Region:Middle East

Author(s):Rebecca

Product Code:KRAD6203

Pages:88

Published On:December 2025

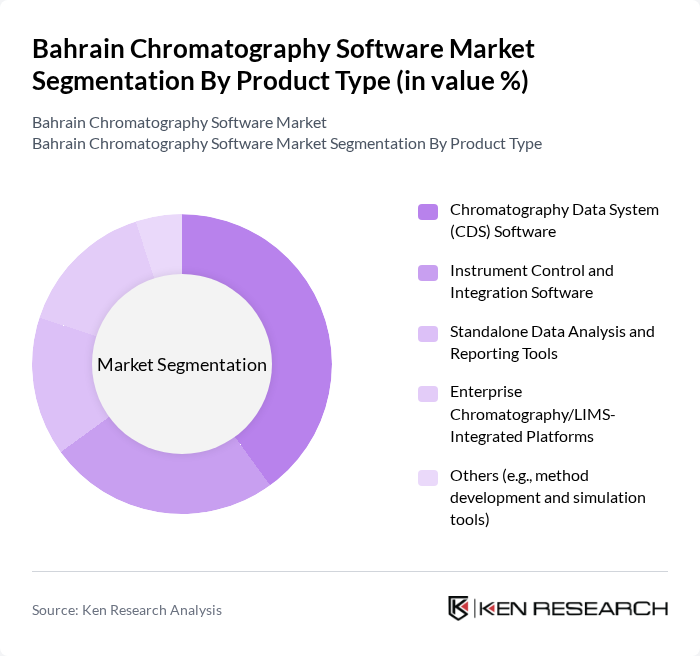

By Product Type:The product type segmentation includes various software solutions tailored for chromatography applications. The leading sub-segment is the Chromatography Data System (CDS) Software, which is widely adopted due to its comprehensive data management capabilities, support for regulatory-compliant audit trails, and integration with a broad range of liquid and gas chromatography instruments. Instrument Control and Integration Software follows closely, as it facilitates seamless operation, scheduling, and remote monitoring of chromatography instruments within increasingly automated laboratories. Standalone Data Analysis and Reporting Tools are also gaining traction, particularly among smaller laboratories and contract testing facilities seeking cost-effective solutions focused on peak integration, quantitation, and report customization. The Enterprise Chromatography/LIMS-Integrated Platforms are increasingly preferred by larger organizations, hospital laboratories, and petrochemical QA/QC labs for their ability to streamline end-to-end workflows, interface with LIMS/ERP systems, and enhance data sharing and compliance reporting across departments. Other tools, such as method development, simulation, and cloud-based analytics tools, are also utilized but to a lesser extent, often in specialized R&D and high-throughput environments.

