higher demand for training pants in this category. The infant segment is also significant, as parents often start using training pants early to prepare for toilet training.

The Bahrain Baby Training Pants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pampers (Procter & Gamble), Huggies (Kimberly-Clark Corporation), MamyPoko (Unicharm Corporation), Fine Baby (Fine Hygienic Holding), Private Label Brands (Carrefour, Lulu Hypermarket, Al Jazira Supermarket), Bambi (Napco National), BabyJoy (Unicharm Gulf), Johnson’s Baby (Johnson & Johnson Consumer Health), Rascal + Friends, Bebem (Hayat Kimya), Pigeon Corporation, Sanita Bambi (Indevco Group), Bebem Natural (Hayat Consumer Products), Private Label Pharmacy Brands (e.g., Boots, local chains), Eco & Organic Niche Brands (imported) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby training pants market in Bahrain appears promising, driven by increasing consumer awareness and a shift towards sustainable products. As disposable incomes rise, parents are likely to invest more in high-quality, eco-friendly options. Additionally, the expansion of online retail channels is expected to enhance accessibility, allowing brands to reach a broader audience. Innovations in product features, such as enhanced absorbency and comfort, will further attract consumers, ensuring sustained growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Training Pants Reusable / Cloth Training Pants Eco-friendly / Biodegradable Training Pants Swim & Night-time Training Pants |

| By Age Group | Infants (6-12 months) Toddlers (1-3 years) Preschoolers (3-5 years) Above 5 years / Special Needs |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail & E-commerce Platforms Pharmacies & Drug Stores Baby & Maternity Specialty Stores Convenience Stores & Others |

| By Material | Conventional Petrochemical-based (SAP & Non-woven) Cotton & Natural Fiber Blends Bamboo & Other Biodegradable Materials Hybrid / Mixed Materials |

| By Brand Type | International Premium Brands International Value / Budget Brands Private Label & Retailer Brands Regional & Niche Eco-brands |

| By Packaging Type | Small Packs (<20 Pants) Medium Packs (20–40 Pants) Large / Bulk Packs (>40 Pants) Subscription & Combo Packs |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others (Including Southern Islands & New Developments) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parental Purchasing Behavior | 150 | Parents of toddlers, Expectant parents |

| Retail Insights on Baby Products | 100 | Store Managers, Baby Product Buyers |

| Pediatric Insights on Training Pants | 60 | Pediatricians, Childcare Specialists |

| Market Trends in Eco-Friendly Products | 70 | Eco-conscious Parents, Sustainability Advocates |

| Consumer Preferences in Product Features | 90 | Caregivers, Child Development Experts |

The Bahrain Baby Training Pants Market is valued at approximately USD 40 million, reflecting a steady demand driven by increasing awareness of child hygiene and rising disposable incomes among families.