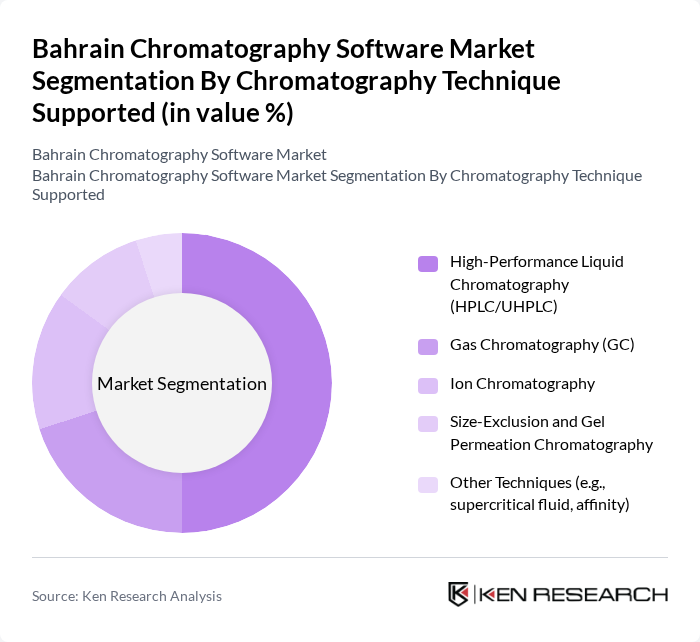

By Chromatography Technique Supported:The segmentation by chromatography technique supported reveals that High-Performance Liquid Chromatography (HPLC/UHPLC) is the dominant technique, widely used in pharmaceutical quality control, biopharmaceutical characterization, clinical diagnostics, and petrochemical analysis due to its efficiency, reproducibility, and ability to handle complex mixtures. Gas Chromatography (GC) is also significant, particularly in environmental monitoring, refinery and petrochemical testing, and food flavor/contaminant analysis. Ion Chromatography is gaining traction for its effectiveness in analyzing anions, cations, and polar molecules in water quality, power plants, and pharmaceutical applications. Size-Extraction and Gel Permeation Chromatography are utilized in specialized applications such as polymer and materials analysis, biopolymers, and aggregate profiling of biologics. Other techniques, including supercritical fluid and affinity chromatography, are less common but are emerging in niche research and high-value biopharmaceutical and chiral separation use cases.

The Bahrain Chromatography Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, PerkinElmer Inc., Shimadzu Corporation, Bruker Corporation, Bio-Rad Laboratories Inc., Sciex (AB Sciex LLC), KNAUER Wissenschaftliche Geräte GmbH, Merck KGaA (MilliporeSigma), Cytiva (Danaher Corporation), Sartorius AG, Waters Middle East FZE, Agilent Technologies Middle East & Africa, Gulf Scientific Corporation (Regional Distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chromatography software market in Bahrain appears promising, driven by technological advancements and increasing regulatory demands. As laboratories seek to enhance efficiency and accuracy, the integration of AI and automation will likely become standard practice. Furthermore, the government's commitment to fostering innovation in biotechnology will create a conducive environment for growth. This trend is expected to attract investments, leading to the development of more sophisticated software solutions tailored to local needs.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Chromatography Data System (CDS) Software Instrument Control and Integration Software Standalone Data Analysis and Reporting Tools Enterprise Chromatography/LIMS-Integrated Platforms Others (e.g., method development and simulation tools) |

| By Chromatography Technique Supported | High-Performance Liquid Chromatography (HPLC/UHPLC) Gas Chromatography (GC) Ion Chromatography Size-Exclusion and Gel Permeation Chromatography Other Techniques (e.g., supercritical fluid, affinity) |

| By Deployment Model | On-Premises Private Cloud Public Cloud / SaaS Hybrid |

| By Functionality | Data Acquisition and Integration Data Processing and Advanced Analytics Method Development and Validation Compliance, Audit Trail, and Data Integrity (e.g., 21 CFR Part 11) Reporting, Visualization, and Workflow Automation |

| By End-User | Pharmaceutical and Biopharmaceutical Companies Clinical and Diagnostic Laboratories Academic and Research Institutions Environmental and Food Testing Laboratories Petrochemical and Industrial QC Laboratories |

| By Industry Vertical | Healthcare and Life Sciences Food and Beverage Chemicals and Specialty Chemicals Oil and Gas / Petrochemicals Others (e.g., forensic, academic research) |

| By Licensing and Commercial Model | Perpetual License Subscription / SaaS Concurrent / Floating License Pay-Per-Use and Outcome-Based Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Laboratories | 90 | Laboratory Managers, Quality Control Analysts |

| Food Safety Testing Facilities | 80 | Food Safety Officers, Laboratory Technicians |

| Environmental Testing Agencies | 70 | Environmental Scientists, Compliance Officers |

| Academic Research Institutions | 60 | Research Professors, Graduate Students |

| Chromatography Software Vendors | 40 | Product Managers, Sales Executives |

The Bahrain Chromatography Software Market is valued at approximately USD 15 million, reflecting a five-year historical analysis and Bahrain's position within the global chromatography software and analytical instrumentation markets.